#115: Financial services are becoming commodities. Fintechs and banks, data companies.

W FINTECHS NEWSLETTER #115

👀 Portuguese Version 👉 here

This edition is sponsored by

Iniciador enables Regulated Institutions and Fintechs in Open Finance, with a white-label SaaS technology platform that reduces their technological and regulatory burden:

Real-time Financial Data

Payment Initiation

Issuer Authorization Server (Compliance Phase 3)

We are a Top 5 Payment Initiator (ITP) in Brazil in terms of transaction volume.

💡Bring your company to the W Fintechs Newsletter

Reach a niche audience of founders, investors, and regulators who read an in-depth analysis of the financial innovation market every Monday. Click 👉here

👉 W Fintechs is a newsletter focused on financial innovation. Every Monday, at 8:21 a.m. (Brasília time), you will receive an in-depth analysis in your email.

Access to financial services, once limited to a select few, is rapidly expanding in both developed and developing countries, thanks to digitalization. This transformation has reshaped the competitiveness of the sector—and where there’s competition, some players inevitably stand out.

All About Data

In Latin America, financial inclusion saw a significant leap—from 55% in 2017 to 74% in 2021. This expansion has broadened the potential market for banks and fintechs: more customers, more transactions, more data. The growth of embedded finance and fintech proliferation has leveled access to the financial system, turning basic banking products into something resembling commodities. Yet, there's still vast potential for growth in certain segments and regions.

In a market with little product differentiation, what sets one financial institution apart from another when most offer the same “bread and butter” services (credit cards, high-yield accounts, etc.)? Data. Specifically, how they use it. The winners in this space won’t be those who simply offer accounts or cards but those who transform their data into personalization and accurate predictions—creating customer experiences they didn’t even know they wanted but now can’t live without.

Nubank recognized this early on. Its July 2024 acquisition of Hyperplane, a company that developed proprietary foundational models to leverage banking data for customer benefit, and its 2021 acquisition of Olivia, an AI-driven personal financial management (PFM) platform, weren’t just about technology—they were about data and expertise in using it. The game has changed.

Who Wins in Fintech?

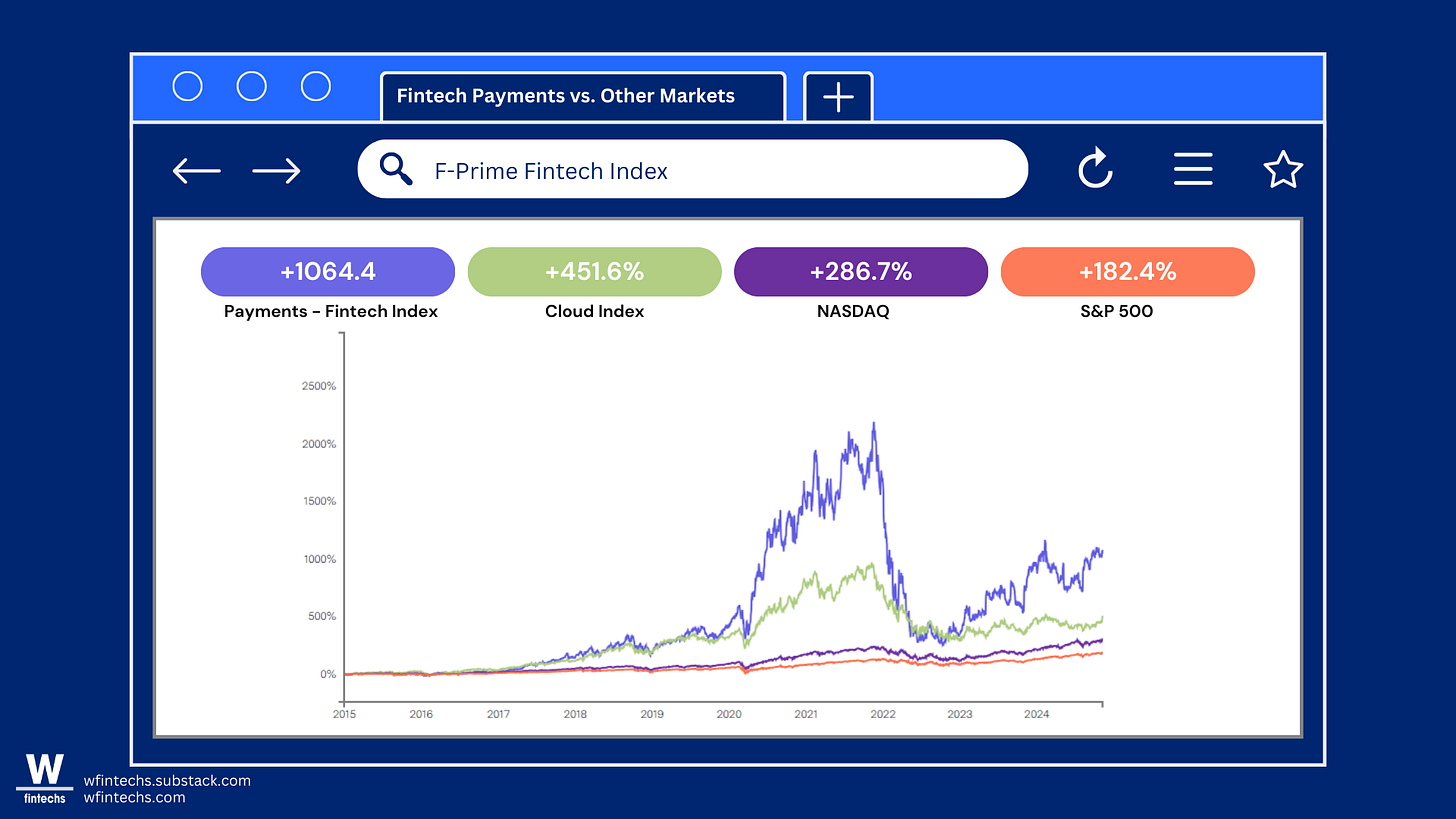

Looking at the Fintech Index, which tracks the sector's performance, fintechs are outperforming giants like Cloud, Nasdaq, and the S&P500. The index has grown by +720.9%, compared to +451.6% for Cloud, +286.7% for Nasdaq, and +182.4% for the S&P500. Despite peaking at $1.3 trillion in 2021 and then dropping to $389 billion, the index rebounded to $568 billion in Q2 2024.

Although it has rebounded, many segments still fall short of expectations. Insurance, Lending, and Proptech show negative performance, with Proptech being the weakest. Wealth Management has seen modest growth of +13.6%, while Banking, despite an improvement of +54.4%, still lags behind the benchmarks set by Nasdaq and the S&P500. The B2B SaaS segment, with growth of +323.4%, remains below Cloud’s performance, indicating there’s still room for growth.

Payments: The Heart of the Fintech Sector

On the other hand, payment fintechs shine as the true heart of the industry, delivering an extraordinary growth of +1064.4%. This surpasses not only all other fintech segments but also far outpaces benchmark indices like Cloud, Nasdaq, and the S&P500.

In 2010, the fastest way to transfer money from New York to London on the same day was to hop on a flight from JFK to Heathrow and deliver it in person 1. Fast forward a little over a decade, and the landscape has changed dramatically. With a far more advanced payment infrastructure, transactions that once took days are now completed in mere seconds.

In Brazil, payment fintechs marked the first step in transforming the financial sector, breaking the dominance of Cielo and Rede, whose market share plummeted from 90% to 45% in just a decade. This shift wasn’t a coincidence: regulatory reforms opened the doors for new players like Stone and PagSeguro, which focused their strategies on small and medium-sized businesses. The resulting price war drove down merchant discount rates (MDRs) from 2.9% to 2.3% for credit cards and from 1.6% to 1.1% for debit cards.

But even with this transformation, in 2019, 77% of retail transactions were still made in cash 2. Merchants were stuck with high credit card fees and long waiting periods to access their funds—sometimes up to 30 days!

Nothing compared to the efficiency and technology gains brought by Pix, the instant payment system launched in 2020 by the Central Bank of Brazil. Pix reduced transaction costs for merchants. While debit card fees were 1.1% and credit card fees 2.3%, data from the fourth quarter of 2022 3 showed that the average cost for businesses to receive payments via Pix was 0.33% per transaction. What was once a maze of fees and bureaucracy became something faster and cheaper.

The role of payments in generating data cannot be overlooked. The massive adoption of Pix, which occurred before the implementation of Open Finance, laid the groundwork for a robust data-sharing infrastructure. Without a widely accepted payment system, creating an efficient data ecosystem would have been much more challenging. International experiences show that digital payments not only increase the volume of generated data but also significantly promote financial inclusion 4.

Pix has not only democratized access to financial services—bringing over 70 million people into the financial system 5 —but also created the data foundation necessary to drive new innovations . As of September 2024, 173 million users, including individuals and businesses, use Pix. Transaction data can serve as the cherry on top for many predictive models. In countries where digital payment systems are less widespread, like many in Latin America, we observe lower financial inclusion and, consequently, a more limited data pool. Pix accelerated inclusion and generated the data volume needed to fuel the growth of Open Finance.

Strategic Positions in This Economy

In a market where financial services are becoming commodities, the real value lies increasingly in data. Banks and fintechs have access to mountains of information that not only reflect customers' financial behavior but also their needs, preferences, and potential future actions. This is where the opportunity lies: as financial services become harder to differentiate, the winning strategy now depends on how effectively a company uses its data.

The Three Core Premises

The first sign of this transformation is that the value of services no longer lies in the financial product itself but in the ability to mine and interpret data. Open Finance will be the game-changer here, as I mentioned in a previous edition (👉link here). Banks and fintechs understand that loans or checking accounts are only meaningful if paired with a package of predictions about what the customer will want or need tomorrow.

Institutions are pouring billions into technology, positioning themselves closer to giants like Google and Amazon 6. In Brazil alone, investments may reach up to USD 8 billion, with a strong focus on artificial intelligence 7. In the past, the differentiator was which institution had the best service and manager; today, it’s who has the best algorithm. In other words, it’s about who collects, processes, and uses data with the greatest precision.

Mastering personalization will not only enable companies to predict customers’ next steps but also their future needs. Banks and fintechs are no longer just providing credit or safeguarding money—they are evolving into data companies selling financial products and services.

The Four Types of the Data Economy

Within this emerging data economy, four main types of players stand out: Data Brokers, B2C Companies, B2B2C Service Providers, and Compliance Companies.

B2C Companies, such as banks and fintechs, leverage consumer data to create personalized financial products. This sector is evolving rapidly, with new use cases constantly emerging in the market. The W Fintechs report, published in September (👉 link here) and scheduled for release in English in December, highlighted that many of these use cases focus on financial management and tailored offers.

Data Brokers are companies that buy and sell consumer data, including credit bureaus, which have historically sourced this information from financial institutions without clear monetization policies for consumers or those institutions.

In the U.S., regulations surrounding the buying and selling of data are gaining momentum amid growing concerns over privacy and unauthorized use of personal information. In 2019, the California Consumer Privacy Act (CCPA) granted consumers the right to request information about the sale of their data and opt for its deletion. Since then, additional laws in states like Virginia and Colorado have increased restrictions on Data Brokers.

Further advancements have also been made toward a framework resembling regulated Open Banking—the Consumer Financial Data Rights (CFDR), discussed by the Consumer Financial Protection Bureau (CFPB). This regulation aims to strengthen consumer control and transparency over their data, enabling them to decide how and with whom their information is shared.

With the progress of Section 1033, the role of Data Brokers and other institutions that rely on third-party data is expected to change significantly. The full implementation of regulated Open Banking in the U.S. may demand greater compliance and transparency, reducing the likelihood of data collection without explicit consent. In Brazil, market players such as Serasa and Boa Vista SCPC have also expanded their commercial and product strategies as Open Finance continues to advance.

For B2B2C Service Providers and Compliance Companies, direct control over data is more limited. B2B2C Service Providers act as data aggregators, using APIs from banks and fintechs to deliver integrated solutions. This is a promising market where some players are already seeking consolidation. And Compliance Companies play a critical role in Open Finance. They not only facilitate API connectivity in compliance with regulations but also support banks and fintechs in ensuring adherence to regulatory standards.

This positioning will lead to diverse commercial impacts. High-impact commercial players, such as B2C Companies and B2B2C Service Providers, are those that can transform data into significant economic value—whether through innovative products or direct monetization. Meanwhile, low-impact commercial players, like Data Brokers and Compliance Companies, participate in the data economy but with less direct economic influence. Each type of participant plays a distinct role, contributing at different levels to the overall data economy.

The Future of the Data Economy

Looking ahead, the transformation of the data economy is undeniable. New players are exploring data monetization models that go beyond traditional approaches. Companies leveraging predictive data can, for instance, personalize services in real time, creating unique offers for each customer. What is clear is that institutions capable of seamlessly integrating diverse data sources and delivering tangible value to customers will emerge as the winners. As financial services increasingly become commoditized, fintechs and banks are shifting their focus to optimizing the user experience. Generating insights that enhance processes like credit, fraud prevention, and investment recommendations positions these institutions as ‘data factories’. The key question is no longer about merely collecting data but about transforming it into high-value insights.

The evolution of fintechs showcases this journey: the first generation disrupted payments, bringing more people into the system and generating more data; the second generation focused on financial management; and the third generation revolves around data-driven experiences—Open Finance and artificial intelligence. This new phase will demand institutions to go beyond basic banking capabilities, focusing on the customer and data as the central assets for innovation.

Profitability challenges will undoubtedly arise along this path, pushing many players to explore new frontiers. The case of PayPal exemplifies this shift toward diversification.

PayPal officially launched a new advertising business. In an interview with the executive leading this initiative, he shared:

“The sheer amount of transaction data that we have at our fingertips is just incredible—it’s much more than any single retailer would ever have.”

With over 400 million users relying on its services, PayPal uses this vast repository of information to enable advertisers to precisely target and reach consumers based on their spending habits. This illustrates how other segments of the economy are intersecting with financial companies.

For investors and stakeholders, the message is clear: success in the data economy demands patience and long-term vision. While financial services may appear commoditized, the ability to transform data into personalized experiences is the real competitive edge. Data is no longer a byproduct; it is the most valuable strategic asset. Financial institutions are no longer merely offering credit or safeguarding money—they are evolving into data companies selling financial products and services. Those who understand this dynamic will hold a significant competitive advantage in the next decade.

Read about

👉 How can institutions turn Open Finance opportunities into revenue?

If you know anyone who would like to receive this e-mail or who is fascinated by the possibilities of financial innovation, I’d really appreciate you forwarding this email their way!

Until the next!

Walter Pereira

Disclaimer: The opinions expressed here are solely the responsibility of the author, Walter Pereira, and do not necessarily reflect the views of the sponsors, partners, or clients of W Fintechs.

https://www.jpmorgan.com/content/dam/jpm/treasury-services/documents/jpm-payments-are-eating-the-world.pdf

https://20392958.fs1.hubspotusercontent-na1.net/hubfs/20392958/AA%20US%20White%20Papers/Pix%20White%20Paper%20By%20Matera.pdf

https://www.bcb.gov.br/content/estabilidadefinanceira/pix/relatorio_de_gestao_pix/relatorio_gestao_pix_2023.pdf

https://publications.iadb.org/en/accelerating-digital-payments-latin-america-and-caribbean

https://www.bcb.gov.br/detalhenoticia/744/noticia

https://www.tamr.com/blog/4-trends-driving-record-investment-in-technology-at-global-banks

https://portal.febraban.org.br/noticia/4091/pt-br/#:~:text=Bancos%20estimam%20investir%20R%24%2047,em%202024%2C%20revela%20pesquisa%20Febraban&text=O%20or%C3%A7amento%20total%20dos%20bancos,R%24%2047%2C4%20bilh%C3%B5es.