#146: Short Takes: Neobanks: born in times of crisis, scaled through regulation and innovation

W FINTECHS NEWSLETTTER #146

👀 Portuguese Version 👉 here

👉 W Fintechs is a newsletter focused on financial innovation. Every Monday, at 8:21 a.m. (Brasília time), you will receive an in-depth analysis in your email.

Welcome to the Short Takes edition! As the name suggests, unlike deep dives, these editions will explore a variety of topics that might later evolve into full deep-dive editions.

Short Takes is designed for entrepreneurs, investors, and operators looking for quick, actionable insights.

Many neobanks emerged as a consequence of events that combined financial crises, regulatory transformations, and technological advancements, creating a fertile environment for the birth of a new generation of institutions that challenged the logic of traditional financial services. They proposed a leaner, more accessible, and user-centric model — especially after the 2008 crisis, when the pillars of banking trust collapsed and regulators like the FCA in the UK and BaFin in Germany decided to open the market to new entrants. In Latin America, the movement also gained traction, mainly under the banner of financial inclusion and increased banking competition.

In Brazil specifically, the regulatory approach adopted by the Central Bank allowed new institutions to emerge with targeted and segmented value propositions, breaking away from the logic of the universal bank and opening space for solutions focused on customer groups previously neglected by the traditional banking system.

By eliminating physical branches and legacy systems, neobanks drastically reduced their operational costs — serving a customer can cost as little as $20 per year at a digital bank, compared to over $200 at a traditional bank. This enabled them to adopt aggressive acquisition strategies, offering no-fee accounts, intuitive experiences, and a promise of radical transparency.

While incumbents remained tied to the logic of interest spreads and hidden fees, neobanks grew rapidly, unafraid to operate with tight margins, fueled by a cycle of high liquidity that facilitated access to funding via venture capital and IPOs.

In the early years, the revenue engine of neobanks revolved around a simple gear: the interchange fees collected on card transactions. This model gained traction especially in the United States, thanks to a loophole in the Durbin Amendment that allowed banks with less than $10 billion in assets to maintain higher margins — a key factor that helped companies like Chime scale quickly without relying on credit products or direct monetization of users.

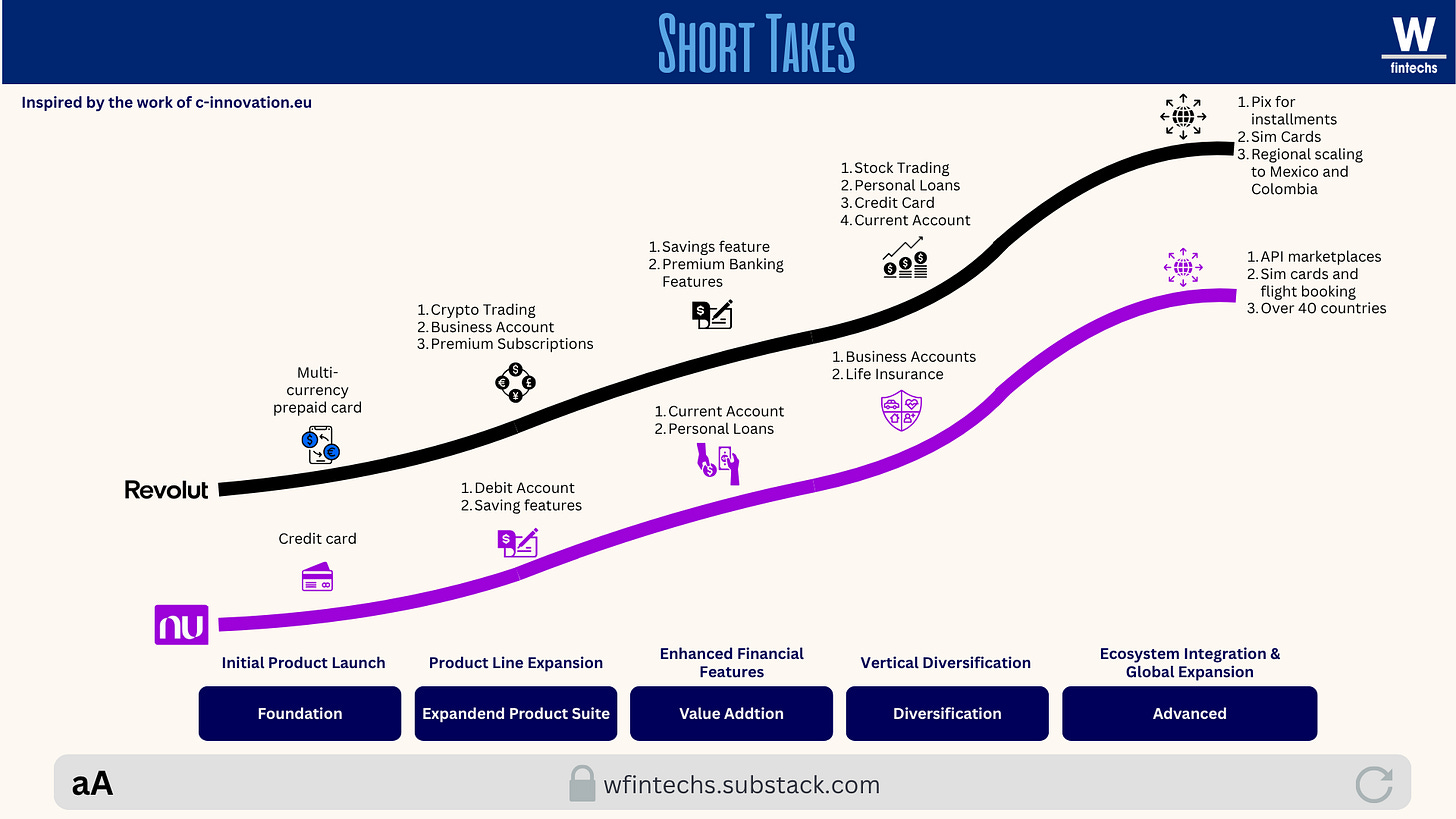

Over time, however, it became clear that relying solely on interchange would not be enough to achieve financial sustainability. Neobanks began diversifying their revenue streams, launching premium plans with benefits like early access to salary deposits, foreign exchange at interbank rates, travel insurance, crypto and stock trading — and even concierge services, as seen in Revolut’s Metal plans, which today account for over 30% of its revenue, and Nubank’s Ultravioleta — proving that users’ willingness to pay for better financial experiences was no longer a distant dream.

This shift from freemium to premium wasn’t driven solely by investor pressure or a desire for profitability, but also by users themselves, who began to see value in services once reserved for black cardholders or private banking clients.

The edge of neobanks has always been in the fluidity of the user experience, in building journeys that adapt to the user's behavior — not the other way around — which explains the success of features like Chime’s “Get Paid Early” or Revolut’s real-time currency exchange, which allows users to hold multiple currencies and convert them at near-zero rates. These features challenged one of the biggest taboos of traditional banking: the hidden fees that silently erode value.

Wise followed a similar path, allowing multi-currency accounts and instant transfers with lower FX spreads on select rails. But this required not only a real-time payment (RTP) infrastructure at both ends, but also the capability to navigate complex and fragmented regulatory environments across different jurisdictions.

Read more on Wise’s strategy 👇

As competition intensifies and traditional banks begin to copy these features, neobanks are being pushed to go further, entering more complex segments such as credit, insurance, crypto assets, and even banking-as-a-service — as a way to remain relevant and gain control over their infrastructure. Dependence on third parties has limited the flexibility of many players that lack their own banking license or full control of their core banking system.

In the credit space, few have stood out as much as Nubank, which managed to scale its credit card model intelligently by combining real-time data analysis with faster risk decisions. This paved the way for a profitable business model in a market characterized by high capital costs and structural default — which also explains why other players, like Starling in the UK, chose to develop diversified credit portfolios, including overdrafts, personal loans, and SME lines.

Despite all this evolution, the challenges remain significant. Customer acquisition is still expensive, monetization doesn’t always keep pace with growth, and regulation has become stricter — especially on topics like KYC and AML — leading some neobanks to face investigations and operational restrictions in strategic markets.

What’s increasingly clear is that as the sector matures, neobanks are moving away from the initial disruption hype and closer to what could be called a “sustainability engineering” phase. The challenge is no longer to prove that it’s possible to operate without branches, offer total transparency, or deliver better user experiences — but rather to build resilient financial ecosystems that combine margin, scale, and relevance in an increasingly regulated, competitive, and trust-sensitive environment. As I wrote in the edition on super apps: the goal is to align with a strategy that turns a one-time customer into an ecosystem customer.

Until the next!

Walter Pereira

If you know anyone who would like to receive this e-mail or who is fascinated by the possibilities of financial innovation, I’d really appreciate you forwarding this email their way!

Disclaimer: The opinions expressed here are solely the responsibility of the author, Walter Pereira, and do not necessarily reflect the views of the sponsors, partners, or clients of W Fintechs.