#123: Core Banking in an Open World: What’s the future of the banking operating system?

W FINTECHS NEWSLETTER #123

👀 Portuguese Version 👉 here

👉 W Fintechs is a newsletter focused on financial innovation. Every Monday, at 8:21 a.m. (Brasília time), you will receive an in-depth analysis in your email.

This edition is sponsored by

Iniciador is the complete infrastructure platform specialized in Regulated Open Finance, enabling Payment Initiation and Data Access.

The solution removes technology and compliance concerns, allowing clients — with their own regulatory license or using Iniciador’s — to focus on new products and business growth.

💡Bring your company to the W Fintechs Newsletter

Reach a niche audience of founders, investors, and regulators who read an in-depth analysis of the financial innovation market every Monday. Click 👉here

Technologies are becoming increasingly open, and core banking is following suit. Some players have made these systems more modular, accessible, and scalable, enhancing the flexibility of banking product offerings. What was once rigid and difficult to adapt is now transforming into a collaborative ecosystem, more easily aligning with market needs.

Core banking is the operating system of the financial sector. From fintechs to large banks, all daily operations run through it: credit and debit transactions, regulatory reporting, and integrations with other systems.

In recent years, new players have challenged the incumbents. In 2024, the market grew from $12.45 billion to $13.63 billion, reflecting a CAGR of 9.5% 1. The sector is more competitive, and flexibility is no longer a differentiator—it’s now a survival condition for banks and fintechs.

Market changes have reduced institutional revenues, making it unfeasible to charge per transaction or adopt recurring models. Meanwhile, costs like fees for active and inactive accounts and transaction fees charged by technology providers remained. Core banking players without flexibility started losing ground to platforms more adaptable to this new scenario.

Some fintechs operating with Banking as a Service (BaaS) are also at an inflection point: migrating to their own license to gain more control over their operations. The big dilemma for many of these companies is whether to “build or buy.” In some cases, both banks and fintechs decided to develop their core banking systems internally, seeking the necessary flexibility to stay competitive. That was the case with Nubank 2 and Revolut 3, which built their own banking platforms and processors from scratch. Stark Bank followed the same strategy and later commercialized its solution, turning it into a new revenue stream.

This movement opened the door for a new generation of companies that combine open source and modular platforms to offer more innovation and customization. The French company Formance, for example, raised over $21 million in January 2025 to continue developing its open source technology for the banking system. Similarly, the Brazilian company Lerian raised a little over $3 million to build the next open source stack for financial services. The promise of more adaptable, open, and collaborative systems is enticing, but the real challenge is how to build a community that not only buys into the idea but also invests and engages with this technology. That’s one of the topics in today’s edition.

The First Generation of Core Banking

A good way to understand the history of core banking and where it’s heading is by looking at the evolution of operating systems that make your computer work and allow you to read this text.

The history of operating systems reflects the disputes and collaborations that shaped the course of the technology we see today. In the 1980s, IBM, in a rush to launch its new PC, sought an operating system and, after failed negotiations with Digital Research, partnered with Microsoft. The solution was 86-DOS, acquired by Microsoft and transformed into PC DOS and MS-DOS. With a licensing model, Microsoft dominated the market, while IBM, after a brief flirtation with OS/2, lost ground to Windows.

In the corporate world, systems like CP/M were pioneers, but it was Unix that stood out for delivering more stability. The big turning point came in 1991 when Linus Torvalds, a student from Finland, released Linux, an open source project that turned innovation into a global effort. The model broke some paradigms of proprietary software, allowing developer communities worldwide to engage.

Interestingly, despite being open source, Linux is centralized. Linus Torvalds and the Linux Foundation maintain control over what goes into the kernel (the core of the operating system). The foundation ensures the process is organized, but ultimately, it’s Torvalds and other maintainers who decide what makes sense for the system. This balance between open collaboration and centralized control has worked well for companies like Red Hat and SUSE, which offer paid support for Linux.

I believe this is a good starting point for the story of core banking. From the dominance of CP/M and MS-DOS to Windows and Linux, it’s clear that in technology, competition and collaboration are two sides of the same coin.

Core Banking

When we look at core banking, we see an evolution that has developed in parallel with operating systems. I’ll break its history into four generations.

In the 1970s and 1980s, we were in the era of mainframes. These monolithic systems were inflexible, had limited integration capabilities, and were usually built in-house by banks themselves. Between 1990 and 1995, the first generation of core banking emerged, marked by the arrival of early providers offering a basic stack with a licensing model. It was functional but lacked customization and agility.

Then, between 2010 and 2015, the second generation arrived: core banking went through a modularization process, separating its key components. This shift created more flexibility, making it easier to customize and integrate with other services. During this generation, the business model also began transitioning to a subscription or service-based approach.

The third generation emerged around 2017–2019, driven by the rise of cloud computing — though some players from the previous generation also adapted. The focus shifted from on-premises systems, which ran on local servers within institutions, to cloud-based environments. Companies like Mambu and Pismo became key players in this space. Scalability became the new priority, allowing financial institutions to adjust their infrastructure based on demand.

Now, companies like Lerian are ushering in the fourth generation, where open-source architecture takes center stage. Growth is increasingly driven by community-led growth. Instead of relying on proprietary or rigid solutions, institutions gain the freedom to shape their systems according to their needs and emerging technologies.

The Anatomy of Core Banking Players

To understand a core banking stack, we can compare it to a car: every part, from the engine to the wheels, needs to work together. If one fails, the entire system stops. The ledger, for example, is the heart of everything. It’s the database responsible for storing credit and debit accounts, calculating balances, and managing limits. To put it simply, it’s like a store’s cash register, where all transactions are recorded and must be organized to ensure the numbers always add up.

The governance stack is another essential component that supports this structure. It covers the regulatory aspects of core banking, from KYC (Know Your Customer) to tax and compliance regulations, ensuring the bank meets all legal requirements. Think of it as the internal audit of core banking, making sure everything follows the rules.

The third key component is messaging, which connects core banking to other financial systems and payment networks. It acts as a communication network, ensuring transactions are processed and reach their final destination. In the U.S., this involves networks like FedNow and The Clearing House, which handle fund settlements. In Brazil, messaging is managed by the Sistema Financeiro Nacional (SFN), which oversees financial data exchanges. This also includes integrations with boletos, bill payments, card networks, and any internal or external financial system.

Starting in 2010, second-generation core banking players began focusing on the ledger. With rising competition and tighter regulations, banks had to reinvent their revenue streams without being able to cut costs at the same rate. In Brazil, the Central Bank banned fees for Pix transactions for individuals — something that was previously allowed for older payment systems like TED and DOC. Meanwhile, in the U.S., the CFPB imposed limits on overdraft fees, disrupting previously reliable monetization models.

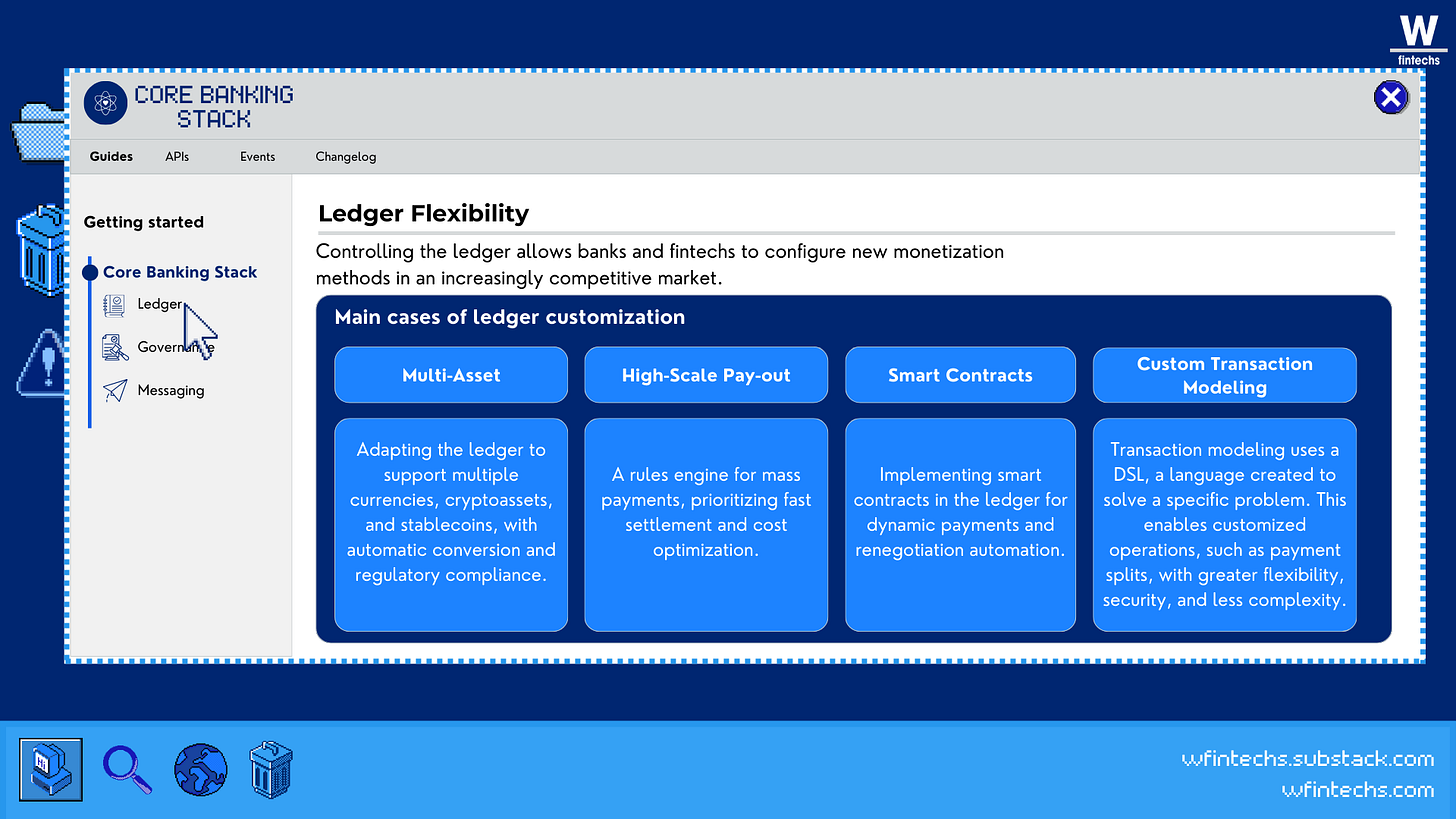

As margins shrank and revenue predictability faded, the ledger evolved from a simple transaction register into the core of financial strategy. Controlling the ledger meant controlling and creating new revenue streams. Some institutions decided to internalize this component, gaining the agility to test new models, adjust costs, and develop new income flows.

If you're enjoying this edition, share it with a friend. This will help spread the message and allow me to keep offering quality content for free.

Customizing the ledger unlocks new use cases, such as enabling banks and fintechs to integrate multiple asset types — traditional currencies, crypto, and stablecoins —creating a competitive edge. Another example is the implementation of smart contracts, which make payments dynamic and automate contract renegotiations, eliminating intermediaries — ideal for complex transactions.

Finally, transaction customization through DSLs (Domain-Specific Languages) offers a more flexible approach compared to traditional solutions like REST or SQL, which tend to be more rigid. REST requires fixed standards, while SQL, commonly used for managing large datasets, limits flexibility for custom rules, such as payment splitting or dynamic compound interest calculations.

With DSLs, this reality changes. They allow companies to create solutions with tailor-made rules without relying on multiple integrations or modifications to generic systems. For example, a payment platform using a DSL for custom payment splitting can create automated rules based on predefined criteria, such as percentage share or fixed amounts. If a merchant and a supplier make a joint sale, the DSL can instantly split the payment between them, adjusting percentages according to agreed parameters — like sales performance or contract terms. This simplifies the process, increases transparency, and eliminates manual adjustments.

Diving into the players

To understand ledger customization, I'll analyze two Cloud Core generation companies: Pismo and Mambu. While Mambu was a pioneer in cloud banking, Pismo stood out by offering a complete ledger, becoming a benchmark in payment processing.

Mambu

Mambu still relies on external payment processors, which can increase complexity and costs for its clients. Since its founding in 2011, the company has established itself as a leading player in cloud-based core banking. Its API-first architecture and availability on AWS, Google Cloud, and Microsoft Azure have helped reduce infrastructure costs.

Mambu adopted the concept of Composable Banking, where its clients build their services from independent modules, connecting external solutions through APIs instead of developing everything in-house. Its orchestration layer, the Mambu Process Orchestrator (MPO), is its key differentiator, as it accelerates the development of new financial products due to the partnership ecosystem Mambu has created. The platform integrates with companies like ComplyAdvantage for AML, Marqeta for card issuance, ClearBank for real-time payments, Wise and CurrencyCloud for international transactions, and Stitch, which optimizes data flow to data warehouses like Redshift and BigQuery.

Unlike Pismo, which centralized everything in its own platform, Mambu established several partnerships for payment processing. The payment process and card issuance vary depending on the supplier. For example, ClearBank provides banking infrastructure via APIs, while GoCardless simplifies recurring payments. Wise optimizes international transfers with real-time currency conversion.

For card issuing and processing, Mambu partners with Marqeta, allowing the issuance of both physical and virtual cards. Marqeta handles everything from card creation to payment authorization and funds availability verification. After the transaction is completed, the platform communicates with payment networks such as Visa and Mastercard to validate and approve the operation, with settlement happening directly in Marqeta’s system.

Although the orchestrator has accelerated the development of new products, it requires multiple integrations. The configuration process is simple (link to documentation 👉 here), with JSON files imported directly into the MPO. However, periodic updates and the necessary adjustments to integration configurations can be challenging for the tech teams at banks and fintechs, who must ensure smooth operation and real-time functionality of the processes — especially in payment processing.

Pismo

While Mambu focused on building an ecosystem, Pismo understood that for many financial players, having a core banking system is just the beginning. They also need an efficient payment solution, like a card. That’s why Pismo not only offers the account ledger but also integrates payment processing directly into the platform, eliminating external vendors and reducing integrations and costs.

Pismo’s differentiator lies in its agnostic approach: both the account and the payment processor are designed to be flexible, adapting to various technologies and global standards, which allows it to meet the needs of both traditional banks and challenger banks.

The flexibility is evident in the Account API (link to documentation 👉 here), which makes it easier to manage balance, credit limit, and customer data. Accounts can be configured for different types of use, such as credit or debit.

In 2022, Pismo more than doubled its transaction volume, opening 35 million new accounts and issuing 70 million cards 4. Its event-driven architecture turns every transaction into an “event,” automatically triggering actions within the system. This improves control, facilitates reporting for regulators, and ensures regulatory compliance, with each transaction — purchase or transfer — going through authorization, processing, and accounting.

The platform also offers banking models, such as Banking as a Service (BaaS), allowing clients from various sectors to connect to licensed providers, such as BTG, Celcoin, Itaú, and JD Consultores, offering services like digital accounts, bank transfers, and loans.

Through its offer of an account ledger and payment processing, Pismo has expanded into other geographies. This has led the company to seek connections with major real-time payment systems worldwide, such as Pix in Brazil, Faster Payments in the UK, and the United Payments Interface (UPI) in India.

Different Strategies

This isn’t about which solution is better or worse, but about a choice based on the specific needs of each bank and fintech. Mambu focused on flexible solutions for institutions that needed to scale quickly, prioritizing external integrations. Pismo, on the other hand, focused on offering an integrated platform, allowing centralized management of accounts and payments.

What’s interesting is how both leveraged the cloud’s potential to offer flexibility. Mambu was a pioneer, but Pismo realized that without payment processing, its model would be costly for clients. We can say that this strategy proved to be right in 2023 when Visa acquired the company for $1 billion, a transaction that put Brazilian financial technology in the global spotlight and highlighted Pismo’s ability to integrate agnostically with other financial systems.

The fourth generation of core banking

When I talk about the fourth generation, I’m referring to a bet — it’s still under construction. What differentiates it from previous generations is the search for flexibility and independence, characteristics that the market seeks and that open-source technology can offer.

Mambu created an ecosystem of solutions, positively impacting the development of financial products and making the ledger more flexible. Pismo quickly realized that, in addition to traditional core banking, integrating payment processing would reduce integration time with external solutions and costs. In the fourth generation, we’ll see the combination of the best features from previous generations, but with flexibility often meaning giving up something very valuable to a tech company: the source code.

In this field, companies like Formance and Lerian have been betting on this thesis. I’ll dive deeper into Lerian’s model, but first, it’s important to understand how open-source governance works.

Understanding open source governance

At the beginning of this edition, I mentioned that comparing the history of core banking to operating systems would help understand the new phase of the market. The history of Linux is relevant for understanding what’s at stake here. In the open-source universe, I’ll use two examples: the Linux Foundation and the Apache Foundation.

Linux and Apache both bet on an open model, allowing developers and users to actively participate, which enabled the organic growth of both projects. Instead of a closed model, the goal was to create a collaborative environment with recurring contributions.

Both demonstrated how an open model generates scalable products, but with different governance models. Both adopted open-source code, but with different approaches to governance. In Linux, governance is centralized within the Linux Foundation, with Linus Torvalds and others deciding on the kernel. In contrast, Apache’s governance is decentralized, giving more autonomy to management groups (PMCs), though still adhering to foundation guidelines (link to documentation 👉 here). Despite being open, both maintain control over contributions, balancing flexibility and oversight in distinct ways.

The arrival of Lerian

Now, let’s focus on Lerian. Looking at the evolution of core banking, it’s clear that flexibility is essential for expanding a solution. This is evident in the stories of Mambu and Pismo, which showed that, beyond the ecosystem, the focus should be on delivering what the client needs simply and at the lowest cost.

Lerian offers this to the market: an open-source ecosystem that even allows its competitors, such as Pismo and Mambu, to use its ledger and develop solutions on top of it, similar to what happened with Apache and Linux, for instance.

Behind Lerian are Fred Amaral and Marilyn Hahn. I’ve been following their journey for several years and believe they are the perfect match for building this solution. Fred founded Dock, a company that became a reference in BaaS in the Brazilian market, while Marilyn founded Banklyn, also in the BaaS segment, which was sold to Méliuz and later to BV.

Knowing this is important for one reason: they know this market like few others, from implementing BaaS to migrating to core banking. This experience is reflected in Lerian's proposal. While Pismo and Mambu took different paths, Lerian bets on flexibility and customization via open-source, with its product called Midaz.

Betting on open-source makes sense for several reasons. With more banks and fintechs migrating to their own core banking systems in search of flexibility, Lerian can be a shortcut: instead of starting from scratch, they can build on an already tested base. Furthermore, open-source brings a higher level of trust — its greatest strength is transparency. Anyone can inspect the code, identify vulnerabilities, and validate the system’s security.

Midaz follows the same principles as open-source projects like Apache and Linux: there are rules. Just as the secret in Linux lies in the kernel, for Lerian, it’s in the ledger. Everything revolves around the evolution of the ledger.

The contribution process 5 is simple and structured. It starts with identifying the problem (when a need or failure in the code is detected), followed by the pull request (a request to add changes), commit signing (when the contributor formalizes the changes), code review (where others check the quality and security of the code), and finally, the merge (integration of the code into the main repository).

Transparency is a central pillar of Midaz’s governance, with all decisions being made based on open communication between all participants. If conflicts arise, the resolution process begins with mediation, and if necessary, it can be escalated to the Steering Committee, ensuring disputes are resolved impartially 6.

Building an ecosystem

Open-source, however revolutionary, has a big issue: monetization. There’s no free lunch. Lerian solved this with two models: community and enterprise. In the community model, users of the open-source version receive support from the GitHub and Discord community. In the enterprise model, clients use the same code, but with added plugins and services.

There are three options: (i) Lerian Cloud (SaaS), with ready-made infrastructure and full support for software, infrastructure, and cybersecurity; (ii) Managed Cloud, where Lerian manages the client’s infrastructure (AWS, Azure, or GCP); (iii) 3rd-Party Managed, where the client or third parties handle the infrastructure and receive software support. Something similar happens with the French company Formance, which also adopts a modular platform approach, like AWS, allowing its clients to integrate various modules to optimize their financial infrastructure.

Lerian doesn’t charge for active or inactive accounts or transaction fees. The pricing model is simple and transparent: subscription fees (support and plugins) and cloud costs for those using Lerian Cloud. This means costs scale as the company succeeds and grows, making the model more dynamic and fair. Lerian offers both its own and third-party plugins, a strategy similar to Mambu. Some examples include Pix, boleto payments, card processing, multiple accounts, regulatory solutions, currency exchange, investments, CRM, ERP integrations, and even crypto and insurance solutions.

Building a community

Success in open-source doesn’t happen overnight, but it relies on an engaged community. Linux and Apache showed that building this foundation takes time. For Lerian, I believe the path is already being paved: its founders have been part of the industry, which helps establish a solid reputation.

We can assess the community’s performance based on the engagement in Lerian’s GitHub. In the past 30 days, there have been over 80 contributions — the main contributors are still team members. This will be an interesting metric to revisit in the coming months as marketing initiatives continue to evolve.

I believe an interesting example of community building is Rocketseat, a community that became a major software development education platform. I’ve been following the company since 2019 and remember how it had its big boom in 2020. Through strategic partnerships, such as the acquisition of Shawee, hackathons, and workshops, they solidified their brand in the tech market. Lerian could experiment with the same channels, and this could be an excellent way to attract talent while creating a strong sense of belonging and mission, based on: creating flexible solutions that empower institutions to manage their own operations autonomously, in an open, collaborative, and accessible way.

👉 Subscribe to W Fintechs and receive an analysis like this in your inbox every Monday.

Apache of core banking?

Lerian may not be the Linux of core banking, but I believe it could become the Apache: a solid foundation for those who want to build. It's not about replacing Mambu or Pismo, but offering banks, fintechs, and even competitors a flexible, open, and collaborative development base. If it works, it could transform how core banking is developed and scaled around the world.

During my conversation with Fred, I was impressed by his ability to connect ideas and break down complex topics simply. The first thing he told me, right after I praised his professional journey, was: "And none of this was planned." I think that sums up what it means to build a community: human connection and contribution are not planned; they simply happen when supported by solid foundations. Lerian is building part of this future stack; I hope they succeed.

If you know anyone who would like to receive this e-mail or who is fascinated by the possibilities of financial innovation, I’d really appreciate you forwarding this email their way!

Until the next!

Walter Pereira

Disclaimer: The opinions expressed here are solely the responsibility of the author, Walter Pereira, and do not necessarily reflect the views of the sponsors, partners, or clients of W Fintechs.

https://www.thebusinessresearchcompany.com/report/core-banking-software-global-market-report

https://building.nubank.com.br/pt-br/the-spark-of-our-foundation-a-letter-from-our-founders/

https://www.fintechfutures.com/2024/03/from-start-up-to-unicorn-the-rise-of-revolut/

https://aws.amazon.com/pt/blogs/aws-brasil/como-a-pismo-processa-200-milhoes-de-eventos-por-dia-utilizando-servicos-aws/

https://github.com/LerianStudio/midaz/blob/main/CONTRIBUTING.md

https://github.com/LerianStudio/midaz/blob/main/GOVERNANCE.md