#26: Insurance and opportunities: a landscape from Brazil

W FINTECHS NEWSLETTER #26: 01/11-07/11

Hi everyone,

In this edition of W Fintechs I decided to write in English this time and I’ll talk about:

The main characteristics of the Brazilian market

Opportunities for entrepreneurs and investors

Some players and insurers

👉W Fintechs is a newsletter about fintechs, every Monday at 8:21 a.m. you’ll receive an email about insights and happenings in the universe of fintechs — usually I write in Portuguese.

The Brazilian insurance innovation ecosystem started to grow in 2016. Large companies in the sector started initiatives to modernize and further develop their corporations, while seeking to change their culture and follow the transformations created and promoted by insurtechs. In addition, the sector's innovation ecosystem is buoyant with large fundings like Justos which raised more than US$30 million in Series A last week — being 4x larger than the standard Series A in Brazil.

The main characteristics of the Brazilian market

There was a time when the Brazilian insurance industry was highly concentrated. Concentration in the sector began in the 1970s, when government initiatives at the time sought to mature the financial system. One of the objectives of the Financial Reform introduced by the government was the formation of large financial conglomerates in the country. Consequently, providing greater stability to the economy and facilitating economic development.

Thus, a series of M&As occurred that reduced the number of companies from 176 in 1970 to 94 in 1975. 49% of total insurance premiums were concentrated in the hands of the 5 largest companies. This concentration was due to the acquisition of several insurance companies by some banks.

Since then, there is still a strong presence of financial institutions in the insurance field (model known as bankassurance) — with Banco Bradesco and Banco do Brasil, which are in the Top 5 of the main banks in the country, with 22.36% and 5.96% of the entire market, respectively.

Insurance segments

Before the implementation of the Real (an economic plan introduced in 1994 that caused monetary stability after decades of high inflation), the market of life insurance was small when compared to non-life insurance. This is because with the high inflation rates that the country was experiencing before the Real, there was a high level of uncertainty regarding longer term contracts.

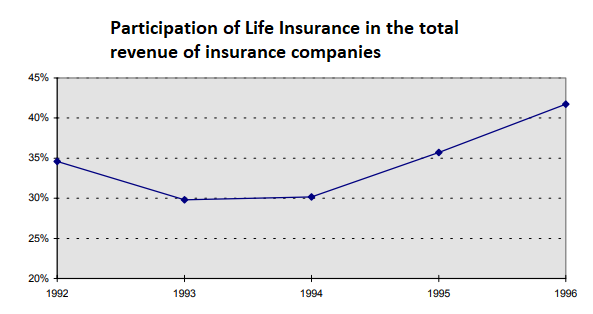

However, after the implementation of the Real, the market of life insurance increased, as shown in the chart below, taken from the article on Rating de Seguros.

The data in the last report by Atlantico pointed out that life insurance has matured and represents 65% of the total life insurance market — compared to 35% of non-life insurance.

Specialization in a segment

Before the economic opening of the 1990s, it was common for companies not to specialize in a single segment (for example, some focused more on life insurance, others on non-life insurance). However, after the entry of foreign players and consequent greater competitiveness, there was greater specialization on the part of the insurers.

For example, the insurance company Porto Seguro specializes in non-life insurance, in 2020 it holds approximately 27.57% of car insurance. SulAmérica specializes in health insurance, and holds approximately 38.05%.

The only one that deviates from the standard is Bradesco Seguros, a subsidiary of Banco Bradesco, which has good participation in both the life and non-life insurance lines.

Opportunities for entrepreneurs and investors

The industry that now yearns for innovation and disruption. SUSEP (Superintendency of Private Insurance), the institution that regulates the sector in Brazil, after long periods of being traditionalist and averse to changes, changed its position in the face of new players — foreign companies and insurtechs.

SUSEP initiatives

SUSEP's first major initiative in light of the emergence of insurtechs was the creation of a commission in 2017 to discuss how the sector could innovate and experience major transformations in the coming years. The initiative was aligned with consultants and C-Levels from the main insurance companies and insurtechs in the country.

Then, in line with global trends, SUSEP created the Regulatory Sandbox, an initiative that constitutes an experimental regulatory environment. It enables the implementation of innovative projects that present products or services to be offered in the scope of the insurance market. Moreover, new methodologies, processes, procedures, or existing technologies are developed and offered by insurtechs and applied in different ways.

After more than a decade shelved, SUSEP took the first step towards the digitalization of subscription — called Digital Policy. According to SUSEP, the new system should reduce the cost of regulatory compliance, modernize the capture of data from the market and stimulate the sector's efficiency, fighting against fraud.

Open Insurance

Currently, the agency leads one of the largest data sharing initiatives in the country: Open Insurance.

According to the EY, Open Insurance is still under initial discussion, even in countries where Open Banking has already reached maturity.

In Brazil, where Open Banking (or Open Finance) is currently in its third phase, insurers and regulators have been working together to establish Open Insurance systems and policies — the fourth phase is expected to start sharing insurance and pension data.

In the insurance market, data related to policies of individuals and companies are not easy to share today. Consumers generally cannot use their insurer's portal to download policy data, including transactional ones, in an already structured form and, consequently, cannot securely and quickly share their data with any other institution that may offer better conditions.

With Open Insurance, that reality will change. According to the EY, Open Insurance will give insurers the opportunity to strengthen their brand's relevance by enhancing the fundamental value they offer to consumers.

Insurtechs

In addition to innovative initiatives by regulatory institutions, Brazil is also experiencing a boom in insurtechs, with 49.6% born between 2016-2020.

The insurtech movement, as in the rest of the world, has as its main objective: solve the sector's problems and improve the efficiency of processes. Thus, according to data from the Distrito, the sector is divided between B2B (55.8%), B2C (38.9) and B2B2C (5.3%).

Some players and insurers

Data from CB Insights show that the sector has broken records, thanks to mega-rounds. Insurtechs raised US$4.8 billion in Q2 2021, a record increase of 89% over Q1 2021 and an increase of 210% compared to the same period last year.

Justos

In Brazil, the scenario is no different.

Last week, insurtech Justos raised more than US$30 million. The insurance startup develops a technology aimed at car insurance. The proposal is to price car insurance based on customer behavior. Justos takes measurements through the user’s cell phones to define risk models assessing the quality of the client's direction. With this, the company wants to offer plans up to 30% cheaper than the market average. Besides, Justos offers monthly discounts based on consumer efficiency using artificial intelligence. The startup operates through a partnership with an insurance company (in a model known as the Managing General Agent (MGA)) which eliminates the step of obtaining a license from the regulatory institution SUSEP.

Minuto Seguros

Another insurtech that also stood out this year was Minuto Seguro.

Founded in 2011 and with a fully digital sales proposal, the business's success stems from the integration with analogue. In 2018, more than R$ 200 million in premiums were issued, an increase of 30% compared to 2017. Insurtech bets on technologies such as big data and artificial intelligence to make the process of quoting and contracting insurance faster.

In July, Minuto Seguros was bought by Creditas loan fintech. With the purchase, fintech will start a new business vertical and will strengthen the car vertical, allowing the contracting of a complete package of services, such as credit with vehicle guarantee, financing, purchase, sales, auto insurance, within a single app.

Insurtechs and insurers

According to a survey conducted by PWC in 2016, 74% of respondents saw fintech innovations as a challenge for their industry. The report said insurers were focused on reaching their competitors through customer centric and internal culture changes.

In addition to the modernization of their business models, some consolidated insurers are following two paths: (i) they create their own insurtechs, such as Caixa Seguradora, which in 2015 created Youse, as part of Caixa Seguradora's strategy of evolving into the world of online insurance companies; (ii) they acquire part of an existing insurtech, like Porto Seguro, which acquired 74.67% of SegFy earlier this year.

Banco do Brasil Seguridade also created its own insurtech Ciclic, in December 2017, in partnership with the Principal Financial Group. Insurtech was a pioneer in offering digital pensions in Brazil.

Conclusion

Since the implementation of the economic plan Real, which controlled inflation in Brazil, and the economic opening in the 1990s, several insurance companies both foreign and Brazilian were able to offer their products to final consumers.

Over the past 30 years, the insurance market has undergone a profound transformation. Regulatory agencies in conjunction with representatives from insurers and insurtechs have cooperated to create new initiatives that drive innovation and better customer benefits.

The Open Insurance, Regulatory Sandbox and the digitalization of insurance policies are some initiatives that the regulatory institutions are providing to the market.

On the insurers side, they are modernizing their business models through the use of new technologies. Some acquire insurtechs that have been serving the market for a few years, others build their own startups in-house.

One thing is clear: the insurance market in the coming years will not be the same.

Read more 📚

Distrito Insurtech Report 2020 (Portuguese)👈

O mercado de seguros no Brasil: um setor em expansão e suas características principais 👈

Global perspectives on insurtechs (English)👈

Insurance Tech Q2 2021 (English) 👈

Until the next!

Walter Pereira