#126: More integrations, more data: opportunities in the workflow market and the new wave of decision engine companies

W FINTECHS NEWSLETTTER #126

👀 Portuguese Version 👉 here

👉 W Fintechs is a newsletter focused on financial innovation. Every Monday, at 8:21 a.m. (Brasília time), you will receive an in-depth analysis in your email.

This edition is sponsored by

Iniciador is the complete infrastructure platform specialized in Regulated Open Finance, enabling Payment Initiation and Data Access.

The solution removes technology and compliance concerns, allowing clients — with their own regulatory license or using Iniciador’s — to focus on new products and business growth.

💡Bring your company to the W Fintechs Newsletter

Reach a niche audience of founders, investors, and regulators who read an in-depth analysis of the financial innovation market every Monday. Click 👉here

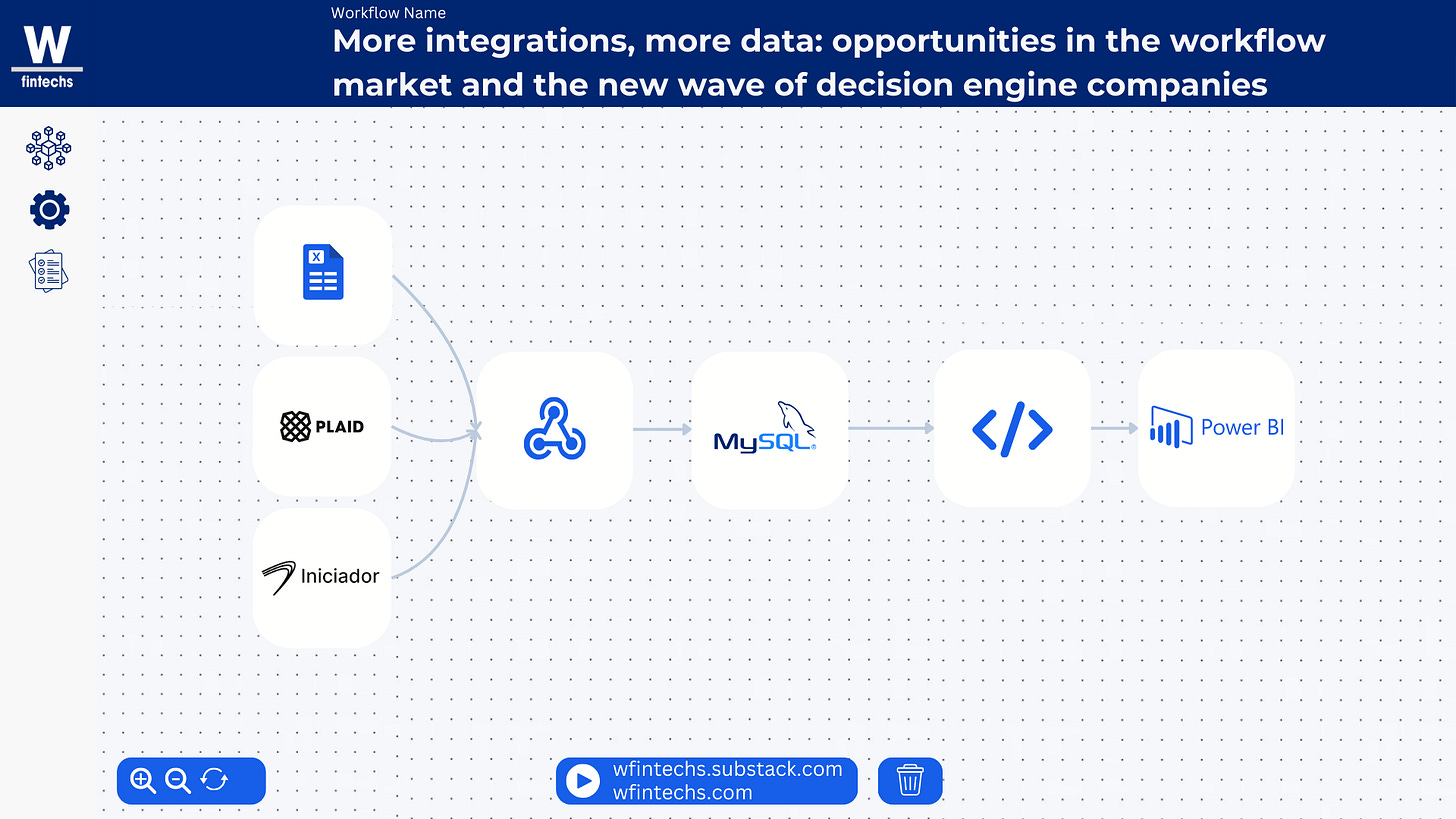

Approving credit, processing a transaction for a company, managing a back office: all of this depends on a workflow. As a business grows, it connects to an increasing number of suppliers and technology providers. This means dealing with multiple APIs, various data sources, and different destinations and functions for that data.

There’s another challenge in this equation: bringing more data into the company can be risky—whether due to data protection regulations or concerns around security and governance. In other words, having data and not using it can complicate matters.

In previous editions, I’ve written that Open Finance represents a great opportunity for fintechs and banks to innovate. However, to take advantage of it, it would be crucial to have clarity on the goals of entering this infrastructure—even when regulatory requirements are in place (link to edition #114 👉here).

Defining this purpose from the start accelerates ROI and enables real use cases. Before integrating data from open infrastructures, these companies also need to establish a data culture and extract value from the information they already have. This is where workflow comes in: structuring, automating, and integrating the available data, ensuring efficiency, governance, and also strategic use. One example of this is Zapier, which, by connecting multiple platforms in a simple, no-code way, revolutionized the integration market and demonstrated the impact of automation in practice. But that’s not enough. Decision engine platforms also take this logic further, automating real-time decisions with rules, models, and data.

Relevant cases like LendAPI, which connects fintechs to alternative data sources for credit, and Taktile, which optimizes risk decisions without requiring code, show how this technology can transform business strategies. More integrations, more data, more intelligence: the next generation of fintechs will master this art, and that’s exactly what I’ll explore today.

The Agility of the API Economy

The API economy has revolutionized the fintech market—and it was the topic of edition #15, link 👉 here. Through various integrations, the go-to-market was not only shortened but also operational efficiency was increased.

Companies are no longer isolated; they are part of a vast, interconnected ecosystem of suppliers, regulators, and technology partners. It’s no surprise that various API management players have emerged to monitor and manage the connections between them. Each integration adds a layer of risk but also an opportunity for gain.

Mambu

A clear example of this is Mambu. In edition #123 (link 👉 here), I wrote that core banking players are adopting the concept of ecosystems in their market entry and expansion strategies. Mambu has invested in creating an ecosystem of core banking solutions, integrating providers of governance, messaging, and payment processors.

By positioning itself as an integration hub, Mambu led the transformation of the banking sector through the cloud. However, the real challenge of this strategy is balancing efficiency in orchestrating integrations with the need to prevent this complexity from becoming an operational burden for its clients. In a market where agility is increasingly important, success depends directly on the ability to manage this ecosystem without losing control or simplicity.

Zapier

Another equally relevant example in the integration and automation market is Zapier. For analysis, I will explore four points: the context of its emergence, the challenges faced, the strategies implemented, and the central thesis behind its success.

Context

We can say that Zapier was one of the first companies to understand the complexity and potential market of APIs and different platforms.

In 2011, Wade Foster, Bryan Helmig, and Mike Knoop were not well known in Silicon Valley, but they saw an opportunity that was already gaining attention at the time: everyone wanted their apps to talk to each other, but no one wanted to waste time coding manual connections.

Foster had graduated during the 2008 financial crisis and found opportunities only outside the traditional path. In May 2011, as an email marketing manager at Veterans United Home Loans, he needed to connect software from different companies that couldn’t communicate with each other. He spent months manually syncing emails, databases, and statuses.

At the same time, he reconnected with Bryan Helmig, a college friend who had also worked with him on some freelance projects. The two realized there was a solution: create a tool to automate these integrations. They then called on Mike Knoop, another college mate, and Zapier was born.

The first MVP was very simple, but it solved a real problem for businesses: integrations with different systems. To attract the first customers, Foster dived into forums for popular products like Evernote, Salesforce, and Dropbox, identifying the most requested integrations. He responded to those requests, suggesting technical solutions with each service’s API, and at the same time, shared a link to the Zapier demo.

Zapier grew rapidly, reaching 1 million users in 2015 with a freemium model, allowing users to test and see the value of the platform before deciding to pay.

In practice, the platform enables automation between apps through "Zaps," which are workflows set up with triggers and actions. The user defines an event (e.g., receiving an email in Gmail) that triggers an action in another app (such as automatically saving the attachment to Google Drive). This flow can be expanded into multiple steps and even conditioned by specific rules with the "Paths" function, which allows for branching based on logical decisions.

The tool also offers features like scheduling recurring automations and webhooks, enabling more complex and customized integrations. By allowing Zaps to be scheduled to run at specific times or integrating data from any service without the need to write code, the platform reduces the demand on IT teams and also provides a quick, flexible experience for business and data professionals. The growth strategy was based on increasing the portfolio of integrations, as the more connections, the more value users saw in the platform.

Then came the pandemic, and the entire world needed more automation, more integration, and more efficiency. Zapier rode this wave like few companies. By 2023, it was already generating $310 million in ARR, a 35% increase from the previous year. A massive growth for a company that raised only $1.4 million in venture capital and reached $100 million in ARR in less than 10 years.

Challenges

Along the way, they faced challenges such as bugs in integrations that were important to users. This situation was worsened by slow support and generic responses. Since the company chose to raise less investment and grow with a lean team, responsiveness was sometimes compromised. Interestingly, even after establishing itself as a relevant player and achieving significant annual revenue, Zapier still faces many criticisms regarding its support, like this example from March 2024.

The rapid growth brought new features but also compromised the user experience. Some customers began to feel that Zapier was prioritizing expansion over stability. Meanwhile, competitors like Make, Workato, n8n, and other more specialized solutions gained more and more space.

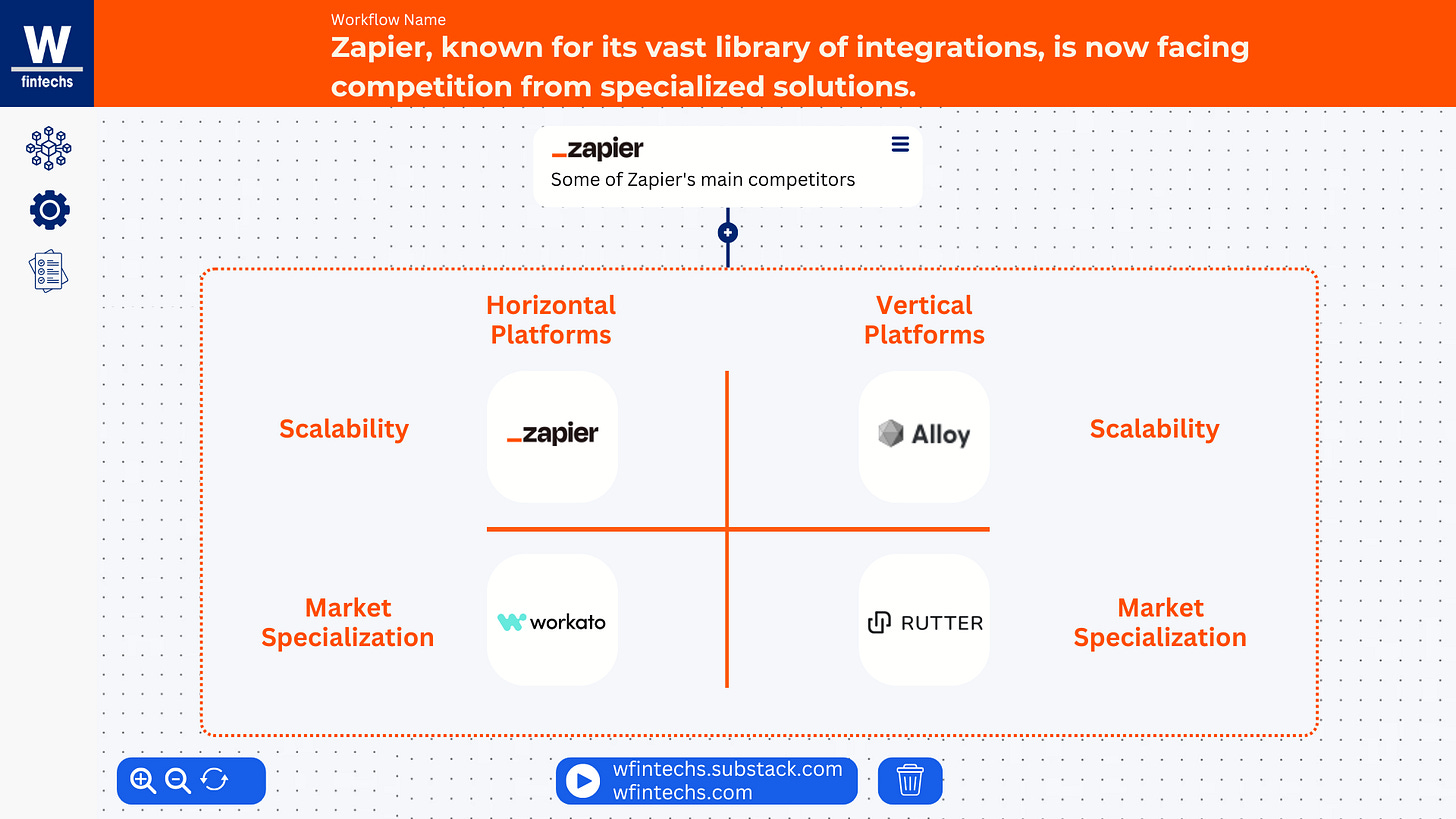

Zapier operates as a horizontal platform, meaning it tries to do everything and serves a variety of use cases in automation. However, its strategy of trying to be everything to everyone began to be a problem once other platforms emerged offering more specific use cases and even less technical integration.

Platforms like Tray.io are giving companies the freedom to build native integrations in a more customized way, reducing the reliance on an external platform.

In other words, what seemed like an advantage for Zapier—its vast library of integrations—is now being overshadowed by the ability of companies to develop their own internal solutions. This has put Zapier in a delicate situation: the very partners they helped integrate can now build their own solutions.

Meanwhile, the market is specializing, with vertical platforms gaining ground by focusing on specific niches. Alloy, for example, focused on e-commerce automation; Rutter on custom integrations for e-commerce; Parabola focused on data flows; while Finchspecialized in payroll, solving HR needs in a practical way. These more specialized solutions offer value that Zapier, with its more generalist approach, cannot deliver. In this context, the generalist platform model is losing strength, while more focused and native solutions are starting to attract more user attention.

Strategies

The freemium model brought millions of users but also overwhelmed support. Relying on third-party services, some integrations would break, workflows would fail, and the team had to put out fires while building new features and making the platform more useful for users.

Zapier then realized that the scalability of integrations couldn't rely on a manual model. In the beginning, this approach worked, but as the number of users grew and demands increased, the process became a problem. The manual development of integrations limited the platform's speed in expanding its offerings, and it quickly became clear that this method was not sustainable in the long run.

That's when Zapier transformed into an open and collaborative platform, where developers could contribute and expand integration capabilities without relying on a centralized effort. The focus on building a developer network wasn't just about expansion, but a strategy to keep the platform relevant and competitive in the long term.

Another challenge was the SEO game. Zapier rode a huge wave by creating thousands of pages optimized for search, ensuring exponential growth. But relying too much on Google is like building a house on rented land: any change in the algorithm could sink traffic and, consequently, the platform's growth. To mitigate this risk, Zapier diversified its strategies, investing in partnerships, co-marketing, and, most importantly, educational content.

Zapier’s marketing strategy was built around promoting partnerships from the start. In 2013, when integrating new partners and clients, the platform would make promotional posts and encourage collaborative actions, such as blog posts, email campaigns, social media, and webinars. This not only increased the visibility of the integrations and the company but also reinforced its value proposition by highlighting partners on their own pages.

The "How We Work" series was a big success as well, attracting not just potential users but also anyone interested in improving their productivity at work. Through tutorials, e-books, webinars, and a strong social media presence, Zapier reached over 250,000 monthly readers by 20151. The SEO and content marketing strategy combined organic growth for the platform and helped solidify its market position, always focusing on educating users and establishing itself as a reference in the industry.

The Thesis Behind Zapier’s Success

The conclusion we’ve reached is that Zapier is consolidating itself in the growing iPaaS market — some forecasts suggest that this market will reach $62 billion by 20332. Hyperautomation, which includes Zapier, is also growing rapidly, reaching $31 billion in 2021 3. But the competitive environment is getting bigger: companies like MuleSoft and Boomi, both acquired by major corporations, already dominate the enterprise sector, while new platforms like Alloy have started to gain market share as well. Additionally, giants like Google and Microsoft have begun developing their own automation solutions.

But as we observe Zapier’s growth, it becomes clear that it wasn't the result of luck but rather the execution of well-crafted strategies in a market hungry for automation. In a scenario where companies operate with an average of 88 apps4 and business professionals jump between nearly ten tools a day, the need for more integration across platforms is real.

The abundance of platforms should accelerate work, but it often only creates new bottlenecks, making automation increasingly necessary — so much so that 90% of workers say it improves productivity 5. Zapier not only understood this pain but built the perfect antidote.

Focusing on organic traffic and adopting the freemium model allowed Zapier to lower entry barriers and attract millions of users. The task-based pricing model also ensured high margins and a lean operation, driving organic growth with capital control.

The company continues to implement strategies to remain relevant in an increasingly verticalized and competitive market. Recently, Zapier integrated an AI that allows users to request integration workflows via prompts, automating the entire process. The product has been evolving alongside user demands and new technologies, but its reliance on giants like Google and Microsoft for integrations could pose a risk to its growth in the coming years, as both companies are developing their own solutions.

The New Generation of Workflow and Decision Engine Companies

Understanding Zapier’s story is useful for one reason: the integration market is changing. Zapier has established itself as a highly efficient player in terms of capital: it raised little and grew a lot. There are costs to this trajectory, such as the various criticisms of its support, but in a way, the strategy of creating a developer ecosystem — since its traction channel is the integrations themselves, the more the better! — and the content strategy to optimize its SEO were key to its growth.

However, it has been losing ground to platforms that offer more flexibility and solve vertical problems, i.e., those that are not generalists. This is interesting because by focusing on a niche, an audience, and a specific problem, the solution becomes deeper. Bringing this to the financial sector, I see great potential to create relevant companies in the workflow, iPaaS, and process automation space.

In the banking sector, for example, processes like customer data integration, risk analysis, and regulatory compliance require solutions more tailored to their specific needs, something generalist platforms simply can't offer with the same efficiency.

Here, the key lies in depth, not breadth. The next wave will be companies that focus on connecting the world of financial data more intelligently, with the flexibility needed to scale. These companies will certainly have the chance to capture a significant share of this market, creating solutions that not only meet but adapt to the needs and evolution of the financial sector — something I mentioned in issue #123, where core banking players are seeking more flexibility through open-source technologies, for example (if you haven’t seen it, link 👉 here).

Analyzing the Players

There are several decision engine players developing relevant solutions in the automation and integration market. I will explore Taktile in more detail and provide an overview of other important players such as LendAPI, Gyra+, and Alloy (not the same as previously mentioned). Taktile has an interesting journey, starting with a broad vision and then focusing on a specific problem. Additionally, its strategies can teach us a lot.

Taktile

Taktile is an example of a company that reinvented itself by focusing on a specific problem after starting more broadly. Founded in 2020 by Maik Taro Wehmeyer and Maximilian Eber, the mission was simple: to help institutions use their data more efficiently. On its initial website, Taktile made it clear that its goal was to accelerate the adoption of tools like ML/AI in companies to maximize positive outcomes.

The company quickly stood out, becoming one of only ten German startups to receive funding from Y Combinator. With founders having more than 25 years of experience in developing custom ML solutions for sectors like insurance and banking, Taktile was well positioned to bring this vision to life.

In 2021, Taktile focused on three segments: asset management, banking, and insurance. Looking at the website from that time, Taktile positioned itself as a platform capable of transforming data into strategy and decision-making, but in a broader sense, with the added value of ensuring that its ML algorithms met the governance requirements of the financial sector — the difference was undoubtedly in the experience the team already had in this market.

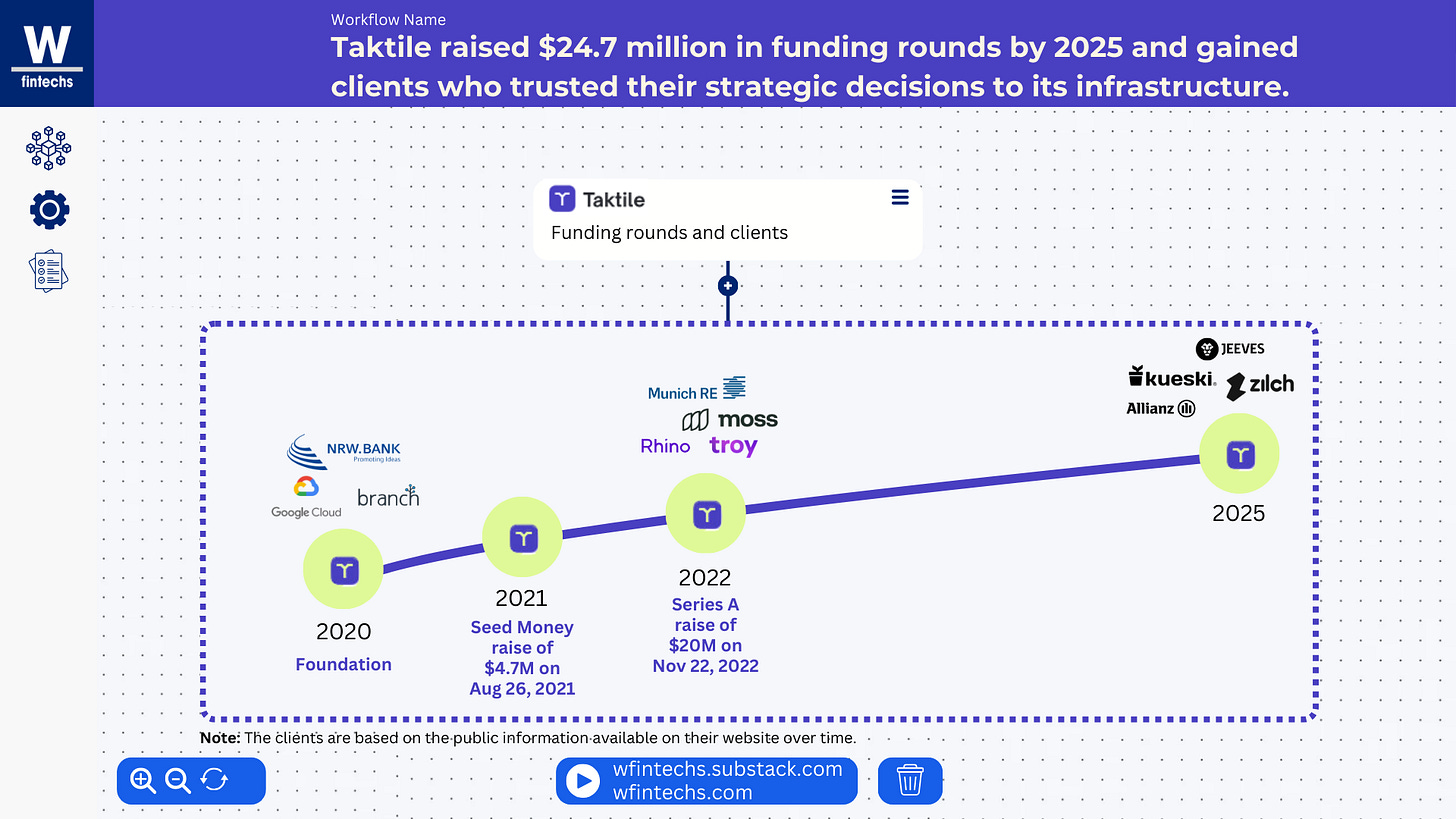

Among its features at the time was the ability for clients to access and enrich all their data, connecting, expanding, and governing data from various sources such as ERP, CRM, and real-time events like customer interactions and transactions. Testimonials from brands like NRW Bank, Google Cloud, and Branch confirmed that the team's expertise, combined with their vision on the importance of data for decision-making, was truly coming to fruition.

In 2022, Taktile made the definitive leap to establish itself as a decision engine, standing out for its ability to transform data into faster and more informed strategic decisions.

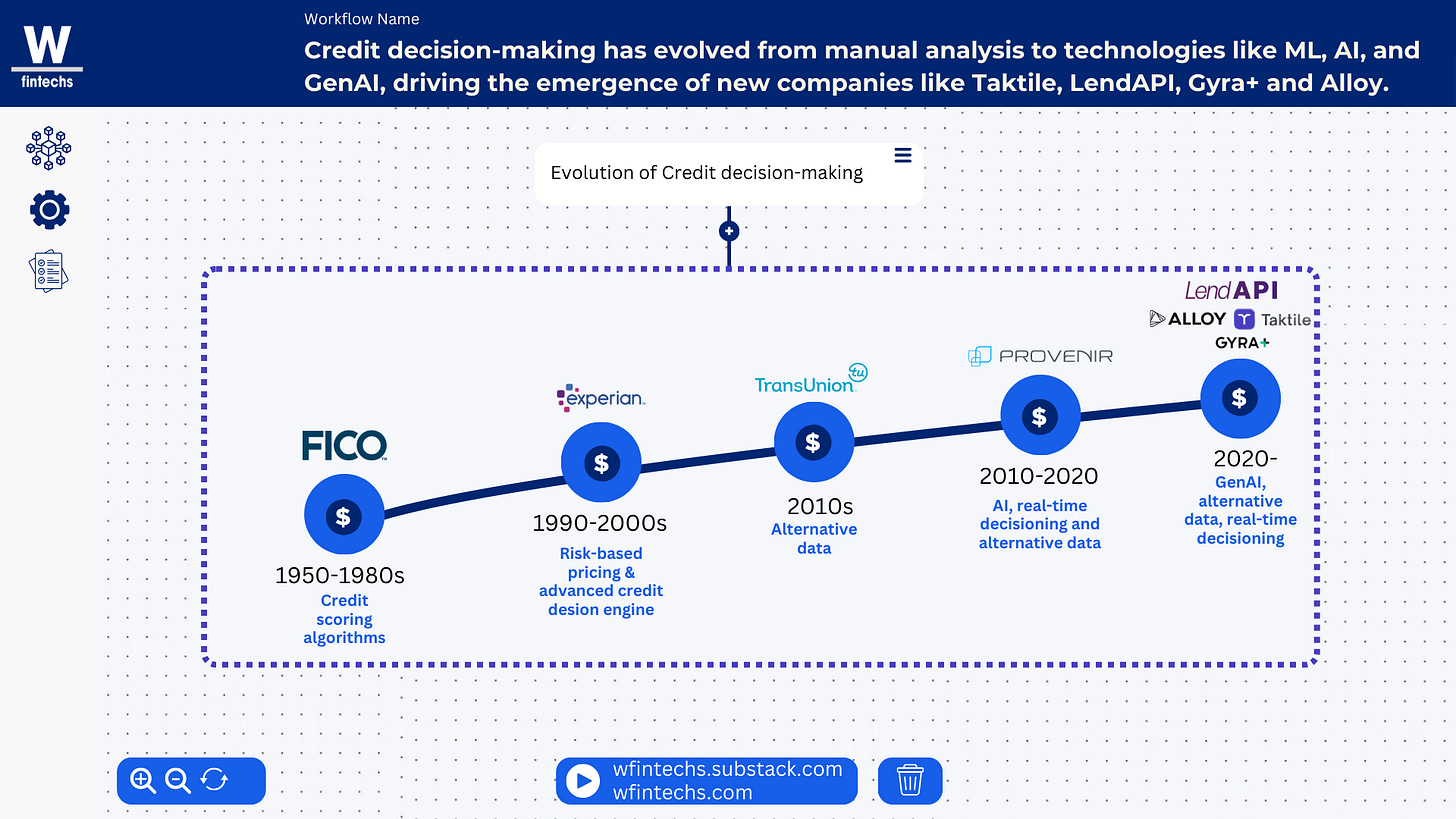

Looking at the evolution of this market, it's clear that institutions are increasingly demanding specialized solutions. Credit decision-making evolved from manual analysis to credit scoring algorithms in the 1950s. In the 1980s, process digitization took place, and by the 1990s, risk pricing systems made the process even more objective and precise. But it was from 2000 onwards that AI and alternative data enabled even greater enrichment of decision-making, with companies like Taktile, LendAPI, Gyra+, and Alloy accelerating this progress with even faster and more personalized analyses.

By integrating machine learning directly into decision-making, Taktile allowed companies to use an ML Ops platform or connect their own tools, such as AWS Sagemaker, Azure ML Studio, or Google Vertex AI, turning data into more accurate decisions.

For the financial sector, the platform became an ideal tool for offering flexibility and control, helping to optimize small business credit or create new financial products. The advantage was in testing different strategies in real time, using transactional and behavioral data, which allowed for quick adaptation to market needs.

In 2023 and 2024, the company solidified this positioning, enhancing its visual identity with a branding update. The predominant blue would represent the experience gained in the years since its founding in 2020.

It's interesting to note the different clients the company has gained over time. In 2021, brands like NRW Bank, Google Cloud, and Branch were highlighted on its website. The following year, they were joined by Munich RE, Moss, Rhino, and Troy. By 2025, Allianz, Mercury, Kueski, Zilch, and Jeeves had also joined the client list. In other words, the company focused on the financial sector, earning the trust of major banks, insurers, and fintechs that make decisions based on its infrastructure.

In 2022, the company grew its revenue by more than 300% and began driving over 250,000 decisions every day. The growth rate confirmed that the initial thesis, although somewhat broader, was correct: data drives decisions, and the financial industry needed this.

If you're enjoying this edition, share it with a friend. This will help spread the message and allow me to keep offering quality content for free.

Today, Taktile's solutions are based on two main areas: B2B, focusing on flows for credit underwriting, onboarding, KYB, and transaction monitoring; and B2C, using the same flows but geared toward fintechs and institutions focused on the end consumer. Since 2022, the product has evolved significantly, including the ability to co-create models in real time, allowing teams to share insights and optimize flows together. Just as the company's initial strategy was to enrich algorithms with data from CRM, ERP, and other sources, today the platform features a vast library of pre-built integrations with external providers like Belvo, Serasa, and Plaid, enabling the addition of new risk signals with just one click.

Similar to what Zapier built in terms of automation, Taktile allows data collection from various sources and the creation of rules for processing and decision-making. This automation connects systems from different origins and integrates AI and third-party applications to expand its capabilities, ensuring decisions are made faster, more accurately, and based on up-to-date and precise data. The platform also allows professionals to carry out operational tasks directly on it, such as in collections, where they can send SMS or emails to debtors, further simplifying the management and communication process.

Taktile in practice

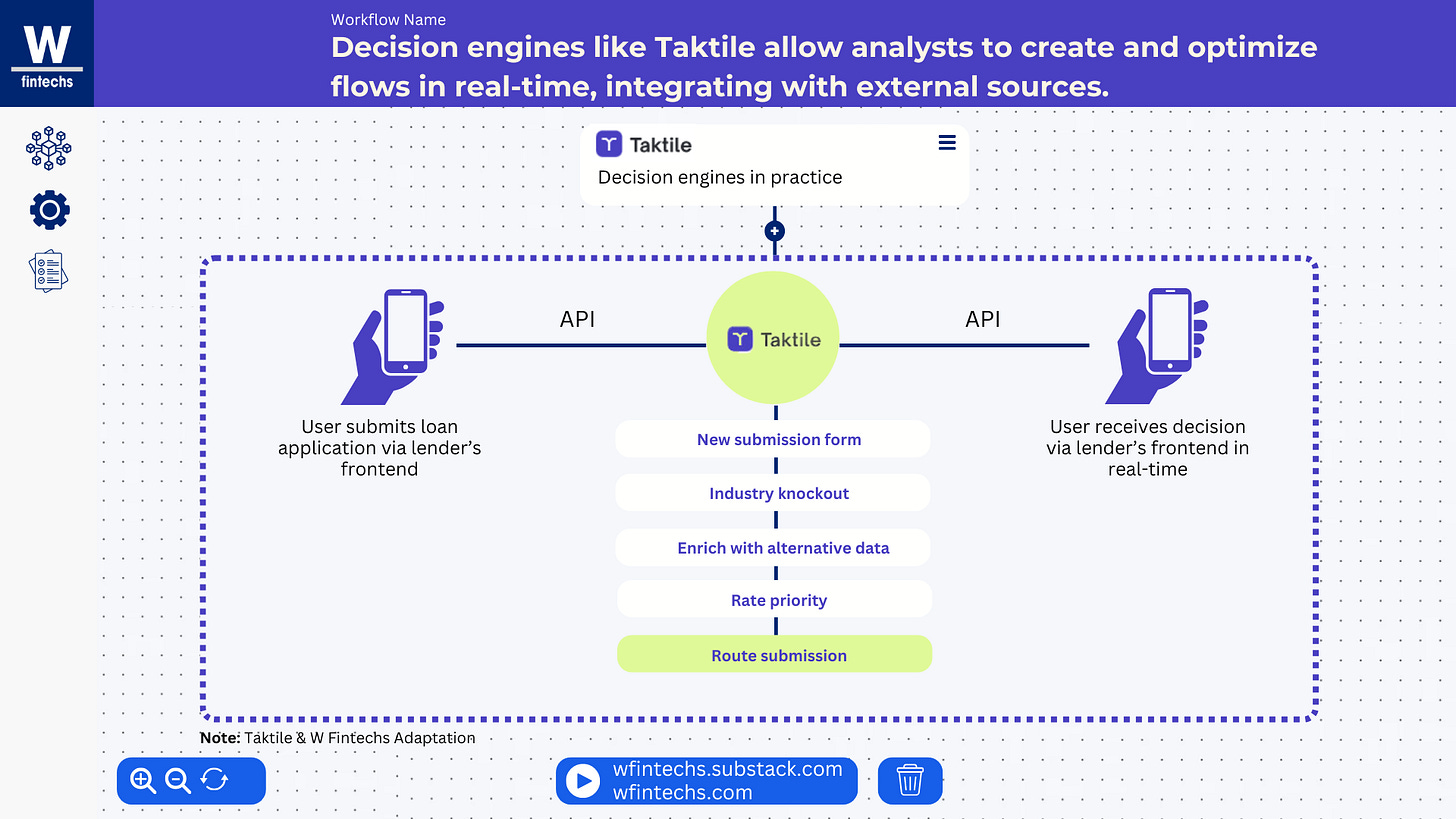

In practice, decision engines like Taktile adopt Interactive Decision Design, enabling analysts and managers without a technical background to create, test, and optimize decision flows in real time.

Taktile and some of its competitors are changing the game by combining deterministic behavior, probabilistic behavior, and artificial intelligence with integrations of alternative data.

This can be seen in practice with the case of Zippi, a Brazilian fintech supporting microentrepreneurs, which managed to accelerate the implementation of new credit and fraud rules by 67%, drastically reducing the time between testing and production 6. Taktile played a key role in consolidating Zippi's risk infrastructure, unifying all analyses into a single platform. This reduced latency and enabled real-time decisions, even during peak demand periods. The impact was direct on the customer experience, which now receives faster and more personalized responses.

Strategy and Expansion

Taktile adopts a communication strategy similar to Zapier's, with a blog that covers everything from the impact of its product on clients to highlighting fintechs that could be disruptive in the coming years. For example, the list of the 50 fintechs to watch in Brazil not only brings the company closer to potential clients but also creates significant network effects among those mentioned.

To further strengthen its market position and build closer ties with fintechs and banks, the company brought in Jason Mikula, in 2024, a fintech industry reference known for his newsletter "Fintech Business Weekly," which has over 50,000 subscribers.

Taktile exemplifies how vision and mission can remain the same, but along the way, different ways of achieving them can be found. The company's initial mission was indeed to help financial institutions make better use of their data. The big lesson here lies in the ability to adjust the strategy as the market evolves, specializing where there was greater demand. The founders' experience, combined with market needs, were factors that contributed to the company's growth, which raised over $20 million in 2022.

An overview of the players

Considering other decision engine players, it is evident that much of the new generation also explores artificial intelligence, alternative data, and a no-code interface. LendAPI, for example, started vertically, beginning its journey in 2024 with a clear mission: to facilitate the creation of financial products for institutions.

Looking at LendAPI's evolution, it's interesting to see how its business model and strategy have adapted over time. The company initially offered a free version to attract users, allowing them to test the platform with all the essential features, including an advanced decision engine. The goal was to collect feedback while users grew with the platform7. Over time, LendAPI created paid versions, starting with the Starter edition, followed by Pro and Enterprise editions, offering more functionality and customization to serve both small and large market players.

From there, LendAPI adjusted its pricing to reflect the platform's evolution, offering plans like Launch for $3999 with 3000 applications, up to Scale for $8999 with 12,000 applications and advanced features like A/B testing and Back Testing.

With this strategy, the company processed over 10 million banking applications in 20248. Other companies are also specializing in a specific market need.

For example, Alloy has automations focused on credit, but also concentrated on offering regulatory compliance features. Its main advantage lies in the ability to ensure that onboarding and transaction processes comply with KYC and AML requirements, using a security-centered approach and integration with multiple data providers.

Taktile, on the other hand, has relied on artificial intelligence from the start, with the aim of offering personalized financial decisions and highly adaptable workflows. The Brazilian company Gyra+ started as a small business credit fintech in 2017, but now it aims to become a SaaS platform for credit decisions. It has already executed over 700,000 workflows and analyzed over 10 billion limits, serving companies like iFood and Banco Mercantil.

Meanwhile, the Mexican company Moffin is also an iPaaS platform offering data integration and client screening solutions for credit analysis. By using multiple data sources, the platform enables identity validation and financial risk assessment. With simplified access through REST APIs or no-code forms, it serves industries ranging from pharmaceuticals to financial institutions in Mexico.

👉 Subscribe to W Fintechs and receive an analysis like this in your inbox every Monday.

The future of automation, decision-making, and integration in fintech

What is clear is that, in a world where data is multiplying and integrations are expanding, banks and fintechs will need to master not only the art of workflow but also decision engineering and orchestration.

Whether it’s the case of Zapier, which is losing ground to more verticalized solutions, or Taktile, which, through machine learning, optimized and personalized workflows, and alternative data, is transforming the way credit is granted and collected, one thing is certain: all these players act as ecosystem orchestrators. The ability to orchestrate processes and make automated decisions with agility will be the key differentiator for fintechs and banks in the coming years. In an increasingly collaborative and open financial world, where different data sources and service providers connect, system orchestration will become even more relevant.

If you know anyone who would like to receive this e-mail or who is fascinated by the possibilities of financial innovation, I’d really appreciate you forwarding this email their way!

Until the next!

Walter Pereira

Disclaimer: The opinions expressed here are solely the responsibility of the author, Walter Pereira, and do not necessarily reflect the views of the sponsors, partners, or clients of W Fintechs.

https://blog.groovehq.com/zapier-interview-with-wade-foster#how-zapier-leveraged-seo-to-catch-new-users

https://www.verifiedmarketresearch.com/product/integration-platform-as-a-service-ipaas-market/

https://www.grandviewresearch.com/industry-analysis/hyperautomation-market-report

https://www.okta.com/businesses-at-work/2021/

https://medium.com/gigaom/how-many-apps-do-people-use-f29bdbbd3baa

https://www.taktile.com/articles/zippi-and-taktile

https://substack.com/home/post/p-137395503

https://www.lendapi.com/blog/10-million-applications-and-counting-lendapi-accelerates-banking-innovation?utm_source=chatgpt.com