#156: Short Takes: Trump got bothered by Pix, while more countries adopt similar systems

W FINTECHS NEWSLETTTER #156

👀 Portuguese Version 👉 here

👉 W Fintechs is a newsletter focused on financial innovation. Every Monday, at 8:21 a.m. (Brasília time), you will receive an in-depth analysis in your email.

Welcome to the Short Takes edition! As the name suggests, unlike deep dives, these editions will explore a variety of topics that might later evolve into full deep-dive editions.

Short Takes is designed for entrepreneurs, investors, and operators looking for quick, actionable insights.

Last week, Donald Trump launched an offensive against Pix, invoking Section 307 as justification for a trade investigation against Brazil. The allegation of unfair practices in the payments sector actually hides a growing discomfort with Pix's expansion into the territory of American giants. Visa and Mastercard built empires on interchange fees and closed processing networks and the Brazilian model is starting to threaten that.

Pix not only eliminated transaction fees for individuals but also reduced the operational space of card networks in millions of everyday transactions. According to data from the Central Bank, Pix now processes more transactions per month than all credit and debit cards combined. In 2024, the total volume transacted through Pix surpassed R$ 17 trillion.

For comparison, credit cards moved R$ 3.6 trillion and debit cards around R$ 1.2 trillion. In terms of transaction count, Pix already accounts for over 40 percent of all electronic operations in the country. This means that in just five years the system has become a real challenger to giants that spent decades dominating the payments market.

Paul Krugman got straight to the point in his recent newsletter. The United States fears Pix and it’s not because of the technology itself but because of what it represents. While discussing Republican resistance to central bank digital currencies (CBDCs), Krugman pointed out that Pix already delivers what crypto promised and failed to achieve: low transaction costs, financial inclusion, and large-scale adoption. What Brazil created, he says, is a system that works and poses a threat to the American financial lobby.

It is no exaggeration to say that Pix has unintentionally become a geopolitical symbol. In just five years the solution created by Brazil’s Central Bank reached 93 percent of the country’s adult population and transformed how Brazilians handle money. Today Pix is mentioned in IMF reports, in US legislative sessions, and even in political speeches as a supposed competitive threat. The brilliance of Pix does not lie in its technology but in the fact that it is a public policy that worked and worked fast.

It is very likely that geopolitics will now start focusing on payments. Europe, although it does not yet have a well-established open banking infrastructure, could also move in the same direction with account-to-account (A2A) payments eliminating card dominance.

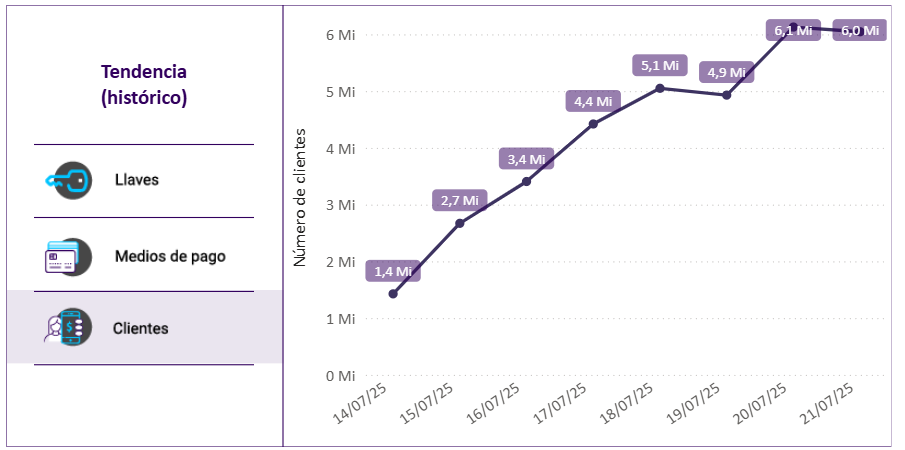

Bre-B in Colombia is the most recent example. Launched by the Banco de la República in July 2025, the Colombian public infrastructure already has over 13.4 million registered keys. There are 7.88 million payment methods linked and 6 million clients just in its first days of operation.

Bre-B might well be Colombia’s Pix. Its use cases already include payments between people and small businesses using QR codes and keys and there is a clear roadmap for expanding into B2B and payroll payments in the future.

The key structure is the same as Pix. A unique identifier such as national ID, phone number, email, or business code replaces the need to share account numbers. This layer of abstraction allows different institutions to participate fluidly in the network without creating user friction. In Bre-B’s case, P2P payments are free. Payments to businesses are still in early stages but there are signs that fees may apply, especially if reconciliation or reporting is involved.

Colombia’s goal mirrors what Brazil sought and achieved since 2016: reducing the use of physical cash, which still represents 70 percent of transactions in Colombia.

What is happening now is a real payment systems race. India with UPI. Saudi Arabia with Sarie. And now Colombia with Bre-B. All are following the same playbook: digitize money, modernize payment architecture, and use public infrastructure to foster competition.

Years ago I wrote that the future of the financial system would not come from Wall Street but might emerge in Mumbai, São Paulo, Cape Town, or even Bangkok. Perhaps the future of money really is being written far from developed countries not because they have more technology but out of pure necessity.

Until the next!

Walter Pereira

If you know anyone who would like to receive this e-mail or who is fascinated by the possibilities of financial innovation, I’d really appreciate you forwarding this email their way!

Disclaimer: The opinions expressed here are solely the responsibility of the author, Walter Pereira, and do not necessarily reflect the views of the sponsors, partners, or clients of W Fintechs.