#144: The super app strategy and Mercado Pago: turning a one-time customer into an ecosystem customer

W FINTECHS NEWSLETTER #144

👀 Portuguese Version 👉 here

👉 W Fintechs is a newsletter focused on financial innovation. Every Monday, at 8:21 a.m. (Brasília time), you will receive an in-depth analysis in your email.

Recently, Mercado Libre released its latest results. Between 2024 and 2025, the company delivered remarkable performance. Net revenue jumped from US$ 4.3 billion to US$ 5.9 billion, a 37% year-over-year increase. Operating income rose from US$ 558 million to US$ 763 million, while net income climbed from US$ 345 million to US$ 494 million. This growth was driven primarily by greater operational efficiency and accelerated revenues from advertising and logistics.

Mercado Pago, in turn, posted even faster growth: total payment volume (TPV) soared from US$ 40.7 billion to US$ 58.3 billion (+43% YoY), with 64 million monthly active users and strong growth in acquiring TPV (+32% YoY) and total processed transactions (+38% YoY). These figures reinforce the strength of the company’s ecosystem model, which continues to position itself as the leading digital platform in Latin America. That’s why I’m resharing an edition I wrote a few months ago for W Fintechs.

As the competitive landscape intensifies — driven by new entrants and regulatory changes — players are being forced to rethink their strategies. In edition #123 (link 👉here), I wrote about how core banking is undergoing a transformation, especially with the rise of open-source technologies, as many players now seek greater flexibility over their ledger. Gaining control over the ledger has become essential to owning the revenue model, particularly in a context where some new regulations are eroding traditional revenue streams — such as the end of P2P transaction fees and caps on overdraft charges.

In other words, it’s time to look for new sources of revenue. Incumbents still hold an advantage that challengers are working to build: data. The idea is that the more data you have, the better you can anticipate your customer's behavior — at least in theory.

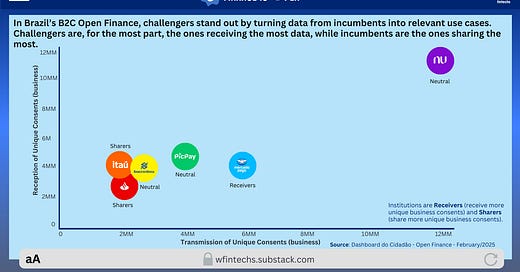

But data alone doesn’t solve everything. Among incumbents, some players are still in the early stages of becoming truly data-driven. In the context of Brazil’s B2C-focused Open Finance, it’s largely the challengers who are receiving the most data — while the incumbents are the ones sharing the most.

In the last edition of FinOpen (link 👉here), I highlighted how banks and fintechs are competing for territory in B2B Open Finance. While over 30% of the banked population already shares data under the B2C model, only 1.5% of businesses do the same. The strategies also differ — challengers are more active in the B2C space, while in B2B, players are testing different theses.

It makes sense that large banks would have a bigger appetite for B2B. Their quarterly results show that credit portfolios for this segment are more robust than those in B2C — BRL 461.1 billion at Banco do Brasil and BRL 662.2 billion at Itaú as of December 2024.

What I keep thinking is: if Nubank built a $50 billion business by focusing almost exclusively on B2C in its early days, it’s reasonable to assume there’s still a lot of untapped potential in B2B. The opportunities are there, but the challenges are different — more complex.

In today’s edition, I’ll explore how some players are expanding their reach in B2C to serve different moments in their customers’ lives. Nubank and Itaú are going head-to-head. Itaú, with the highest profits in the financial sector — over $6 billion — has decided to unify the digital experience in its main app by integrating its digital wallet, iti, into the bank’s core app. The focus now is to become a super app. It’s a move that seems to echo the path Nubank chose years ago — adding services and deepening customer relationships.

This move by Itaú and Nubank may very well be a smart way to increase average revenue per active user and customer lifetime value (LTV). But I don’t believe it’s the only path. Readers will quickly realize that with a super app strategy, the ambition is to become the central hub to a customer’s financial and digital life. Even so, when we look at the current level of integration, there are still many gaps to be filled.

How do super apps emerge?

When we look at the global distribution of super apps, it’s clear that this model first gained real traction in Asia and Eastern Europe — especially in emerging markets. That growth was fueled by a convergence of three key factors that supported the model at the time: unmet social needs, structural limitations common to developing countries, and technological advances that drastically reduced the cost of digital access.

The first generation of these companies reflected this reality. In regions with poor physical infrastructure and fragmented services, bundling multiple solutions into a single app wasn’t just convenient — it was a smart way to deal with scarcity and tight margins. Super apps became the main way to essential services: financial, logistical, social, and even governmental.

A central driver of super app development was mobile-first technology. Unlike countries where digital inclusion happened gradually via computers, in emerging markets the digital leap was straight to smartphones. With cheaper mobile and more affordable mobile data, it became possible to reach millions of people in record time. It’s no coincidence that in many African countries, mobile money was adopted by telecom providers as a way to leverage their network infrastructure to promote financial inclusion.

These multifunctional apps evolved from already-established services. WeChat, for example, began as a messaging app and later added payments, social networking, service bookings, and e-commerce. The key was frequency and relevance of user interaction. An app used several times a day for one specific purpose had a greater chance of expanding into other services — especially if it could remove friction in a simple, seamless way.

Another essential piece in building a super app was integration with the financial system. Adding payment solutions turned these apps into transaction platforms, which boosted user loyalty and deepened dependency on the ecosystem. Over time, these platforms started offering credit, insurance, investments — and eventually became full-fledged ecosystems.

The growth strategy behind super apps differs from that of traditional Silicon Valley apps. Rather than pursuing immediate vertical or global expansion, super apps grew horizontally, focusing on dominating their local market before diversifying their service portfolio.

Although super apps emerged in countries with generally unfavorable economic conditions, that variable actually contributed to their success. In developing nations, purchasing power tends to be relatively low — India, for instance, had a nominal GDP per capita of $2,099.60 in 2019, compared to $65,297.52 in the U.S. In this context, individual spending is limited, making it unlikely that a single service alone could generate enough return or sustain competitive advantage.

To survive, many apps had to offer multiple services, gradually evolving into full ecosystems. What becomes clear in the strategies of super apps is that each user is no longer just a one-time customer — but instead represents an entire market, with multiple journeys unfolding within a single platform.

The strategy of Latin American players

The first time I addressed this topic here, back in 2021, I imagined that the super app model would face more challenges when scaling to other countries — especially developed ones.

Take PayPal’s strategy in the U.S. over the past four years, for example. At the time, I saw it as not very promising. But today, seeing how major players are now putting significant effort into this model, I realize my perspective was limited by the references I was using. WeChat and Alibaba managed to establish themselves in China, often with government support. Kaspi in Kazakhstan — which I wrote about in 2021 (link 👉here) — also benefited from government backing for its expansion, and now has over 14 million monthly active users, representing more than 70% of the country’s population. Even so, I believe we’ll still see the rise of more specialized super apps, preferred by users for specific needs.

While many banks and fintechs are aiming to become the central hub of their customers’ financial and digital lives — as I mentioned above — I believe those that master specific segments in depth, and know how to leverage data effectively, stand a good chance of capturing a significant share of the market.

In Latin America, we’re already starting to see various moves in this direction. Several players are exploring this model, such as Rappi in Colombia and Brazil, Mexico’s Oxxo proximity store network, and Ualá in Argentina.

But today, I want to focus on the strategies of two players in particular: Mercado Pago and Inter.

Mercado Pago

Every super app starts with an initial trigger. That’s the path the major Chinese players followed: Alibaba started in e-commerce, WeChat began as a messaging app — and from there, they expanded to cover many aspects of users’ lives.

Although Mercado Pago was originally created within Mercado Libre as a payment solution for e-commerce, it now functions as a POS system, digital bank, card issuer, credit processor, and connects e-commerce, brick-and-mortar retail, and financial services into a single ecosystem.

Mercado Pago started as a payment solution and evolved into a full-fledged payment infrastructure. I find this model interesting because it closely resembles what Klarna has built in North America and Europe.

The strategy of combining e-commerce with financial services has created an ecosystem with operational synergies that reinforce the business model. On the Mercado Libre side, in 2024, the marketplace’s GMV reached $14.5 billion, driven by 525.5 million items sold 1.

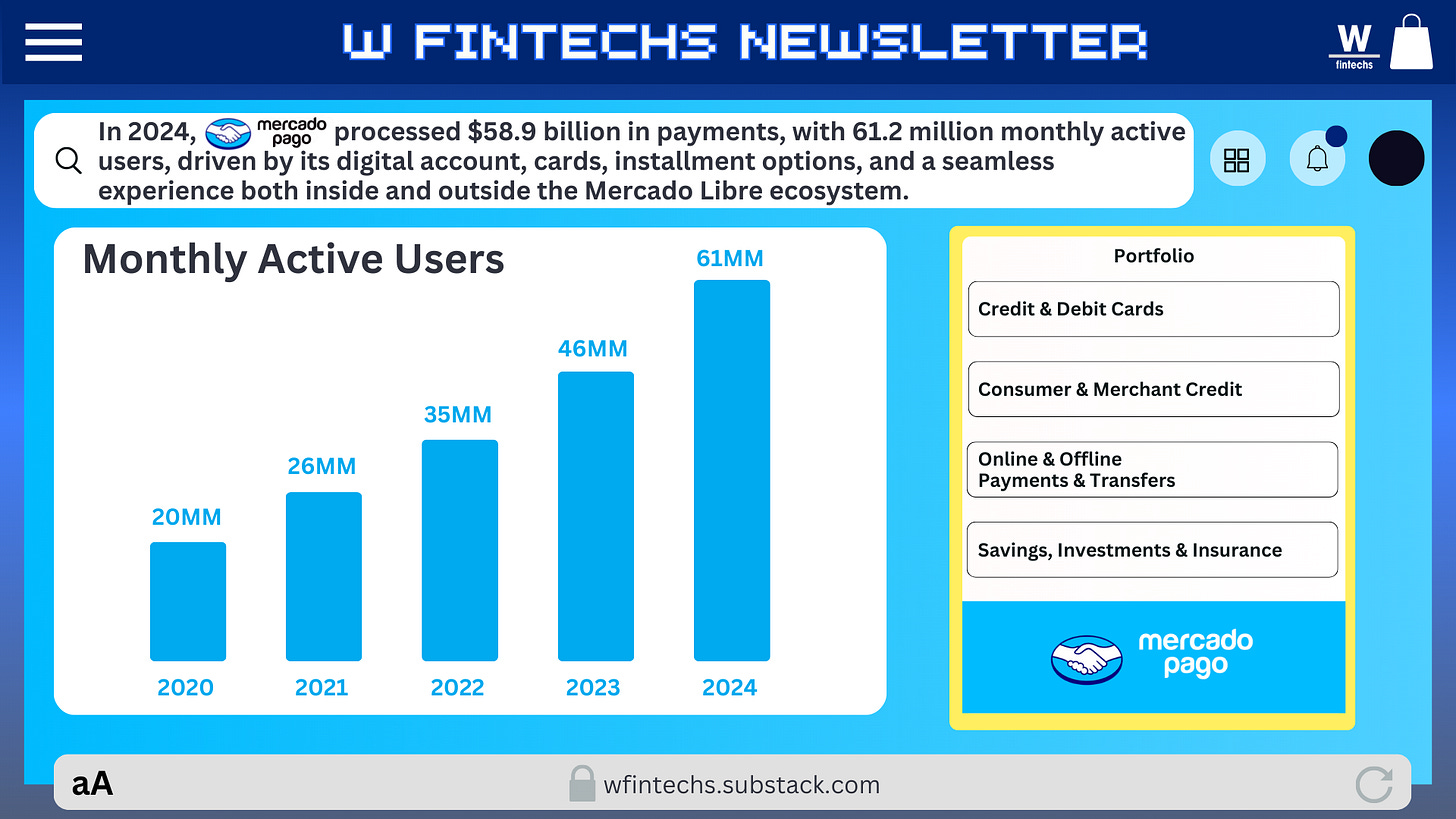

Beyond its marketplace core, Mercado Pago processed $58.9 billion in payments in 2024, supported by a base of 61.2 million monthly active users. Its broad value proposition is showing results and is built around a digital account with competitive yields, card issuance, installment payments, and an integrated experience for both consumers and merchants — inside and outside the Mercado Libre ecosystem.

Credit has also become a key vertical for the business. Mercado Pago reached 30 million credit users and ended 2024 with a total portfolio of $7.97 billion, with credit cards now making up the largest portion of that portfolio.

An interesting point is that the company is now betting on growing by upgrading the sophistication of its portfolio. The strategy, known as a move upmarket, focuses on attracting higher-value customers with more profitable contracts — likely boosting earnings within this vertical.

Looking specifically at the Brazilian arm, which represents a significant part of the business, the credit portfolio reached BRL 4.2 billion as of June 2024, with nearly 80% allocated to credit cards and personal loans 2. Since 2020, the credit division has been authorized by the Central Bank of Brazil, which means the company can now both issue credit and raise funds in the market through the issuance of bonds and deposits.

The credit sector in Brazil is extremely concentrated and expensive. Mercado Pago has positioned itself as a player aiming to democratize access to credit, leveraging its own ecosystem to offer more inclusive and personalized products — a strategy similar to what we’ve seen from Oxxo and Klarna.

One thing that became clear as I studied the company is that it holds a true competitive advantage over banks and fintechs. Its positioning as a super app feels like a natural evolution — an intentional move to cover multiple touchpoints in both the merchant’s and the consumer’s journey.

Inter

Inter’s strategy is also interesting for a specific reason: the bank evolved from a traditional structure — founded in 1994 — into a true service hub. Unlike Nubank, which started as a Payment Institution (IP) with a narrower scope focused solely on payment services, Inter already held a broader banking license, classified as S2 by the Central Bank of Brazil, mainly because it was originally focused on payroll loans and real estate financing.

This license gave Inter access to a wider range of financial products when it began its digital transformation in 2015. I remember that back in 2019 and 2020, when I started following the company more closely, the investment vertical was one of its main differentiators. Today, it’s just one of many products and services that make up its broader ecosystem.

This broadening of Inter’s scope — starting with credit and expanding into investments, insurance, foreign exchange, and even content — has translated into consistent results: in 2024, Inter reported a net profit of BRL 973 million and gross revenue of BRL 10 billion.

Annualized TPV reached an impressive BRL 1.5 trillion, supported by a customer base of over 36 million users, around 11 million of whom are active on its marketplace vertical, Inter Shopping.

The super app logic becomes clear when you look at the company’s diversified revenue streams. In 2024, net revenue from the marketplace reached BRL 1.47 billion, and GMV hit BRL 6.4 billion. This channel already represents a significant portion of the value generated per customer and reinforces Inter’s positioning as a complete ecosystem — not just for financial transactions, but also for shopping and loyalty.

One of the main drivers behind this monetization is Loop, the loyalty program that integrates with various verticals on the platform. Over 9.8 billion points were redeemed in 2024, encouraging engagement and cross-sell across the ecosystem. This integrated experience led to an average revenue per active customer (ARPAC) of BRL 20.60 per month.

In Inter’s model, the marketplace serves as a strategic bridge within the super app: it not only strengthens customer retention on the platform but also boosts app usage frequency. In 2024, the insurance vertical sold over 5.4 million policies, and assets under management surpassed BRL 19 billion. The drive for revenue diversification has materialized in practice through a strategy that combines vertical integration, data intelligence, and international expansion — with nearly 4 million global customers already on board.

If you're enjoying this edition, share it with a friend. This will help spread the message and allow me to keep offering quality content for free.

The battle between Nubank and Itaú

I believe the ecosystems of Mercado Libre and Inter set the stage for us to explore the cases of Nubank and Itaú. That’s because Mercado Libre started as a pure e-commerce player and later expanded into financial services, while Inter began as a credit-focused bank and gradually broadened its offerings until it became a full-fledged super app — and managed to turn that into tangible results. These are very different paths, but both show how the super app strategy goes beyond the world of banks and fintechs, as seen with Mercado Libre, and can lead to meaningful financial gains, as it did with Inter.

Inter was founded in 1994 and reinvented itself in 2015 — it took more than two decades to make that digital leap. Now imagine Itaú, a bank with over 100 years of history, which began its long transformation journey with key milestones in the 1980s, 2000s, and more recently in 2015. Comparing the journeys of Inter, Nubank, and even Mercado Libre to that of Itaú isn’t always fair — especially since Itaú operates with a broader range of banking licenses, allowing it to cover a much wider array of financial products.

That said, I’ll focus solely on analyzing the bank’s digital strategy over the past few years.

Itaú

Optimizing its digital transformation process is what gave Itaú the agility it needed to innovate in a market as dynamic as the financial sector in recent years. The bank’s Q4 2020 institutional presentation clearly illustrates this shift. That year, Itaú was already managing 70 petabytes of data — a level of data diversity that allowed the bank to increase the value generated by analytics-based projects by more than 600% 3.

The launch of iti, its digital wallet introduced in 2019, was one of the bank’s key strategic initiatives to attract new customers in a fully digital environment. Initially aimed at the unbanked population, it has since evolved to become a complementary arm to Itaú’s core offering.

The bank’s bet on unifying the customer experience was branded “One Itaú”, which migrated over 5.3 million clients in 2024 to a new technological and operational foundation, with plans to reach 15 million by 2025.

Itaú combined traditional banking features with a broader range of services — such as investments (via Íon), credit, insurance, and even an integrated shopping experience (Itaú Shop) — bringing everything together into a single digital journey.

When compared to the fintechs mentioned earlier, Itaú’s financial figures are massive, simply because its business is far more diversified. Still, the impact of its digital transformation can be seen in key financial indicators, such as its 2024 recurring managerial profit of BRL 41.4 billion. The bank’s credit portfolio is also enormous, reaching BRL 1.359 trillion 4.

Nubank

On Nubank’s side, its strategy to become a super app has started to show clearer results — both in terms of customer engagement and revenue diversification. With over 1 million people actively shopping through its marketplace, and the launch of products like NuViagens and NuCel (which was the topic of last week’s edition link 👉 here), the company is betting on convenience, building a diversified ecosystem, and smart use of data to drive greater user loyalty and monetization.

These effects can be seen in its ARPAC, which reached $10.7 per month, with more mature customer cohorts hitting $25. The average number of products per active customer also jumped to 4.1, reinforcing the super app strategy as a path to retention and monetization. Even with an active user base of nearly 95 million people, Nubank has kept its cost to serve per customer at just $0.80/month, which highlights its strong operational efficiency.

One aspect I find particularly interesting in Nubank’s strategy is how the company has adapted to Brazilian regulations — using each new regulatory milestone as a springboard to expand its business model.

Initially, it obtained a Payment Institution (IP) license, which allowed it to operate as a card issuer and offer digital accounts. Later, it secured a Direct Credit Society (SCD) license, enabling it to scale its credit portfolio using its own capital — without relying on partner banks.

👉 Subscribe to W Fintechs and receive an analysis like this in your inbox every Monday.

The long road to the “ecosystem consumer”

The idea of a “whole-market consumer” is one of the most fascinating aspects of the super app model, in my view. It’s essentially about transforming a one-time user into an ecosystem consumer. The first time I wrote about this, back in 2021, I came to this conclusion: developing economies would be better positioned to create and advance this model — partly out of necessity, partly because of the convenience it offers and the push to monopolize user attention.

What I didn’t foresee was that the competitive dynamics in the years that followed would lead this model to spread beyond just low- and middle-income countries. Other players with the same goal — to monopolize user attention and, more importantly, increase app usage time, recurrence, loyalty, and average revenue per user — began to explore it as well.

Today, I see that this model is far from exclusive to developing countries. It has already become a key part of the strategy for banks and fintechs in different markets. Comparing the examples I’ve mentioned, it’s clear that regulation plays an important role in shaping a marketplace: the broader the regulatory license, the greater the ability to offer a variety of products. But I believe the aggregation factor will be even more decisive.

Open Finance points in that direction: offer aggregation lies at the heart of the thesis behind a truly open ecosystem — though we’re still far from seeing that fully materialize. For many reasons: whether it's the learning curve, as many institutions are still early in their Open Finance journey, or the fact that in Brazil, the use of this infrastructure has so far been more focused on payments. This contrasts with what happened in the UK, for example, where data usage became one of the main use cases — perhaps because the data aggregator role was explicitly outlined in Open Banking regulations, which helped drive adoption.

Once again, I believe we’ll see the rise of specialist super apps, preferred by users for specific needs. Whether any platform will become the main hub to users’ digital and financial lives — I’m not so sure that’s going to happen anytime soon. I think we’ll see many super apps in Latin America that are excellent at solving specific problems, and then go on to cross-sell other products. But I could be wrong — models like Kaspi, WeChat, and Tinkoff, which reach more than half of their countries' populations, don’t seem easily replicable here.

Maybe that could change with government support, but I don’t consider that a highly relevant factor (even if it’s common in the region), given that local regulators tend to focus more on promoting competition and financial inclusion rather than consolidating dominant platforms.

The super app is increasingly being used as a strategy to turn one-time consumers into ecosystem consumers. We're still far from seeing a definitive winner — and maybe that’s not even necessary.

If you know anyone who would like to receive this e-mail or who is fascinated by the possibilities of financial innovation, I’d really appreciate you forwarding this email their way!

Until the next!

Walter Pereira

Disclaimer: The opinions expressed here are solely the responsibility of the author, Walter Pereira, and do not necessarily reflect the views of the sponsors, partners, or clients of W Fintechs.

https://investor.mercadolibre.com/results-and-financials

https://http2.mlstatic.com/frontend-assets/bacen-landings/demonstracao_financeira_IFB_062024_final.pdf

https://www.itau.com.br/download-file/v2/d/42787847-4cf6-4461-94a5-40ed237dca33/d35a2891-861b-4624-a06a-5b371e6e77e0?origin=1

https://www.itau.com.br/download-file/v2/d/42787847-4cf6-4461-94a5-40ed237dca33/e80da43f-c4a7-be01-811c-890e516ce293?origin=2