#145: One Trillion in sight: how registry infrastructure is transforming credit with cards and "duplicatas"

W FINTECHS NEWSLETTTER #145

👀 Portuguese Version 👉 here

👉 W Fintechs is a newsletter focused on financial innovation. Every Monday, at 8:21 a.m. (Brasília time), you will receive an in-depth analysis in your email.

While in the United States the receivables advance market is still dominated by private institutions, with little standardization and no centralized registry system, and in Europe interoperability between acquirers and lenders continues to progress unevenly across countries, Brazil has, in recent years, built notable infrastructure innovations.

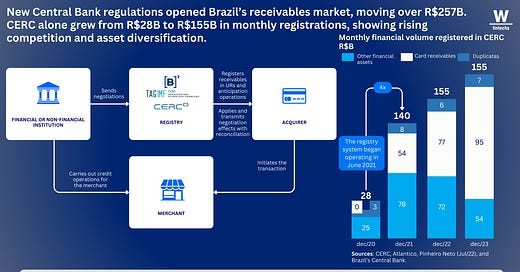

Since 2021, with Resolution 4,734 and Circular 3,952 from the Central Bank, the country began implementing an integrated system of receivables registries. These institutions function as digital notaries for credit, recording the amounts merchants are set to receive from installment card sales — an asset that was previously locked within acquirers' systems and lacked market transparency.

Before the registries, merchants were hostage to their own card machines. They could make a sale today but were only able to advance their receivables through the same institution that processed the transaction. This created a highly concentrated market with extreme power asymmetry — as if the merchant were tied to a single lender with no room to negotiate.

With the new regulations, receivables portability was introduced. Now, this asset can be registered in a standardized format and accessed by any financial institution, provided the merchant gives authorization. This transforms receivables into a kind of credit auction: whoever offers the best rate, wins.

The registries authorized by the Central Bank — CIP, CERC, TAG, and B3 — began competing for leadership in this emerging market. According to the Central Bank, in 2021 Brazil moved BRL 257 billion (approximately USD 50 billion) in advances formalized through receivables registries.

As an example, the registry CERC alone grew from BRL 28 billion in monthly registrations in December 2020 to BRL 140 billion in December 2021, and BRL 155 billion in December 2023. Most of this volume consists of card receivables, but the share of other financial assets has also been increasing — a sign that the system is likely to expand beyond point-of-sale machines.

The digitalization of receivables schedules brings structural benefits. Chief among them is the creation of the Receivables Unit (UR) — a unique identifier for each registered transaction, containing details such as amount, date, card network, and settlement. This level of granularity allows merchants to negotiate portions of their receivables with different institutions and terms.

Previously, banks would block double the loan amount in guarantees. Now, only the portion corresponding to the credit taken is locked. The rest can be used for new operations. This shift alone changes the entire logic of working capital in the country. However, the journey hasn’t been easy. The promise of interoperability still struggles in practice. Fintechs report technical hurdles, unstable systems, and poor user experiences. These challenges slow merchant adoption.

Despite these issues, the data shows progress. The average spread for receivables advances dropped from 5.8 to 4.8 percentage points in one year 1. Meanwhile, spreads on traditional credit rose — a clear sign that the competition enabled by the new infrastructure has started to take effect.