#FinOpen: The long journey of Open Insurance and its connection to Open Finance and Pix; Use cases

W FINTECHS NEWSLETTER #137

👀 Portuguese Version 👉 here

👉 W Fintechs is a newsletter focused on financial innovation. Every Monday, at 8:21 a.m. (Brasília time), you will receive an in-depth analysis in your email.

Welcome to the edition of the Finance is Open series.

Every other Wednesday, in addition to the traditional Monday editions, I will cover key topics and the latest updates on what's happening in Open Finance, both in Brazil and around the world.

Finance is Open is sponsored by

Iniciador is the complete infrastructure platform specialized in Regulated Open Finance, enabling Payment Initiation and Data Access.

The solution removes technology and compliance concerns, allowing clients — with their own regulatory license or using Iniciador’s — to focus on new products and business growth.

💡Want to advertise in the W Fintechs Newsletter?

Reach a niche audience of founders, investors, and regulators who read an in-depth analysis of the financial innovation market every Monday. Click 👉here

When we talk about Open Finance in Brazil, the spotlight usually falls on the most visible initiatives — Pix, payment initiation, the growth of user consents, and the increasing number of API calls. But there’s another equally transformative chapter still under construction: Open Insurance. If Open Banking paved the way for interoperability in the banking system, the promise of Open Insurance is to help redesign the logic of how the insurance industry serves customers. And like every infrastructure shift, it starts slowly but tends to become inevitable in the long run.

Open Insurance follows the same core principle as Open Finance: consumers should have the power to decide who gets access to their data. In this case, insurance data includes everything from policy history and premium payments to claims and risk profiles — information that has traditionally been locked inside insurance companies, limiting both competition and personalization.

Brazil has opted for a coordinated and evolutionary model. Since 2021, SUSEP (the country’s private insurance regulator) has been structuring the initiative into three phases. The first involves sharing public product data. The second moves toward policyholder and contract-level data. The third — and most complex — stage deals with enabling insurance transactions and service initiation, such as buying policies and filing claims in a more integrated way.

Brazil is one of the few countries to position Open Insurance as a structured public policy. SUSEP has been building on the lessons learned from the Central Bank, adapting governance and technical requirements to the sector’s regulatory context. Today, Brazil’s Open Finance model — of which Open Insurance is a part — is the most comprehensive in the world in terms of scope and potential.

The expected impact is twofold: on one hand, greater competition and efficiency; on the other, broader inclusion and personalization. One of the biggest bottlenecks in Brazil’s insurance industry has always been under-service. Data from CNseg shows that even with recent progress, only 13% of Brazilians have life insurance. The insurance sector represents about 6.5% of the country’s GDP, with over R$450 billion (around $90 billion USD) paid in claims and benefits in 2022 alone, according to PDMS 1.

It’s a massive industry — but one with uneven penetration and rigid business models. Open Insurance emerges as a driver of decentralization and innovation, enabling new formats like on-demand insurance, microinsurance, and behavior-based products. These innovations open the door for new players to offer solutions tailored to each person’s real risk profile, based on transactional and historical data.

So far, the framework includes over 70 active APIs, with technical standards aligned to OpenID and FAPI — the same used in Open Banking. While technical progress is ongoing, the biggest challenges are cultural and strategic. According to a Capgemini survey, 73% of respondents said the main barrier is the public’s lack of understanding about how Open Insurance works 2. Other concerns include the engagement of brokers (58%) and tech-related issues such as cost, cybersecurity, and data management. Interestingly, regulatory concerns ranked last on the list.

Lessons from Open Banking

In the case of Open Banking, we’ve seen significant growth in API usage — over 51 billion calls were made in 2023, according to the Open Finance Citizen Dashboard. In Open Insurance, however, this usage is still being developed. Between April 1, 2024 and April 1, 2025, more than 60 million transactions were recorded — including over 20 million incoming requests and more than 41 million outgoing requests, based on the official metrics dashboard3. Out of this total, 5 million were related to the consumption of open data (Phase 1), and around 56 million involved consent-based data sharing (Phase 2).

One of the main differences between Open Banking and Open Insurance lies in the relationship architecture among participants. In Open Banking, data exchanges are mostly bilateral: a financial institution shares information directly with another authorized institution, based on customer consent.

In Open Insurance, the setup is more complex. The insurance sector has historically involved an additional player: the insurance broker, whose role is regulated by Law No. 4.594 of December 29, 1964. In Brazil’s model, brokers are not removed — they are integrated into the system’s architecture. This is where the concept of the SPOC (Customer Order Processing Entity, or Sociedade Processadora de Ordem do Cliente) comes in — an intermediary entity responsible for organizing and managing consent requests and data access.

As a result, information flow in Open Insurance is mediated by the SPOC: on one side, the customer accesses the SPOC’s interface, browses products, provides consent to share data, and views offers; on the other, insurers provide data on existing contracts and respond to quote requests; and at the center, the SPOC consolidates this information, runs real-time comparisons, and presents personalized quotes to the customer based on the authorized data.

This model aligns with the structure of the insurance market, which has its own unique characteristics of distribution and intermediation that differ from the banking system. Brokers still play, in many cases, the role of the main point of contact between the customer and the product, guiding and recommending coverage options.

In this context, the broker’s role is likely to evolve. Beyond simply facilitating sales, brokers can act as data agents — developing their own platforms, comparison tools, embedded insurance products, and integrated solutions within the broader digital ecosystem.

Strategic Positioning Opportunities

In practice, Open Insurance only makes sense if built as a network — and that network is already beginning to take shape. More than 60 institutions are now part of the ecosystem, including major insurers, insurtechs, independent platforms, and new digital entrants. While there are still no fully developed use cases, I’ll look at insurers' digital track records to anticipate potential strategic directions.

Allianz, one of the largest insurers in the world, has been actively embracing digital transformation in Brazil. With over 6 million customers, the company has heavily invested in digital distribution and innovation in recent years. Open Insurance presents a concrete opportunity to enhance product personalization — especially in highly competitive segments like auto and home insurance.

Bradesco Seguros is another major player well-positioned in this emerging market. With privileged access to Bradesco’s banking base — which exceeds 70 million accounts — the insurer has the scale to lead more complex use cases, such as combining banking and insurance data for more accurate pricing and mass-market products. The group’s structure also enables strategic use of data from pension, savings, and health verticals. While close to Allianz in terms of scale and analytical capacity, Bradesco still faces the typical challenges of large institutions in accelerating digital transformation.

Caixa Seguradora, through its connection with Caixa Econômica Federal, benefits from massive reach and plays a key role in financial inclusion. Its main differentiator could be linking Open Insurance with public policies, microinsurance, and products tailored to low-income segments. Caixa already manages one of Brazil’s largest housing insurance portfolios and could use Open Finance data to reinvent insurance as a service embedded in other products.

Porto Seguro, with its vertical structure and large client base (over 13 million), has a strong digital positioning. The company already operates its own digital solutions, such as Porto Bank, and has experience integrating different business fronts — insurance, financial services, healthcare, assistance, and mobility. This gives it an edge in designing seamless user journeys within an open ecosystem, where insurance is just one part of a broader experience.

In the insurtech space, Justos has gained traction with a pricing model driven by users' driving behavior data. Born with a digital-native mindset, the company already operates with technologies aligned with the Open Insurance vision, even before full regulatory rollout. Justos represents the type of player most likely to quickly benefit from an interoperable environment, where behavioral and historical data can be used to build real-time insurance products.

Youse, the digital arm of Caixa Seguradora, also stands out for its fully online approach from day one. With strong appeal to younger, digitally-savvy consumers, Youse has been building a data-driven, user-experience-centric journey. In this context, Open Insurance could be the missing link that unlocks predictive coverage recommendations and connections to financial and mobility data. Its positioning reflects this DNA — born digital, with high potential for impact.

At the other end of the spectrum, insurers like Luizaseg (from the Magalu ecosystem), Neo Seguradora, Novo Seguros, and Simple2u could serve as true innovation labs — using Open Insurance as a bridge to scale operations without relying exclusively on traditional distribution channels. Simple2u is already among the digital players, though its impact is still limited by scale.

Players like BTG Pactual, Sicoob, Prudential, and Cardif could carve out strong positions in high-value niches. BTG’s integrated Open Finance vision can be extended to Open Insurance, where investments, retirement planning, and protection converge. Sicoob, with its local reach, is well-placed to deliver personalized insurance solutions to Brazil’s interior regions, combining local data with financial education journeys. These are distinct strategies, but they share one common trait: data will undoubtedly be the key competitive differentiator.

While data on consent volumes in Open Insurance remains limited, Open Finance — which surpassed 51 million active consents in 2024 — offers a useful benchmark. It’s reasonable to project that the insurance sector could also reach tens of millions of consents in the coming years. The customer base of participating insurers already adds up to hundreds of millions of contracts — the major challenge ahead is turning that potential into real, effective use within the open ecosystem.

Use Cases

When thinking about possible use cases, the data architecture of Open Insurance is extensive. It ranges from basic customer information — name, similiar with “Social Security” number (CPF), address — to contractual data such as policy details, premium amounts, coverage options, deductibles, beneficiaries, claims history, and financial transactions.

The level of granularity is very high. For example, an auto insurance policy may include data about the type of vehicle, drivers, residential postal code, claims history by coverage type, additional packages purchased, and even details about the driver at the time of an incident. In the context of pension products, elements such as triggering events, contributions, returns, portabilities, and withdrawals come into play.

This depth of data enables a new generation of products and services. One of the early use cases is the intelligent insurance comparison tool. With access to previous policy data, a platform could suggest similar coverages that are more affordable, have shorter waiting periods, or offer a better claims history. This would make portability both real and accessible, through a completely digital experience.

Another relevant use case would be an intersector risk score. By combining Open Finance data with Open Insurance data, a fintech or insurtech could, for example, assess a customer’s financial resilience based on their insurance history, claim frequency, and active coverage. This could influence credit limits, rates, or even trigger personalized financial product offers.

Insurers could also build predictive behavioral models by cross-referencing variables like premium payment history, past claims, geographic location, occupation, and even high-risk job roles. As a result, the final price of insurance would no longer be generic but would be modeled in real time—a level of personalization that is still rare in the market.

Brokers, for their part, will be able to position themselves as true data orchestrators. By obtaining the customer’s consent, they can access a comprehensive insurance history and offer context-based curation, providing consultative recommendations grounded in real data. This repositions the broker’s role as an advisor.

There are many potential use cases in this space, but the key takeaway is that the insurance sector can significantly increase its contribution to the country’s GDP and improve people’s lives through Open Insurance. With this infrastructure in place, insurance ceases to be an isolated product and instead becomes an integrated layer of protection within people’s financial journeys. It is no longer a matter of “you need to buy insurance,” but rather “protection is already embedded, activated, and tailored to your context.” Open Insurance represents a genuine opportunity to extend the reach of this service to millions of Brazilians.

If you're enjoying this edition, share it with a friend. It will help spread the word and allow me to keep providing quality content for free.

Contribution

I'm creating a use case mapping, divided into data and payments, with an interactive dashboard. I’ve already mapped out some cases, but before the official launch (expected at the end of March), I want to enrich the mapping even further.

If you'd like to include your institution’s use case, just send me a message by replying to this email or via LinkedIn (link 👉 here). And if you're a fintech without its own license, don’t worry—we want you involved too!

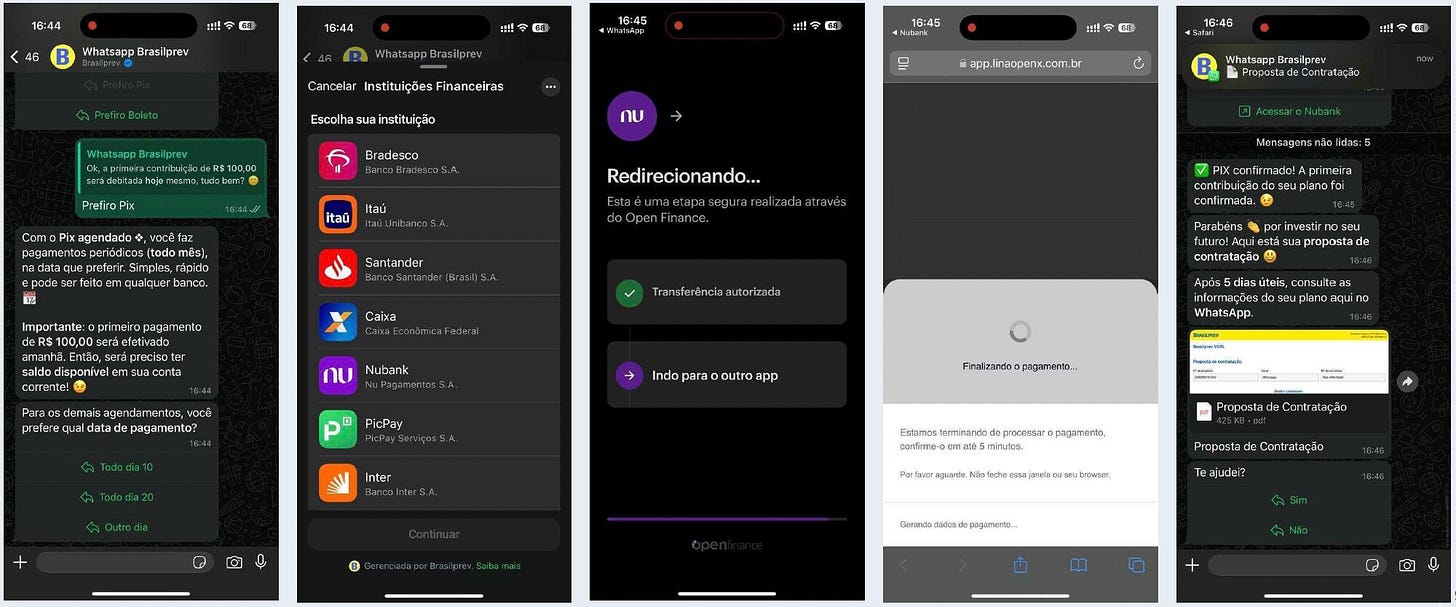

The intersection between Pix, Open Finance, and Open Insurance was brought to life by Brasilprev — Brazil’s largest private pension company — through the launch of a fully digital journey via WhatsApp. This experience allows users to purchase a pension plan with recurring Pix payments, even if they don’t have an account with Banco do Brasil.

It’s been clear for some time now that the conversational banking era is here to stay — and Brasilprev proves this in practice: onboarding is no longer a banking process, but a conversational experience. In the journey, the user selects the contribution amount, receives a proposal, and initiates the payment flow. Behind the scenes, the entire Open Finance infrastructure is at work: once the user selects their bank, they’re redirected to the bank app via payment initiation, authorize the Pix transaction, and return seamlessly to the Brasilprev environment — no new apps, no new registrations.

This flow has two key differentiators. First, it removes the banking barrier: the customer can be with Nubank, Inter, Itaú, or any other Open Finance participant — and still access a product that was traditionally limited to the BB ecosystem. Second, it enables consent-based, interoperable contracting, laying the groundwork for future scenarios where the same customer can share income data, spending behavior, or risk profile to simulate portability, adjust contributions, or receive more tailored offers.

The early data is promising: 80% of customers coming through this channel are from socioeconomic classes C and D, with an average contribution of R$150. In other words, it’s a new audience, with lower ticket sizes but massive growth potential. In practice, the pension product (or insurance) becomes embedded in the user's daily life.

What makes this case so compelling is how everything aligns and feeds into itself: regulation, public infrastructure (Pix + Open Finance + Open Insurance), and business strategy.

If you know anyone who would like to receive this e-mail or who is fascinated by the possibilities of financial innovation, I’d really appreciate you forwarding this email their way!

Until the next!

Walter Pereira

Disclaimer: The opinions expressed here are solely the responsibility of the author, Walter Pereira, and do not necessarily reflect the views of the sponsors, partners, or clients of W Fintechs.

https://cnseg.org.br/noticias/setor-segurador-abre-dialogo-com-ministerio-da-fazenda-em-encontro-com-fernando-haddad

https://revistaseguradorbrasil.com.br/pesquisa-exclusiva-sobre-open-insurance

https://metricas.opinbrasil.com.br/metrics