#139: Short Takes: The Promise of Stablecoins and the Questions They Raise

W FINTECHS NEWSLETTTER #139

👀 Portuguese Version 👉 here

👉 W Fintechs is a newsletter focused on financial innovation. Every Monday, at 8:21 a.m. (Brasília time), you will receive an in-depth analysis in your email.

Welcome to the Short Takes edition! As the name suggests, unlike deep dives, these editions will explore a variety of topics that might later evolve into full deep-dive editions.

Short Takes is designed for entrepreneurs, investors, and operators looking for quick, actionable insights.

Last week, I wrote about Wise's model and how it differs from many other players in the sector. Instead of relying on the traditional global banking network, the company built its own infrastructure: a mesh of interconnected local transfers.

With over 65 licenses in 45 countries, Wise has created a parallel system that drastically reduces the cost and settlement time of transactions. This strategy is based on operating as a “definitive network for the world’s money,” which is only possible because it maintains pre-funded liquidity in local bank accounts across more than 40 currencies.

When a customer makes a transfer, the money doesn’t actually cross borders — instead, it's settled locally. For example, a payment in pounds received in the UK is matched by a payment in Brazilian reais made from Wise’s account in Brazil. This mirrored settlement model has not only made operations faster and cheaper but also provided more control and predictability.

But as I highlighted in last week’s text, Wise is not alone in building alternative infrastructures. The emergence of stablecoins like BRLA, USDC, and USDT also shows a different path from the traditional system, enabling instant, borderless settlements with no intermediaries.

Stablecoins are one of the most interesting — and perhaps most efficient — responses from the crypto economy to one of its biggest dilemmas: how to combine the disruptive power of decentralization with the predictability and security needed by those who want to transact, save, or invest with stability. Since Bitcoin emerged in 2009, the promise was clear — to decentralize money. But in practice, extreme volatility doesn’t align with the everyday function of money.

The idea behind stablecoins is to peg the value of a crypto asset to a stable asset, usually a fiat currency like the dollar or the euro. This allows individuals and companies to transact on the blockchain without being exposed to the drastic fluctuations typical of cryptos like BTC or ETH. In practice, it's an attempt to lay stable tracks for a high-speed train.

The stablecoin market already moves over $215 billion, with players like BRLA, USDT (Tether), USDC (by Circle), and DAI (by MakerDAO). These currencies are being used for international remittances, savings in high-inflation countries, corporate payments, and as the foundation for DeFi applications.

Interestingly, the success of stablecoins has more to do with infrastructure than with currency. They function like money APIs for the internet, opening the door to a new kind of financial infrastructure — more programmable, interoperable, and accessible. The logic, then, flips: it's not the bank setting the rules of circulation, but the protocol behind it.

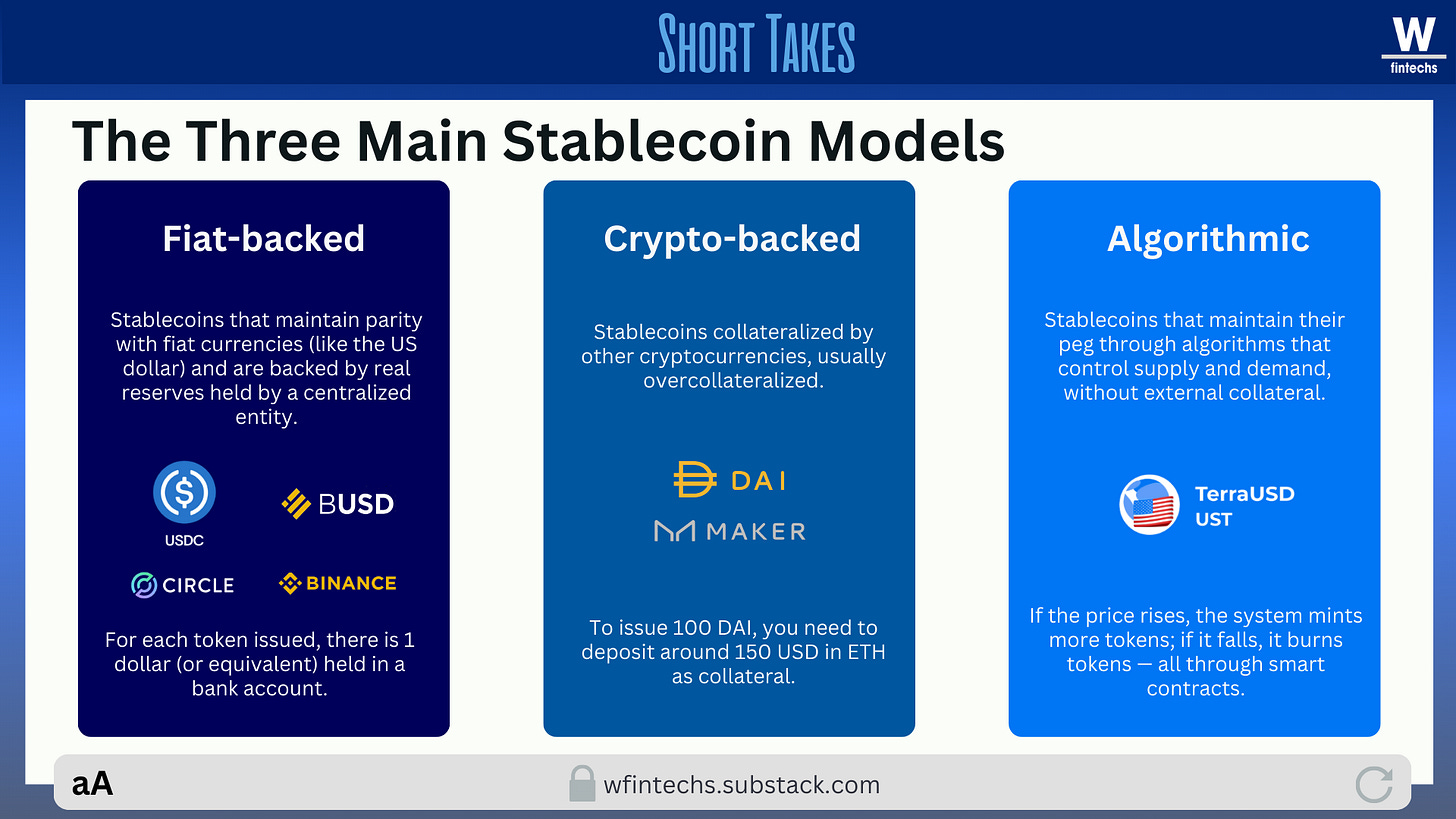

Unlike physical dollars, a stablecoin like USDC can be sent anywhere in the world in seconds, with near-zero fees. There are three main types of stablecoin models: fiat-backed (like USDC, which holds reserves in dollars), crypto-backed (like DAI, which uses ETH as collateral), and algorithmic (like the now-defunct Terra USD).

Each model has its strengths and weaknesses. What unites them is the promise of maintaining a stable value. But as we saw in 2022 with the collapse of Terra, stability is a promise — not a guarantee.

On the regulatory front, the story gets even more complex. Countries like the US, UK, Singapore, and Brazil have different approaches on how (and whether) to regulate stablecoins. The central question is: are they means of payment, financial assets, securities, or collective investment contracts? In Brazil, the securities regulator (CVM) has indicated that the classification depends on the token's actual function — and that’s still subject to many legal disputes.

But perhaps the deeper question is: what do we call money today? When a token issued by a private company, operating outside the traditional banking system, becomes accepted in thousands of stores and apps, is it still “just” a digital asset? Or are we witnessing the birth of a new form of monetary sovereignty?

Very likely, the impact of stablecoins on financial systems won’t be marginal — and they threaten long-standing power structures in traditional markets. Central banks, national payment systems, networks like SWIFT: all will have to adapt. Some have already understood the shift. Others are still stuck in the logic of protecting borders in an increasingly digital world.

Today, over 90% of stablecoins in circulation are pegged to the USD. This further reinforces the role of the US dollar as a global anchor. An interesting scenario is that while China advances with its state-backed digital yuan (e-CNY), the US dominates the stablecoin space via the market.

Circle, the company behind USDC, is leveraging this moment to expand its platform as a “digital dollar for anyone, anywhere.” The ambition is to become the new financial backend of the internet. And with an ecosystem of developers, fintechs, and NGOs already using stablecoins in real-world projects, this idea is materializing quickly.

In practice, what we see is a constant tension between innovation and regulation. On one side, developers and companies eager to scale stablecoin solutions. On the other, governments trying to maintain control over monetary issuance. Some jurisdictions, like New York, have already created specific regimes (like the BitLicense). In the US Congress, there are at least three proposed bills aiming to regulate so-called “payment stablecoins,” requiring 1:1 reserve backing and frequent audits.

In Brazil, despite the advancement of the Crypto Assets Law, the legal classification of stablecoins remains uncertain. The lingering question is whether they are a digital extension of money — or a new asset class? And if they’re both, what is the right legal framework for their regulation?

From a consumer perspective, stablecoins offer an interesting power: accessing the dollar without needing an international bank account. This is especially relevant in countries like Argentina, Venezuela, or even Brazil, where inflation has eroded the purchasing power of the local currency. In this context, stablecoins become both a savings tool and an inflation hedge.

Even so, risks remain. The decentralization promised by some stablecoins is, in practice, quite limited. Most tokens are issued by companies that control the reserves and user access.

Another delicate issue is transparency. Who guarantees that issuers truly hold equivalent reserves? The ideal answer would be public audits and clear rules. But so far, transparency is still incomplete in many cases. The future of stablecoins will depend on a triad: smart regulation, solid infrastructure, and relevant use cases. In other words, it won’t be enough to ensure stability; it must also ensure utility.

Until the next!

Walter Pereira

If you know anyone who would like to receive this e-mail or who is fascinated by the possibilities of financial innovation, I’d really appreciate you forwarding this email their way!

Disclaimer: The opinions expressed here are solely the responsibility of the author, Walter Pereira, and do not necessarily reflect the views of the sponsors, partners, or clients of W Fintechs.