#105: Beyond Banking: What does Nubank's entry into the telecom industry mean, and how could it change MVNOs?

W FINTECHS NEWSLETTER #105: 29/04-05/05

👀 Portuguese Version 👉 here

This edition is sponsored by

Iniciador enables Regulated Institutions and Fintechs in Open Finance, with a white-label SaaS technology platform that reduces their technological and regulatory burden:

Real-time Financial Data

Payment Initiation

Issuer Authorization Server (Compliance Phase 3)

We are a Top 5 Payment Initiator (ITP) in Brazil in terms of transaction volume.

💡Bring your company to the W Fintechs Newsletter

Reach a niche audience of founders, investors, and regulators who read an in-depth analysis of the financial innovation market every Monday. Click 👉here

👉 W Fintechs is a newsletter focused on financial innovation. Every Monday, at 8:21 a.m. (Brasília time), you will receive an in-depth analysis in your email.

The Brazilian banking sector has always been highly concentrated. The banking history of emerging countries shares similarities in this regard. However, recent developments, such as opening the market to fintechs and the implementation of instant payment system, Pix, and Open Finance, have allowed new players to participate in the financial system. This has been great for competition and consumers — it is believed that in 10 years, banking concentration has decreased by 10%. 1.

Fintechs have adeptly navigated the configurations of the Brazilian banking market. Nubank certainly stood out in this regard. Competition has further intensified in the financial sector, and now both banks and fintechs need to adopt an approach beyond banking services to retain customers.

It is in this scenario that we see Nubank and other financial players offering not only credit cards but also insurance, integrated shopping, and... telco services, as announced in April 2024.

Until then, it was common to see telecom companies offering financial services. Africa is a true success story in this regard, where the largest telecommunications companies in the continent's countries have leveraged their customer bases to offer even "mobile money".

The entry of fintechs into telecommunications services is also an interesting strategy for countries where limited internet access is the primary barrier to financial inclusion. For example, in edition 101 [link 👉 here], I covered the case of digital wallets and real-time payments in Peru, where regulators are implementing a new instant payment system, but one of the major barriers is the country's low network connectivity.

We can expect to see more of this movement in emerging countries, where fintechs that have managed to establish themselves in these markets, capturing a significant portion of the banked and digitized population, will expand their scope of services.

The telecom market in Brazil

The telecommunications market is also concentrated and inefficient. Over the past few decades, the telecommunications market in Brazil has undergone significant transformations driven by regulatory reforms, technological advancements, and changes in consumer behavior.

The most important milestone was the General Telecommunications Law of 1997, which promoted the privatization of the sector and opened up space for competition. Prior to that, the sector was highly monopolized by the government. Subsequently, various measures were implemented to encourage competition and protect consumers, such as the creation of the National Telecommunications Agency (Anatel) in 1997, responsible for regulating and overseeing the sector.

However, despite Anatel's efforts, there are many criticisms related to its effectiveness in promoting innovation, its weakness in dealing with emerging challenges, and its institutional instability.

The agency is often seen as slow in adopting technological innovations, facing issues of lack of resources, excessive bureaucracy, and political interference, which impacts its regulatory capacity.

Competition

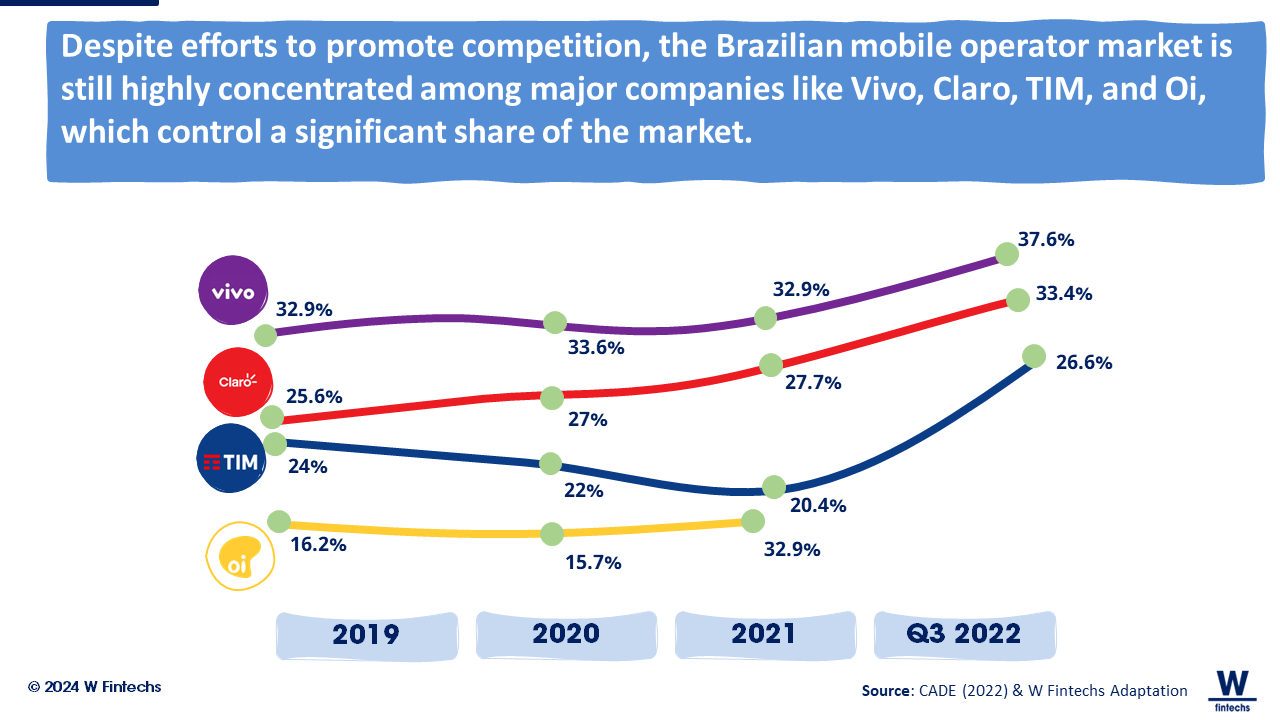

Despite attempts to promote competition, the telecommunications market in Brazil is still characterized by high concentration among a few major companies, such as Vivo, Claro, TIM, and Oi, which dominate a significant portion of the market.

This concentration has limited competition and innovation in some aspects, making it difficult for new competitors to enter and for services to diversify. It has also impacted the quality of services, as shown in the Anatel Satisfaction Survey of 2021. 2.

Digital customer service is not among the best, with an average rating of 6.85 among services. I believe there is a great opportunity here for Nubank — if they follow the same strategy they did in the banking sector, prioritizing customer experience and service.

Among the operators in Brazil, only Claro and Vivo operated in all telecom market segments in Brazil in 2022 3. TIM operates in the mobile service and broadband segments, while Oi exited the mobile cellular telephony market in 2022, remaining in fixed telephony, fixed broadband, and pay-TV segments.

Like in other countries, major telecommunications operators in Brazil are undergoing digital transformation to play a key role in the dissemination of digital services such as security, cloud computing, and the Internet of Things.

To advance in these sectors, operators are seeking partnerships to expand their range of services. In August 2022, Claro stood out as the main player in the Brazilian market, leading in fixed broadband, mobile telephony, and fixed telephony segments.

Vivo also stands out in all three markets, leading in mobile telephony. Oi exited the mobile telephony market in 2022 but remains in prominent positions in fixed telephony and fixed broadband.

Regarding the mobile broadband market, the configuration is practically the same, but with a smaller gap between the leader Vivo, Claro, and Tim.

Brazil has also been investing in the implementation of 5G, which requires substantial investments in infrastructure, especially in optical fiber, since 5G requires five times more than the amount currently installed in the country.

Since the privatizations in the 1990s, these companies have already invested a total of R$ 926 billion, placing Brazil in 5th place in the global ranking of telecommunications infrastructure 4. However, there are still challenges, such as expanding 4G networks, increasing the capacity of existing ones, and ensuring broadband access in remote areas for a successful transition to 5G.

The MVNO Model

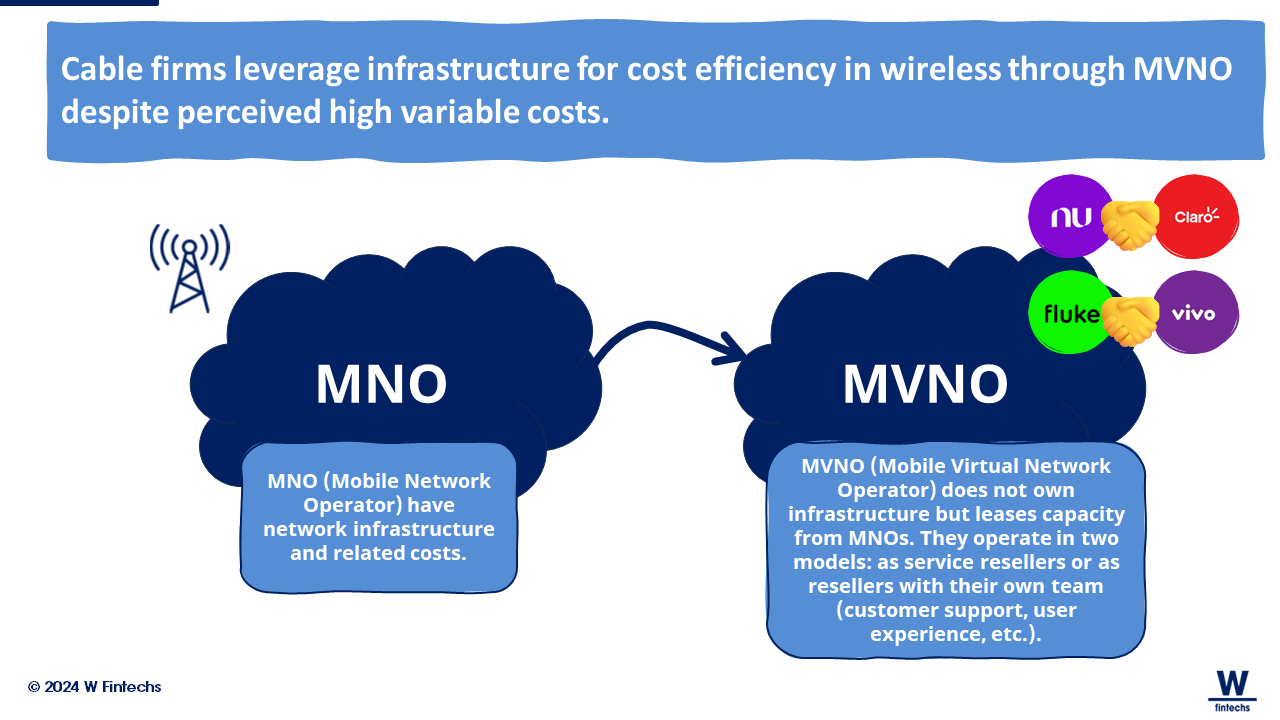

The mobile telecommunications market has also been transforming. The rise of Mobile Virtual Network Operators (MVNOs) is an example of this trend.

MVNOs do not own their own network infrastructure but rather lease transmission capacity from major operators to offer services to consumers.

This means they do not need to build cell towers or similar infrastructure. Instead, they negotiate contracts with major operators to utilize their existing infrastructure.

These MVNOs can operate in two ways: some simply resell the services of the underlying network operator, while others create their own customer service teams, support systems, and marketing to offer a more comprehensive experience to customers.

In Brazil, the number of companies licensed to operate as MVNOs or MVNO aggregators has grown significantly in recent years, from 24 in 2019 to 132 in 2021. Although they still represent a small slice of the market — holding less than 1% of market share (total mobile lines) in Brazil, while in developed countries penetration reaches 20% — MVNOs have the potential to stimulate competition by offering more personalized and innovative plans.

Fluke

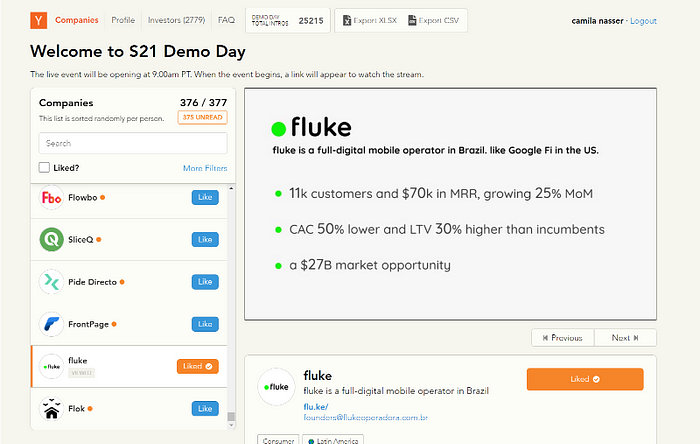

In 2019, I heard this term for the first time when I met one of the founders of Fluke at an event, a digital telecommunications operator that shares a network with Vivo.

At the time, I found it peculiar when he told me he was creating an operator and basing it on what Nubank and Neon were doing in Brazil. Neon, a Brazilian neobank that primarily serves the C and D classes, was then focusing on college students. That was Fluke's strategy: focusing on universities.

The founders were still university students themselves and would leverage that to expand the business. Then the pandemic hit, and we lost touch. In 2021, they announced they were open for crowdfunding investment — a strategy that Nubank would try out later that year, but months afterward: making customers, shareholders.

Fluke's main focus is customer service. Their thesis is that in a basic service like mobile telephony, traditional companies have low NPS scores. In 2018, 40% of complaints to Procon, the consumer protection agency in Brazil, were related to telecommunication services, and on average, 90 million people switch operators every year. A huge opportunity for Fluke.

In 2021, when announcing their participation in the Y Combinator program, Fluke already had 11,000 customers, reaching a monthly recurring revenue (MRR) of $70,000 and showing an impressive monthly growth rate of 25%. Additionally, their customer acquisition cost (CAC) was 50% lower, and customer lifetime value (LTV) was 30% higher than incumbent companies.

One year later, in 2022, the digital operator announced sheds over 80% of its team. Despite maintaining a good NPS, around 70 points, in an interview with the Startup website, one of the founders commented that about 93% of Fluke's revenue covered network costs, with only approximately 7% of their earnings covering other expenses, including payroll. Regulation and the costs charged by operators are still very high, but the landscape may change as more MVNOs emerge.

Fintechs in the game

It's at this point (of costs and scale) that I believe neobanks can capitalize.

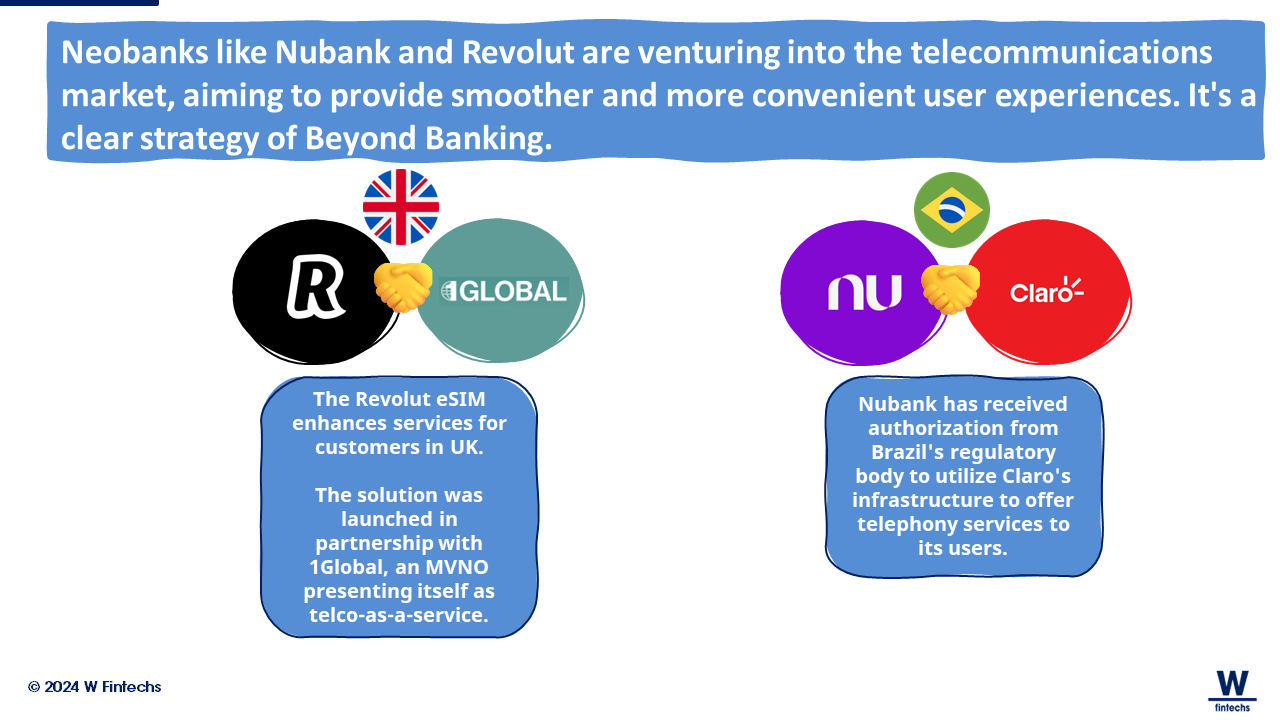

Nubank, for instance, is looking to venture beyond banking services and is gearing up to launch its own mobile phone company. Anatel approved the accreditation contract between the financial institution (through its subsidiary, Nucommerce Ltda.) and Claro, giving the green light for the creation of a new MVNO5.

This partnership will enable Nubank to utilize Claro's network infrastructure to provide mobile services to its customers. The agreement doesn't restrict Nubank to an exclusive partnership with Claro, so they may have the flexibility to explore future partnerships in the telecommunications sector. Considering the current market share of MVNOs in Brazil, I believe there's significant potential to increase competition and offer more affordable alternatives to consumers. This could lead to additional pressure on established operators' prices, encouraging tariff reductions and improvements in services offered to remain competitive, benefiting consumers.

I think Nubank's entry into the MVNO market is another example that merely providing banking services is no longer sufficient. By integrating mobile services into existing financial offerings, Nubank could further enhance customer engagement and loyalty through combined services and potential incentives.

Looking at other countries, this move isn't new or unique. In other markets, other neobanks are also exploring the telecommunications market in pursuit of offering smoother and more convenient user experiences. For example, Revolut has also begun offering such services in the United Kingdom.

What I find most interesting about this approach is that we typically see telecommunications companies venturing into financial services. The reasoning is simple: in many countries, they have a huge customer base (either due to market configuration or service quality). If a company already has a broad customer base, it seems natural to expand its services beyond its core product. The more extensive the network, the more opportunities arise. For example, a telecommunications company may attract customers with cell phone plans and then encourage them to use exclusive financial services offered within the same network, such as mobile money.

In Africa, this strategy has worked well. In Nigeria, for example, the telecommunications company MTN launched the mobile money service known as "MTN Mobile Money." Since MTN already had a vast customer base for cell phones, it leveraged this infrastructure to offer additional financial services. Customers could easily access basic banking services, money transfers, and payments through their cell phones, taking advantage of the convenience of MTN's existing network.

In Kenya, Safaricom introduced the popular mobile money service called M-Pesa. Similarly, Safaricom, a leading telecommunications company in the country, realized that it could leverage its large customer base for telephony to offer additional financial services. M-Pesa allowed users to send and receive money, pay bills, and even make purchases in stores using their cell phones, without needing a traditional bank account.

I don't believe that Revolut's or Nubank's interest is in building a telecommunications company based on their customer base; I see it more as an approach to offer more than just financial services and also improve the customer experience across different services.

Nubank's entry into the telecommunications industry may redefine the boundaries of the traditional banking sector, creating a more integrated ecosystem of services for its user base. Customers win.

If you know anyone who would like to receive this e-mail or who is fascinated by the possibilities of financial innovation, I’d really appreciate you forwarding this email their way!

Until the next!

Walter Pereira

Disclaimer: The opinions expressed here are solely the responsibility of the author, Walter Pereira, and do not necessarily reflect the views of the sponsors, partners, or clients of W Fintechs.

https://fdr.com.br/2022/06/08/concentracao-bancaria-caiu-10-em-10-anos-por-um-grande-motivo-descubra-qual-e/

https://www.mhemann.com.br/2022/03/pesquisa-satisfacao-anatel/

https://cdn.cade.gov.br/Portal/centrais-de-conteudo/publicacoes/estudos-economicos/cadernos-do-cade/Mercados-de-Telecomunicacoes_2023.pdf

https://cdn.cade.gov.br/Portal/centrais-de-conteudo/publicacoes/estudos-economicos/cadernos-do-cade/Mercados-de-Telecomunicacoes_2023.pdf

https://tecnoblog.net/noticias/exclusivo-nubank-deve-lancar-operadora-propria-de-celular/