#127: Short Takes: Cards keep growing, but Pix is gaining (a lot of) ground in Brazil; updates

W FINTECHS NEWSLTTER #127

👀 Portuguese Version 👉 here

👉 W Fintechs is a newsletter focused on financial innovation. Every Monday, at 8:21 a.m. (Brasília time), you will receive an in-depth analysis in your email.

Welcome to the Short Takes edition! As the name suggests, unlike deep dives, these editions will explore a variety of topics that might later evolve into full deep-dive editions.

Short Takes is designed for entrepreneurs, investors, and operators looking for quick, actionable insights.

This edition is sponsored by

Iniciador is the complete infrastructure platform specialized in Regulated Open Finance, enabling Payment Initiation and Data Access.

The solution removes technology and compliance concerns, allowing clients — with their own regulatory license or using Iniciador’s — to focus on new products and business growth.

💡Bring your company to the W Fintechs Newsletter

Reach a niche audience of founders, investors, and regulators who read an in-depth analysis of the financial innovation market every Monday. Click 👉here

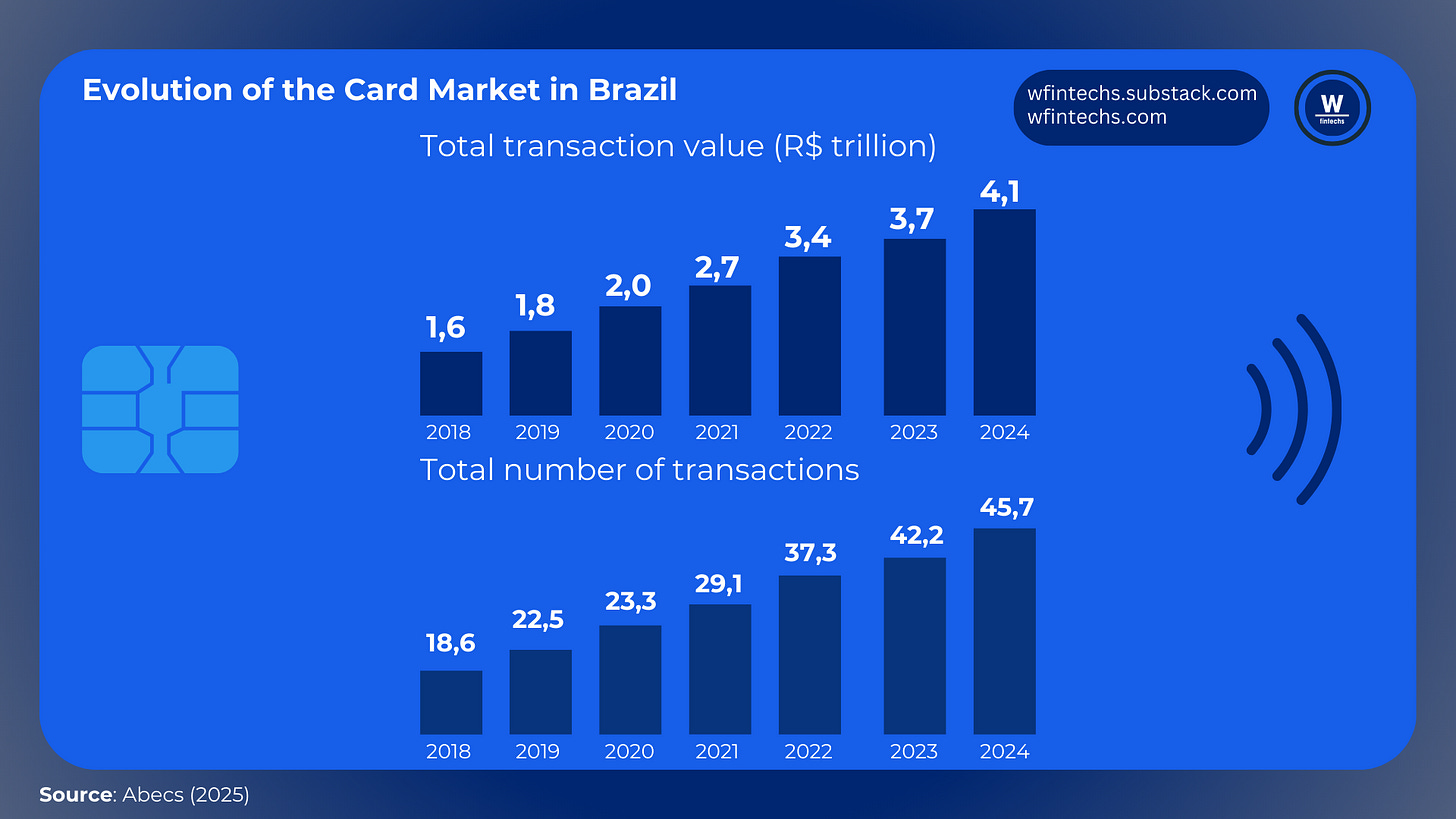

Brazilians have never used their cards as much as they did in 2024, with total transaction volume surpassing R$ 4 trillion for the first time, marking a 10.9% growth 1. Every day, 125 million payments were processed, totaling 45.7 billion transactions throughout the year.

By the end of 2024, 67.2% of in-person payments were made using contactless technology. Meanwhile, recurring payments, such as subscriptions and monthly bills, grew by 88.5% over the past two years.

While cards continue to dominate the market, Pix is solidifying itself as an increasingly relevant payment alternative. Since 2023, Brazil’s Central Bank has been investing in new features like Pix by Approximation and Pix Automatic, which aim to compete with card payments.

Pix by Approximation relies on Open Finance APIs and compatibility with Android and iOS systems. This means that developers must comply with platform rules, making payments more dependent on tech giants like Google and Apple.

On Android, the system offers more flexibility, allowing passive NFC usage. This means a smartphone can receive payments directly without complex configurations, making it easier to develop instant payment solutions via contactless transactions.

On the iPhone, however, Apple imposes NFC restrictions, making it harder to implement Pix by Approximation. This reduces competition and limits consumer choice, making them more dependent on Apple’s own solutions, such as Apple Pay.

Given this scenario, some market initiatives aim to improve accessibility for contactless payments. Proposals from companies like Labrys and Tap2Pix, advocate for developing open solutions that allow any NFC-enabled smartphone to process payments without relying on a specific provider. This could increase competition, reduce costs for consumers, and challenge closed ecosystems like Apple Pay and Google Pay, offering users more freedom in choosing their payment apps.

Pix Automatic works similarly to direct debit for businesses, making it ideal for recurring bills like utilities, tuition, and condo fees. This feature gives businesses more access to recurring payments, lowering operational costs and offering users more payment options—further strengthening Pix adoption.

Currently, payment authorizations cannot be transferred between banks. According to the Pix Automatic Implementation Guide, when a payer authorizes their Payment Service Provider (PSP) to process recurring payments, that authorization is limited to the given institution and cannot be automatically transferred to another bank.

The document highlights a crucial point: when a user sets parameters within their PSP— such as authorized companies, maximum amounts, and debit frequency — these settings do not transfer automatically if they switch banks. This means that users must manually cancel all authorizations with their old bank and set them up again with the new one, reconfiguring permissions and limits from scratch.

This process adds friction, particularly for customers who frequently switch banks or want to centralize payments in a single account. Beyond making migration harder, the lack of portability for these authorizations may limit Pix Automatic adoption and reduce competition among financial institutions.

On the other hand, this restriction serves a purpose: ensuring that each bank maintains full control over authorizations linked to accounts they manage, reinforcing security and system stability. Still, a model that securely transfers these settings could offer users more flexibility without compromising payment system integrity.

There is also room for improvement in the user experience. A centralized panel already exists for managing Pix Automatic authorizations, showing details about recurring payments, limits, and cancellation options. However, navigation could be more intuitive. A more dynamic, user-friendly dashboard would make financial management faster and more transparent, putting authorization controls at the user’s fingertips.

One thing is clear: Pix is not just competing with cards; it is introducing the concept of a platform to the payments sector. While cards still lead in credit transactions and recurring payments, the real competition is not only about transaction volume but about which system can better meet consumer needs while reducing costs and friction.

If you enjoyed this edition, share it with a friend. It helps spread the message and allows me to keep providing high-quality content for free.

🇧🇷 New Open Finance Journey Could Change the ‘Status Quo,’ Says Central Bank - 👉Finsiders

Without specifying which models might be most impacted by the arrival of JSR, Mardilson stated that this new payment track is part of the realization of service sharing in Brazilian Open Finance, which is considered a global benchmark.

“We’re swapping some wheels for turbines. Those who can’t transition from wheels to turbines may feel disadvantaged. But that’s a short-sighted view. The market as a whole has already realized that it’s just a matter of time before things take off and that it’s essential to be involved in all of this,” said the Central Bank representative.

“We’re just at the beginning. Now, we’ve reached a critical turning point: professionalizing the governance structure. This professionalization is a key element for this rocket to break orbit,” he added. The Central Bank representative was referring to the creation of a permanent governance structure, which had a temporary format until last year.

🇧🇷 Nubank and Other Fintechs May Have to Change Their Names - 👉Finsiders

A new rule proposed by the Central Bank (BC) in a public consultation could force many digital banks and fintechs to reconsider their names. A quick search on the BC’s website reveals at least 20 Payment Institutions (PIs) that use the term "bank" in their branding. The most well-known example is Nubank, but other cases include Stark Bank, Will Bank, and Zro Bank, among others.

In a statement, Nu said it is closely monitoring discussions regarding the use of terms related to the word "bank" in the branding of Payment Institutions, financial companies, and banking correspondents. The company also emphasized that “obtaining a banking license, if it were to happen, would not require a capital increase,” given its conglomerate structure.

“We believe that any regulation in this regard will be established only after extensive discussion and will provide sufficient time for all affected institutions to carefully assess the full range of possible compliance scenarios,” Nubank stated. Additionally, the company reinforced that it "fully complies with current legislation and holds all necessary licenses to offer the products currently available on its platform."

Until the next!

Walter Pereira

If you know anyone who would like to receive this e-mail or who is fascinated by the possibilities of financial innovation, I’d really appreciate you forwarding this email their way!

Disclaimer: The opinions expressed here are solely the responsibility of the author, Walter Pereira, and do not necessarily reflect the views of the sponsors, partners, or clients of W Fintechs.

https://abecs.org.br/storage/sector_balances/20/01JKX86ZE3SM0N71DNEQG0DT4R.pdf