#FinOpen: The union of Pix and Open Finance and how it redefines the role of digital wallets; Use cases; Updates

W FINTECHS NEWSLETTER #131

👀 Portuguese Version 👉 here

👉 W Fintechs is a newsletter focused on financial innovation. Every Monday, at 8:21 a.m. (Brasília time), you will receive an in-depth analysis in your email.

Welcome to the edition of the Finance is Open series.

Every other Wednesday, in addition to the traditional Monday editions, I will cover key topics and the latest updates on what's happening in Open Finance, both in Brazil and around the world.

Finance is Open is sponsored by

Iniciador is the complete infrastructure platform specialized in Regulated Open Finance, enabling Payment Initiation and Data Access.

The solution removes technology and compliance concerns, allowing clients — with their own regulatory license or using Iniciador’s — to focus on new products and business growth.

💡 Want to advertise in the W Fintechs Newsletter?

Reach a niche audience of founders, investors, and regulators who read an in-depth analysis of the financial innovation market every Monday. Click 👉here

About this section:

In this section, I bring the latest updates from the working groups and the structure of Open Finance Brazil.

The topics are: governance, with potential rule changes and management updates; technology, with updates on infrastructure, APIs, and security; user experience, highlighting improvements in the journey; and ITPs, addressing news on regulated participants and the Payment Transaction Initiator.

Open Finance Brazil has made progress with the Messaging PoC, which has already reached 31% of active consents, surpassing the established target.

On the technology front, the new version of the Automatic Payments API (v2.0.0-rc.1) introduced significant changes in consent management, payments, and transfers, along with updates to the documentation. Another key update was the implementation of rate limits on the participants' endpoint: starting from 03/10/2025, notifications will be sent to those exceeding 5 TPM, with the change becoming permanent on 04/10/2025. Additionally, for new entrants looking to operate as Account Holders, proving successful tests in the Pix tester environment is now mandatory.

Instant payments are the invisible engine driving data-sharing infrastructure. Though often overlooked, their absence makes implementing such infrastructure significantly more challenging.

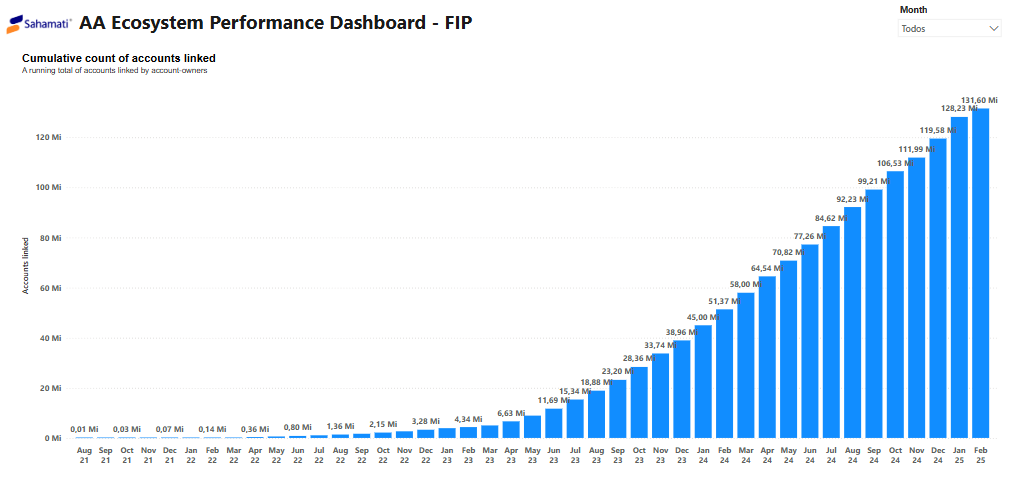

India recognized this connection when it launched UPI. The Reserve Bank of India understood that money in motion is essentially data in circulation. In a country where millions remain on the fringes of the financial system, turning transactions into data was a game-changer for financial inclusion. This led to the creation of Sahamati, a framework that consolidates scattered financial information, gives users control, and unlocks access to credit and services that were previously out of reach.

UPI, however, did not emerge in isolation. It was made possible by Aadhaar, India’s digital identity system, which incorporated biometrics into financial transactions and provided a formal identity for millions previously excluded from the financial system. Together, these initiatives, known as India Stack, laid the foundation for developing new financial products and services. Today, UPI connects over 500 banks globally and can be accessed through multiple service layers. Platforms like BHIM, Google Pay, Paytm, and PhonePe compete for the user interface, leading to market concentration, with Google Pay and Paytm dominating the digital wallet space.

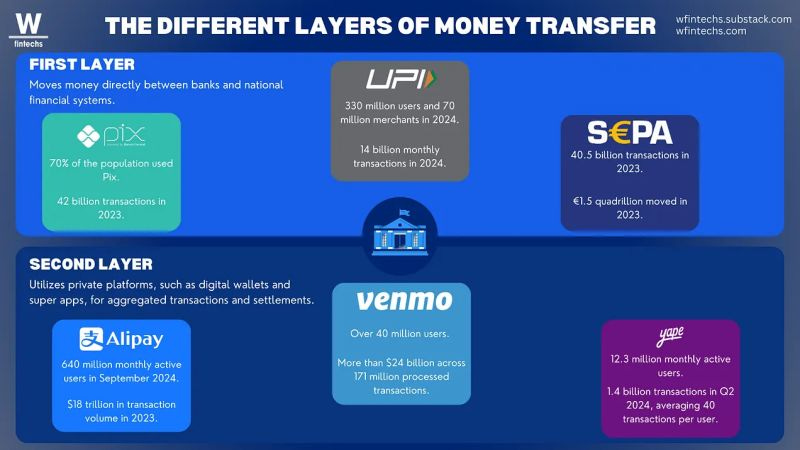

There are several ways to move money, but let’s focus on two main layers. The first involves direct transfers between banks and national financial systems. The second relies on private platforms, such as digital wallets and super apps, which aggregate transactions and consolidate payments.

In Asia, the closed-loop digital wallet model, exemplified by Alipay and WeChat Pay in China, has become dominant. Money circulates within these ecosystems and only reaches the banks at the final settlement stage. This model was designed for efficiency and cost reduction for both users and businesses. In markets with a large unbanked population, this approach has given rise to super apps that handle everything from payments to food delivery.

Brazil took a different path. Pix introduced instant, free, and universally accessible transfers, drastically reducing the need for private digital wallets. Its success was driven by mandatory adoption by banks and a streamlined user experience. With the evolution of Open Finance, digital wallets transitioned into Payment Initiation Service Providers (PISPs), integrating into the banking infrastructure without holding funds—unlike China’s closed-loop wallets.

Each country has found its own approach to modernizing payments. Asia bet on the power of closed ecosystems, while Brazil prioritized simplicity with Pix. Both models are successful in their own way but reflect distinct philosophies.

It’s clear that payments and data are becoming increasingly intertwined. The question is not whether this fusion will happen but how different ecosystem players will monetize it. Those who master this intersection will not only control the flow of money and data but also gain the ability to anticipate and influence user behavior.

If you're enjoying this edition, share it with a friend. It will help spread the word and allow me to keep providing quality content for free.

Contribution

I'm creating a use case mapping, divided into data and payments, with an interactive dashboard. I’ve already mapped out some cases, but before the official launch (expected at the end of March), I want to enrich the mapping even further.

If you'd like to include your institution’s use case, just send me a message by replying to this email or via LinkedIn (link 👉 here). And if you're a fintech without its own license, don’t worry—we want you involved too!

Zippi is a prime example of the convergence between Open Finance and instant payments, structuring its credit offerings for micro and small entrepreneurs.

With a Pix-based model, the fintech provides instant access to working capital, solving a critical liquidity problem for businesses that traditionally face barriers to credit. Data shows exponential growth in total payment volume (TPV), increasing from a base index of 100 in Q1 2022 to 1,203 in Q2 2024. This highlights the scalability of the adopted model, driven by a combination of technology and credit intelligence enhanced by Open Finance data.

The inclusion of structured data via Open Finance has enhanced Zippi's ability to price risk and improve approval rates. Unlike the Credit Information System (SCR), which can have a lag of up to two months, Open Finance provides near real-time access to bank cash flows. As a result, the fintech adjusted its credit policies, lowering operational costs and increasing customer retention during onboarding. The impact of this integration is evident in TPV retention, which jumped from 115% in Q2 2022 to 208% in Q2 2023, indicating stronger customer loyalty and increased reuse of credit lines.

Beyond credit, Zippi leverages Open Finance to optimize its digital journey and collection strategies. With a 13% efficiency gain in onboarding and a 5% reduction in account opening costs, the fintech has improved customer experience and reduced churn.

The integration of Pix and Open Finance not only accelerated transactions but also created a richer and more dynamic data foundation, enabling Zippi to continuously refine its products and scale its operations sustainably.

If you know anyone who would like to receive this e-mail or who is fascinated by the possibilities of financial innovation, I’d really appreciate you forwarding this email their way!

Until the next!

Walter Pereira

Disclaimer: The opinions expressed here are solely the responsibility of the author, Walter Pereira, and do not necessarily reflect the views of the sponsors, partners, or clients of W Fintechs.