#169: New Report: A New Planet Called Pix – 5 Years - English Version

W FINTECHS NEWSLETTTER #169

👀 Portuguese Version 👉 here

👉 W Fintechs is a newsletter focused on financial innovation. Every Monday, at 8:21 a.m. (Brasília time), you will receive an in-depth analysis in your email.

A new planet has been discovered. And it already moves three trillion reais every month.

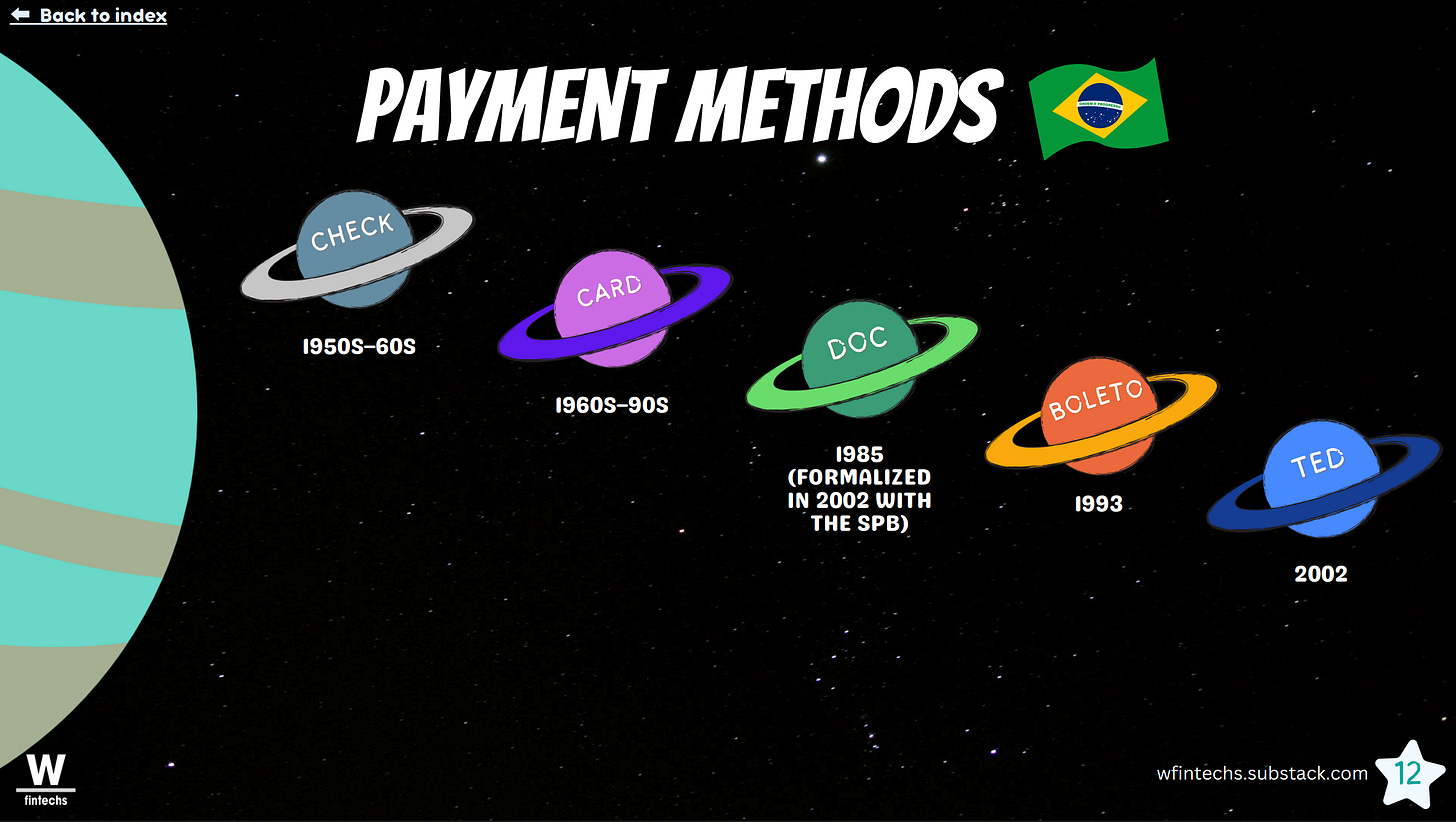

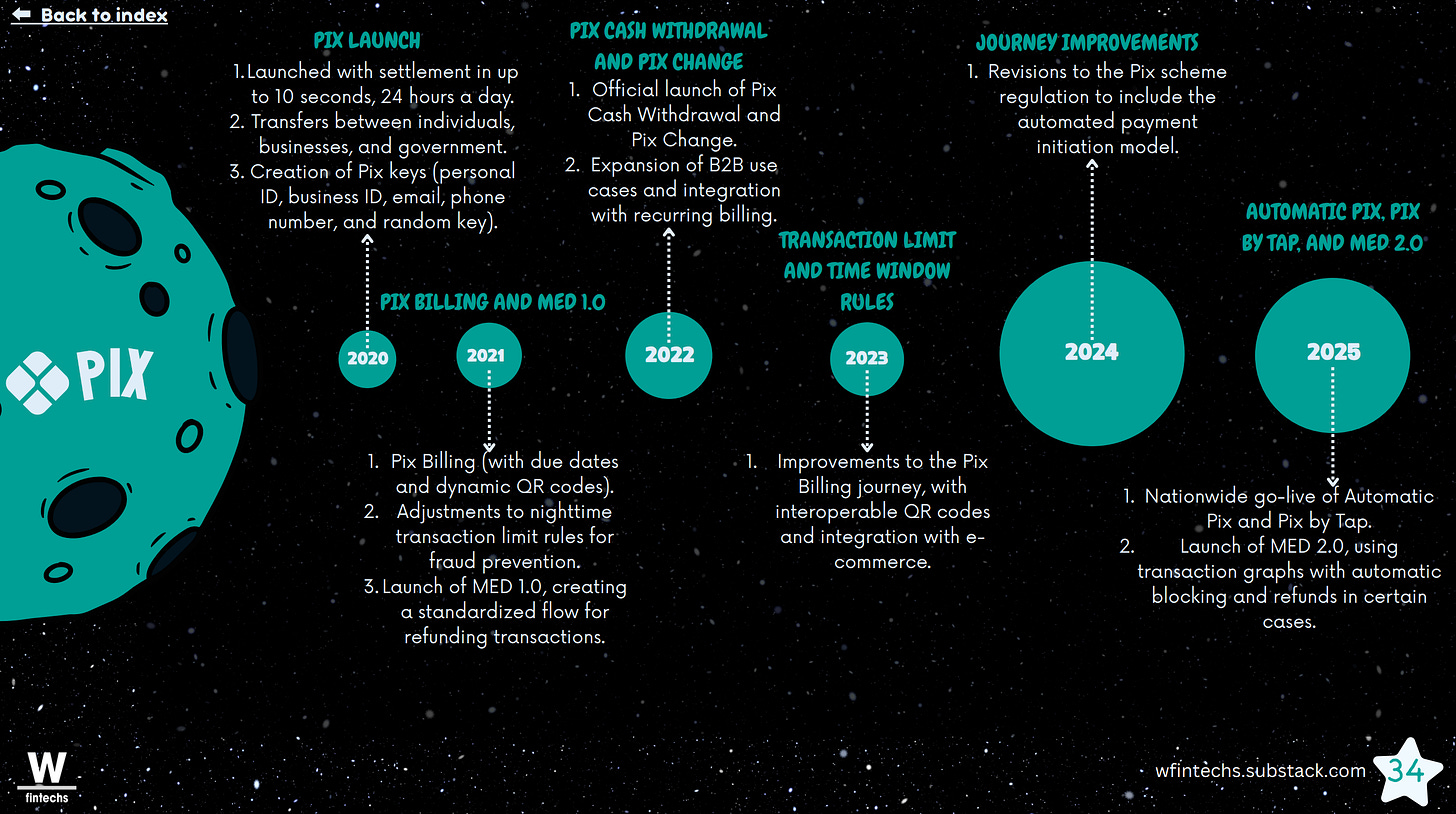

For years, Brazil revolved around old orbits. TED, DOC, boletos, cards, each had its own gravity, its own limits, its own delays. But in November 2020, a light cut through space and opened a new orbit of possibilities. That light was Pix. And it wasn’t an isolated event. It was the sum of tensions, talent, and needs that had been building within the Brazilian financial system. It truly felt as if we were witnessing a planetary alignment.

Last week, on February 3, 2026, W Fintechs published a comprehensive study on the first five years of this ecosystem. The report is structured into three chapters. We begin by reconstructing the past, tracing how payment methods evolved over time and how Brazil gradually organized, regulated, and tested different payment instruments. We then dive into the arrival of Pix, exploring its inner workings, its architecture, and its earliest days. Finally, we turn to the most recent layers, examining its social impact, functional evolution, international expansion, and the new satellites now orbiting this ecosystem.

To tell this story, we brought together those who experienced it up close. Leandro Piano from Belvo explains how payment initiators, one of its core functionalities, are making payments increasingly invisible. Matheus Rauber from the Central Bank shares how the regulator has been integrating Pix and Open Finance into an evolving innovation agenda. Ana Carla Abrão, CEO of Open Finance Brasil, shows how Pix paved the way for a new model of interoperability between payments and data. And Daniel Ruhman, CEO of Cumbuca, offers perspectives on how a foreign company can operate within this ecosystem.

Today, Pix handles more than 6.9 billion transactions per month. The average ticket has surpassed 460 reais. There are 178 million active users, nine out of ten of whom are individuals. And even at this scale, Pix still has room to grow. In a single month, it already moves more than Argentina’s GDP.

We also show how the machinery works: instant settlement, SPI, DICT, RSFN.

And we break down all the major features launched over the past five years: Pix Withdrawal, Pix Change, MED 1.0 and 2.0, Pix Automatic, NFC, Pix Billing with due dates, and Pix as Collateral. We explain how fraud evolved, how the Central Bank responded, how MED 2.0 works, and what real dispute flows look like. We also map the insurance ecosystem that formed around Pix, as banks and fintechs began offering protection against theft, coercion, and unauthorized transactions.

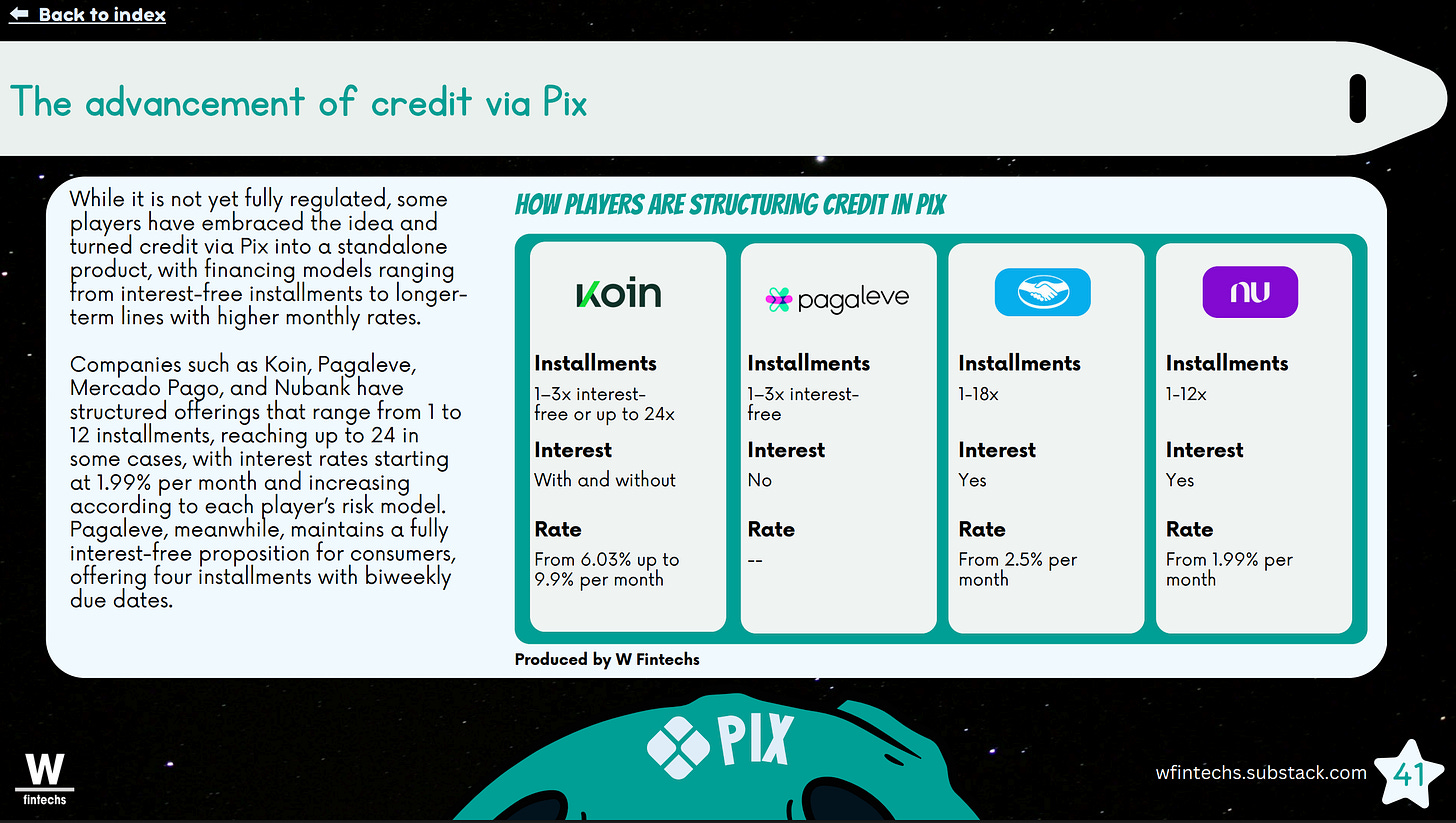

Another highlight is credit. We show how Pix began to serve as a starting point for financing purchases, and how players like Nubank, Mercado Pago, and Pagaleve are testing different models: four interest-free installments, and 12- or 24-installment plans with rates of up to 9 percent a month.

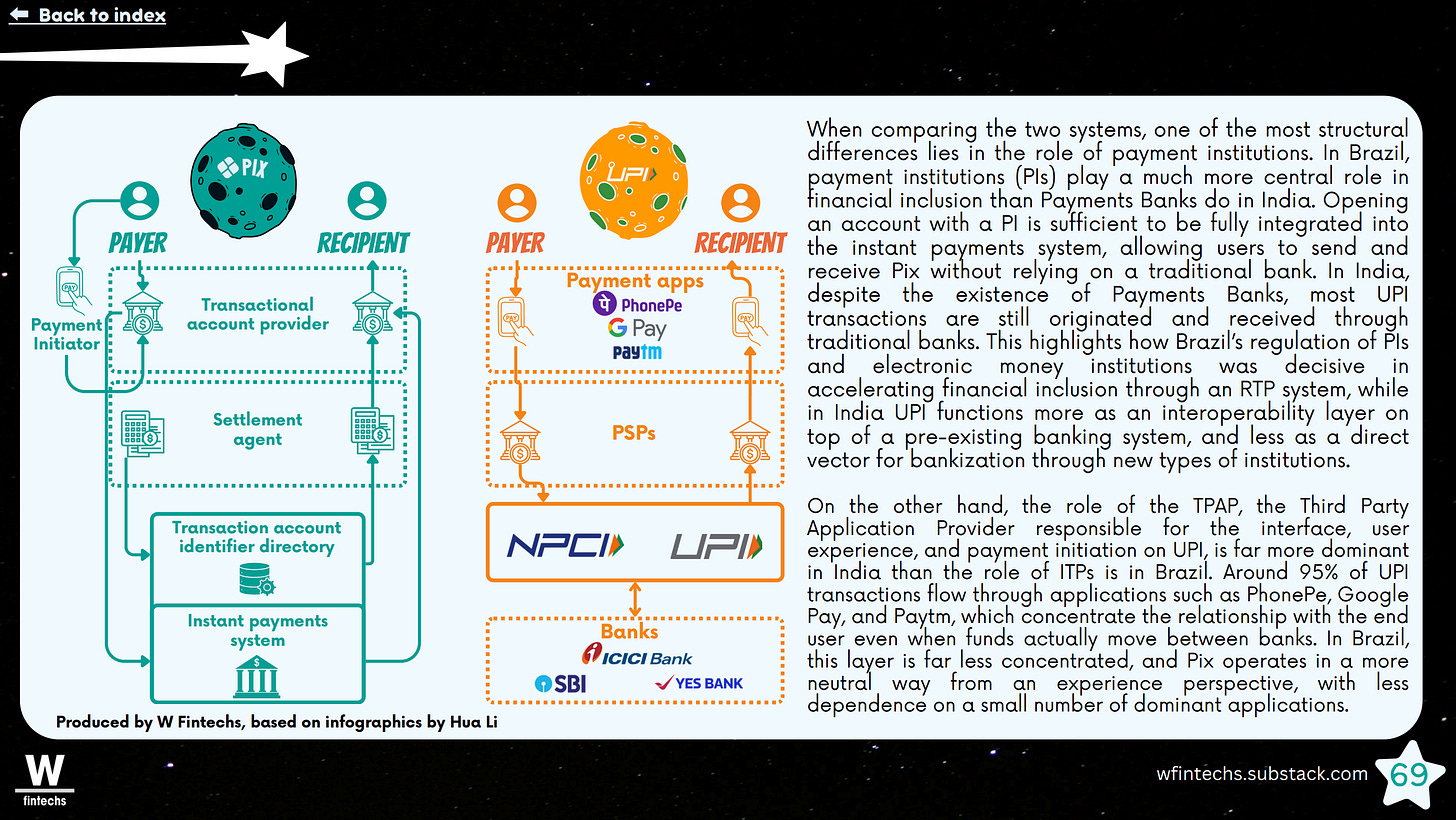

In addition, the document draws comparisons with other payment systems around the world. Although Pix was inspired by India’s UPI, its operating model is far more inclusive and wide-ranging. While UPI has a strong and active participation of TPPs within its ecosystem, Pix follows a different path, with its ITP ecosystem still under development.

The report spans 88 illustrated pages, featuring charts, timelines, visual flows, and language designed for both technical and non-technical audiences who want to deeply understand how Pix truly became embedded in everyday Brazilian life, and why it did so.

If you want to truly understand Pix, read the full report. May this new planet continue to expand, and may we know how to explore it.

Enjoy the read.

Special thanks to our sponsors Belvo, Cumbuca e Boyce Data.

Until the next!

Walter Pereira

If you know anyone who would like to receive this e-mail or who is fascinated by the possibilities of financial innovation, I’d really appreciate you forwarding this email their way!

Disclaimer: The opinions expressed here are solely the responsibility of the author, Walter Pereira, and do not necessarily reflect the views of the sponsors, partners, or clients of W Fintechs.