👀 Portuguese Version 👉 here

👉 W Fintechs is a newsletter focused on financial innovation. Every Monday, at 8:21 a.m. (Brasília time), you will receive an in-depth analysis in your email.

Welcome to the Short Takes edition! As the name suggests, unlike deep dives, these editions will explore a variety of topics that might later evolve into full deep-dive editions.

Short Takes is designed for entrepreneurs, investors, and operators looking for quick, actionable insights.

Last week, I talked about the rise of AI agents in the fintech space. The first major use case for these agents has been in handling the most repetitive tasks — the ones that are time-consuming but require little creativity or judgment. Customer service, tech support, document delivery, data validation, ticket triage. Klarna was one of the first clear examples of visible impact, and in Brazil, InfinitePay demonstrated the power of automation by automating 75% of its customer support, saving R$100 million in 2023 and handling 2.6 million requests with a lean structure.

A recent BCG report highlighted exactly how agents are evolving 1. We're moving away from the era of “if-this-then-that” agents and entering a new paradigm: autonomous agents that observe, plan, act, and collaborate. This isn’t just a technical shift.

Foundation models first emerged as powerful token predictors — essentially, autocomplete machines. They could complete sentences but lacked real understanding of context, intent, or goals.

Then came the chatbots, with models fine-tuned for conversation, answering questions, and mimicking human dialogue. Definitely useful, but still confined to narrow use cases.

The third phase marked a huge leap forward: agentic workflows. Here, we combined LLMs with structured logic — like saying, “if the answer is X, then use tool Y.” This is where we’re currently seeing the most practical value. We already have agents that extract data, fill out spreadsheets, and organize pipelines. They still have limitations, but they’re far more capable than previous generations. The fourth stage — fully autonomous agents — is where the real magic (and real challenges) begin. These agents don’t just react or follow rules; they observe their environment, plan actions, and make real-time decisions. They stop being task executors and start acting more like operators with goals. And this is where the operational value for companies really scales.

The key difference is that while agentic workflows are predictable, autonomous agents must be adaptable. And on the more ambitious horizon, we see multi-agent systems. That’s the endgame: not a single agent, but a coordinated network of agents. Each with a specific role, sharing context, aligning goals, and solving complex tasks together.

What this evolution shows is that the goal isn’t to have a single all-powerful agent doing everything. It’s about orchestrating different capabilities within modular structures.

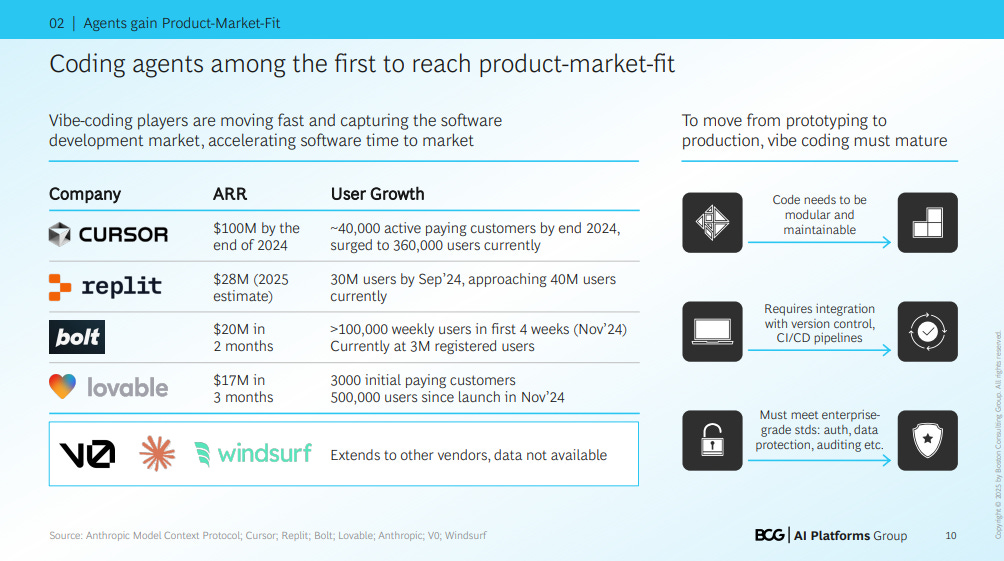

And it’s precisely within this modular logic that coding agents have emerged as the first to truly reach product-market fit. Platforms like Cursor, Replit, Bolt, and Lovable didn’t just attract millions of users in a matter of months, but they also proved that when an agent solves a clear, specific problem (like speeding up app development), traction happens almost organically.

The key takeaway is this: the agents that truly deliver value are the ones that understand how engineering teams operate. They can orchestrate tasks through GitHub, connect to CI/CD pipelines, follow company policies, and execute autonomously. In other words, they behave like real members of the engineering team.

Until the next!

Walter Pereira

If you know anyone who would like to receive this e-mail or who is fascinated by the possibilities of financial innovation, I’d really appreciate you forwarding this email their way!

Disclaimer: The opinions expressed here are solely the responsibility of the author, Walter Pereira, and do not necessarily reflect the views of the sponsors, partners, or clients of W Fintechs.

https://my.ai.se/resources/5731