#116: Data Economy in Finance: A Look at a Few Players. Is Consolidation on the Horizon?

W FINTECHS NEWSLETTER #116

👀 Portuguese Version 👉 here

This edition is sponsored by

Iniciador enables Regulated Institutions and Fintechs in Open Finance, with a white-label SaaS technology platform that reduces their technological and regulatory burden:

Real-time Financial Data

Payment Initiation

Issuer Authorization Server (Compliance Phase 3)

We are a Top 5 Payment Initiator (ITP) in Brazil in terms of transaction volume.

💡Bring your company to the W Fintechs Newsletter

Reach a niche audience of founders, investors, and regulators who read an in-depth analysis of the financial innovation market every Monday. Click 👉here

👉 W Fintechs is a newsletter focused on financial innovation. Every Monday, at 8:21 a.m. (Brasília time), you will receive an in-depth analysis in your email.

In a market where financial services are becoming commodities (check last week’s edition 👉here), value is increasingly concentrated in how data is used and transformed into real benefits for customers.

Banks and fintechs are evolving into data-driven companies, holding an asset far more valuable than transactions and account balances: insights that reveal their customers’ needs, preferences, and future behaviors. The winning strategy lies in leveraging this data to create a competitive advantage that truly stands out.

We’re still far from the peak of this convergence between data and financial services, which means there are plenty of opportunities to explore. Many players are just beginning to unlock the true potential of data, while others are already ahead, adopting new sources and tools to turn data into strategic decisions. The future belongs to those who can master this convergence with speed and precision.

The 4 Types of Companies in the Data Economy

In last week’s edition, I discussed the four main types of companies: Data Brokers, B2C Companies, B2B2C Service Providers e Compliance Companies. Today, I’ll dive deeper into who they are, what they’re doing, and the opportunities emerging in this landscape.

The First Type: B2B2C Service Providers

These companies act as data aggregators, connecting APIs from banks and fintechs to create integrated solutions. By simplifying access to financial data, they enable banks and fintechs to offer more personalized products and services to consumers while making the entire process more scalable.

Plaid in the U.S., Tink in Europe, Truelayer in the UK, Brankas in Southeast Asia, and Belvo in Latin America are some of the key players exploring this space. Let’s take a closer look at two of them: Plaid and Belvo.

Plaid

To understand the impact of Open Banking in the U.S., it’s impossible to overlook Plaid’s story. Founded in 2011, Plaid emerged at a time when banking technology was seen as a strategic differentiator but not a vital necessity. The company positioned itself as a bridge between banks and fintechs — its main clients — translating disorganized financial data into structured, actionable information.

What began as a simple banking API evolved into a platform with over 12 products. Initially, Plaid used screen scraping to access bank data, as banks did not yet offer open APIs. While functional, this approach was criticized by many banks and became unsustainable in the long term. Over time, Plaid transitioned to API connections, which are far more secure and aligned with market growth.

What truly set Plaid apart was its go-to-market strategy. By prioritizing developer experience — offering well-documented APIs and robust support — the company quickly gained traction and built a loyal user base.

Unlike many of its global competitors, Plaid chose to remain independent. While companies like Yodlee, Finicity, and Tink were acquired by larger firms, Plaid charted its own path. In 2019, Visa offered to acquire Plaid for just over $5 billion, but founder Zach Perret believed the offer underestimated the company’s true potential. By 2022, Plaid was valued at over $13 billion, validating its long-term vision.

Visa’s acquisition proposal was no coincidence. At the time, Plaid was already diversifying beyond bank data with products in areas like payments and fraud prevention. This strategic diversification positioned Plaid not just as financial data infrastructure but also as a key player in the payments space.

Plaid also capitalized on changes in the U.S. financial system, such as leveraging the legacy ACH network and introducing FedNow, the new instant payment system. Despite the rise of alternatives like FedNow, Plaid, with products like Signal, turned ACH—a system created in the 1960s with legacy technology —into an almost instant solution. This agility ensures ACH’s continued relevance, maintaining Plaid’s strategic position while exploring new opportunities tied to FedNow’s potential impact on the U.S. economy.

Belvo

Further south, Belvo is tackling opportunities in Latin America. The region presents unique challenges: banking inclusion remains out of reach for millions, data is often disorganized and poorly standardized, and connectivity is fragmented across many countries.

Founded in 2019 by two Spaniards, Belvo entered Brazil in 2020, bringing in Albert Morales to lead operations. A year later, the company raised over $40 million, with 50% of the funding allocated to its Brazilian operation. In Brazil, Belvo focused on building a solid foundation while navigating the complexities of the country’s banking landscape. By 2021, 30 of its 60 clients were already Brazilian.

In 2022, Belvo aimed to expand into Argentina, Chile, and Peru. However, regulatory hurdles and a global liquidity crunch led to a strategy shift.

Belvo narrowed its focus to three key markets: Brazil, Colombia, and Mexico. Among them, Brazil offers the best conditions but faces intense competition. Since Open Finance was regulated in 2021, numerous players have entered the market, making the battle for market share even fiercer.

This strategic market selection reflects a calculated approach: focusing on regions with high growth potential while adapting to local realities. Unlike Plaid’s model in the U.S. — where banking infrastructure is more developed and solutions can scale uniformly — Belvo has opted for a more segmented and locally tailored strategy.

Operating in Latin America is challenging due to factors like political, regulatory, cultural, and infrastructure conditions. For example, in Mexico, political shifts directly affect the central bank’s innovation initiatives. In Colombia, low banking penetration and poor internet access hinder digital platform adoption, despite regulators’ openness to financial innovation. Meanwhile, Brazil combines strong regulation and infrastructure, but the competition is intense.

Rather than rapid international expansion like Plaid, which now operates in 18 countries, Belvo has focused on three core markets and tailored its products to each country’s specific needs.

Challenges for Both

Belvo’s focus on adapting to local market nuances contrasts with Plaid’s global approach, which provides a universal solution to similar banking problems across countries. Belvo has chosen a more gradual and locally connected path, building a strong foundation before expanding further in Latin America.

One key difference lies in the structural challenges of their respective regions, which directly influence growth and product strategies. Like Plaid, Belvo has diversified its product offerings. Plaid’s diversification into payments positioned it strategically to receive Visa’s acquisition offer. While FedNow challenges Plaid’s ACH-based payment product, its broader portfolio ensures continued revenue streams.

Belvo has followed a similar trajectory. In 2023, the company acquired a payment startup and expanded its offerings around Pix, launching products like Recurring Pix, Biometric Pix, Automated Pix, and Smart Transfers. This move positions Belvo not only as a data company but also as a player in the payments space.

For B2B2C Service Providers, expanding their product portfolios seems strategic. They often start with data products, move into payments, and later explore areas like fraud prevention. As I wrote last week, payments are a goldmine for data. The more transactions, the more data. Plaid recognized this, diversifying to maintain its strategic edge. Belvo has done something similar, leveraging Pix to expand its products. The logic is simple: whoever controls the flow of money also controls the flow of data.

The Second Type: B2C Companies

This category includes banks and fintechs that leverage market tools — such as data brokers, compliance companies, and B2B2C service providers — to transform consumer data into personalized financial products.

These data serve as the fuel for a level of personalization that goes beyond the basics. They enable companies to use every interaction as an opportunity to enhance the customer experience. The more data they have, the greater their ability to create contextualized experiences, anticipate needs, and secure a significant long-term competitive advantage.

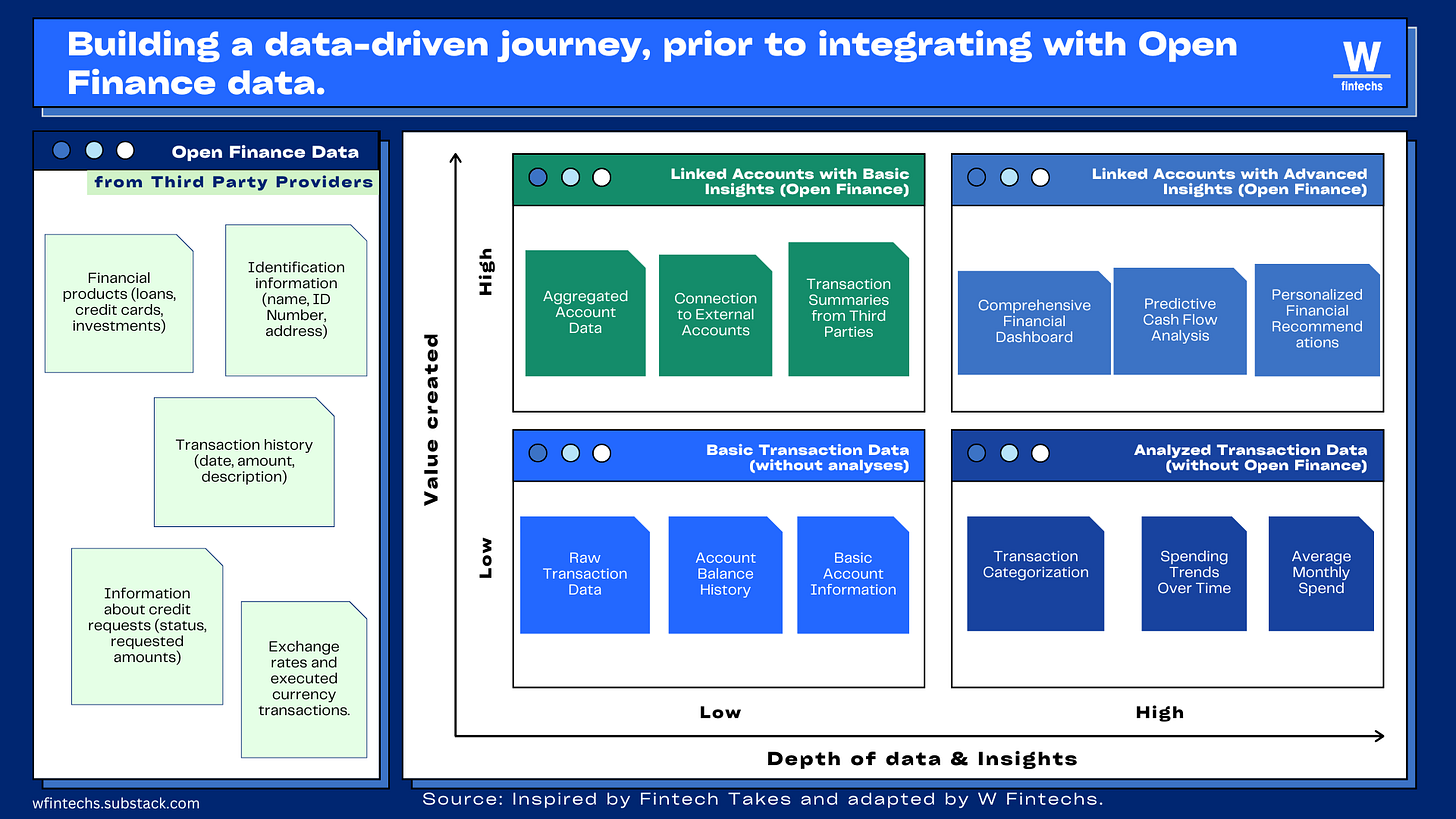

In edition #114, I explored how institutions can utilize both the data they already have internally and data from external sources like Open Finance and Data Brokers. As external sources become more accessible, the differentiation no longer lies in accessing data but in how intelligently and strategically they are used.

The Third Type: Data Brokers

Data Brokers act as intermediaries in the data market, buying and selling consumer data for various purposes, such as creating detailed credit profiles. These data, often obtained from financial institutions or public sources, are traded without clear oversight for consumers. In Brazil, companies like Serasa Experian and Boa Vista fall into this category, leveraging data to improve credit analysis and risk management.

In 2010, Data Brokers gained a new chapter in Brazil: the Cadastro Positivo was introduced as a solution to expand data access and improve credit availability in the country. In 2017, support from major banks — Banco do Brasil, Bradesco, Caixa, Itaú, and Santander — led to the creation of Quod. However, the reality turned out to be quite different. The tool proved to be both ineffective and potentially risky for consumers, as it allowed for potential misuse of information without adequate control or oversight. Ultimately, the promise of transforming credit in Brazil ended up being just another step in the process of data collection and commercialization by the sector's major players.

Some companies in this category are strategically repositioning themselves by acquiring competitors and diversifying operations, such as entering the fraud prevention market, to align with new data regulations. The main challenge here is balancing data collection with the need to meet recent regulatory requirements.

The Fourth Type: Compliance Companies

Plaid and Belvo initially operated in unregulated markets that later became regulated. In contrast, Compliance Companies, such as Iniciador and Finansystech, capitalize on opportunities created by regulation. These companies not only ensure API connectivity according to regulatory standards but also offer consultancy services to banks and fintechs, helping them stay compliant with regulations.

This market holds promise, especially with the advancement of regulations, but it also presents challenges. To ensure sustainable growth and significant revenue generation, these companies will need to diversify their offerings. This might mean expanding into new services or adapting their business models, similar to what we’ve seen with B2B2C Service Providers, which have expanded beyond data to explore payments, fraud prevention, and other solutions.

Guided by regulatory trends, an interesting alternative for these companies would be to expand into new international markets. However, this would involve cultural challenges and a deeper understanding of different regional regulations, requiring further adaptation in their strategies.

Is Consolidation Coming?

A recurring question in the industry, when observing so many layers and players in distinct roles, is: will consolidation occur? In other words, who will stand out and dominate the market? While some areas may see dominance by key players, others will remain competitive battlegrounds. Three factors can be considered here:

First, analyzing the different strategies adopted by companies operating in the financial and data ecosystem, one of the most striking distinctions lies in how they tackle structural challenges and adapt to varying regulations and markets. For B2B2C companies like Plaid and Belvo, the main barrier to entry is building solutions that integrate financial data efficiently and at scale, facing obstacles like disorganized data and the lack of open APIs, particularly in emerging markets.

The second factor is innovation. Companies in the B2C, B2B2C, and Compliance categories are at the heart of a technological revolution in banking. As regulations rapidly evolve to keep pace with innovation, significant opportunities await players who act swiftly. The need for innovation will always prevail, but this will create a volatile market where only a few will manage to keep up in the long term—especially those with limited funding.

Differentiation is another critical factor, turning the quest for consolidation into a genuine battleground. Companies serving end consumers, like B2C firms, must realize they’re not just competing for data but for experience. Consumers want more, and those offering personalized experiences will come out ahead. Unlike Data Brokers, which centralize data for corporate audiences, B2C Companies must build a direct and genuine connection with their customers. Meanwhile, B2B2C players will need to continuously expand their product offerings. Some have evolved from data solutions into payment platforms—effectively dominating both the flow of money and the flow of data.

Some companies choose to chart their own independent path, uninterested in being acquired, as they know that mastering the art of creating value from data transforms what could be a “good business” into a true goldmine.

Therefore, while some segments may consolidate due to data control, the real battle lies among companies that can innovate and deliver genuine value to the end customer. The future of the industry will be defined by those who strike a balance between control, impact, and, most importantly, the ability to provide differentiated and personalized experiences. This is a field where consolidation may happen, but not through control — rather, through adaptation.

Read about

👉 Banks and fintechs are becoming data-driven companies, what opportunities does this create?

👉 How can institutions turn Open Finance opportunities into revenue?

If you know anyone who would like to receive this e-mail or who is fascinated by the possibilities of financial innovation, I’d really appreciate you forwarding this email their way!

Until the next!

Walter Pereira

Disclaimer: The opinions expressed here are solely the responsibility of the author, Walter Pereira, and do not necessarily reflect the views of the sponsors, partners, or clients of W Fintechs.