#FinOpen: The Open Finance paradox: Businesses segment dominate bank balance sheets, yet remain largely untapped. Who’s taking the lead?; Use cases

W FINTECHS NEWSLETTER #134

👀 Portuguese Version 👉 here

👉 W Fintechs is a newsletter focused on financial innovation. Every Monday, at 8:21 a.m. (Brasília time), you will receive an in-depth analysis in your email.

Welcome to the edition of the Finance is Open series.

Every other Wednesday, in addition to the traditional Monday editions, I will cover key topics and the latest updates on what's happening in Open Finance, both in Brazil and around the world.

Finance is Open is sponsored by

Iniciador is the complete infrastructure platform specialized in Regulated Open Finance, enabling Payment Initiation and Data Access.

The solution removes technology and compliance concerns, allowing clients — with their own regulatory license or using Iniciador’s — to focus on new products and business growth.

💡 Want to advertise in the W Fintechs Newsletter?

Reach a niche audience of founders, investors, and regulators who read an in-depth analysis of the financial innovation market every Monday. Click 👉here

I’m evaluating whether the updates from the working groups have actually been useful for you. If you'd like me to continue with this section — or if you have suggestions on how it could be improved — feel free to message me on LinkedIn or reply to this email.

In the first edition of FinOpen, I wrote that Open Finance is a true cooperative jungle, where each player depends on the effort of others to keep moving forward. This dynamic balance has already earned a name in the literature: coopetition — the fusion of cooperation and competition.

Each institution is focused on strengthening its own strategy within Open Finance. However, it’s the collective work that truly drives the ecosystem’s evolution. It may sound like a fairy tale, but fortunately, it’s entirely true. Still, competition remains fierce, and many players have been leveraging the tools available (data) within the rules of the game to stand out in the market.

Open Finance is reshaping how institutions handle customer data. Fintechs like Nubank and Mercado Pago are making strides in the retail (B2C) segment, while traditional banks are crafting their own strategies — some doubling down on Open Finance initiatives, others developing ecosystems, particularly aimed at businesses (B2B).

Some banks have formed strategic partnerships with tech companies to strengthen their positioning — such as Itaú’s partnership with Omie, which led to the launch of “Itaú Meu Negócio Gestão by Omie,” offering integrated solutions for SMEs. In the Open Finance context, the relationship between businesses and financial institutions comes with unique challenges: while individual consumers can switch between banks and fintechs relatively easily, businesses face a more complex transition that requires adapting their entire financial infrastructure. This creates a stronger retention in their banking relationships — at least for now.

To attract more business clients, Mercado Pago has been offering a range of services such as invoice factoring and credit, fully integrated into its ecosystem.

On the cooperative side, Sicredi, for example, has been using Open Finance data to reassess credit limits and offer more personalized financing. The institution has already granted over R$507 million in credit and increased card limits by R$184.9 million through data sharing 1 — showing that Open Finance can deliver direct economic benefits to its members. In 2024 alone, Sicredi generated R$ 25.5 billion in value for its 8.5 million members2.

Among the major banks, Banco do Brasil has stood out since the early days of Open Finance in Brazil. In the business segment, its credit portfolio grew by 18% in 2024, reaching R$472 billion 3. Since 2023, the bank has been building a corporate hub offering centralized receivables management and working capital automation.

Its standout innovation is the Painel PJ, a dashboard that integrates data from multiple institutions and uses generative AI to issue alerts and recommendations. The platform already serves a potential market of 2.8 million businesses.

What’s particularly interesting here is the contrast in Open Finance adoption speed. In the individual (B2C) segment, there are already over 40 million unique consents. In the business (B2B) world, however, only 1.5% of Brazilian companies have shared their data — a number that clearly shows how much untapped potential remains in this space.

Part of the explanation lies in the difficulty companies face in extracting immediate value from existing solutions, combined with a lack of practical familiarity with what Open Finance can actually solve. We may be looking at a classic chicken-and-egg dilemma: businesses aren’t adopting because they don’t yet see practical value — and they don’t see value because the players are still building the very products and use cases that could prove it.

Traditional banks, which have historically held a firm grip on their customers' financial data, are now being forced to rethink their strategies to stay competitive in this new landscape. This strategic reconfiguration is reflected in the chart below (based on data from February 14, 2025). While Santander and Mercado Pago lead in receiving business data consents, institutions like Banco do Brasil and Itaú still operate with relatively modest volumes in both receiving and sharing data. Despite holding significant credit portfolios in the business segment — R$ 461.1 billion at Banco do Brasil and R$ 662.2 billion at Itaú Unibanco as of December 2024 — their Open Finance efforts in the B2B space are still maturing.

However, this lag in full Open Finance adoption doesn’t mean there’s no movement. In this context, competitiveness goes beyond just collecting data. Some institutions are investing in dynamic credit models, integrated financial management platforms, and more seamless payment flows — all of which show that the race for relevance in the business segment is just beginning.

In this early phase of Open Finance for businesses, the use cases I’ve been seeing are less about launching entirely new things and more about making what’s already available actually work. Banks, fintechs, and platforms are focused on connecting systems, redesigning workflows, and removing operational friction.

It’s less visible work, but essential for making Open Finance part of businesses’ everyday operations. The shift lies in how these pieces are being fitted together to handle long-standing tasks — with less effort and in less time.

If you're enjoying this edition, share it with a friend. It will help spread the word and allow me to keep providing quality content for free.

Contribution

I'm creating a use case mapping, divided into data and payments, with an interactive dashboard. I’ve already mapped out some cases, but before the official launch (expected at the end of March), I want to enrich the mapping even further.

If you'd like to include your institution’s use case, just send me a message by replying to this email or via LinkedIn (link 👉 here). And if you're a fintech without its own license, don’t worry—we want you involved too!

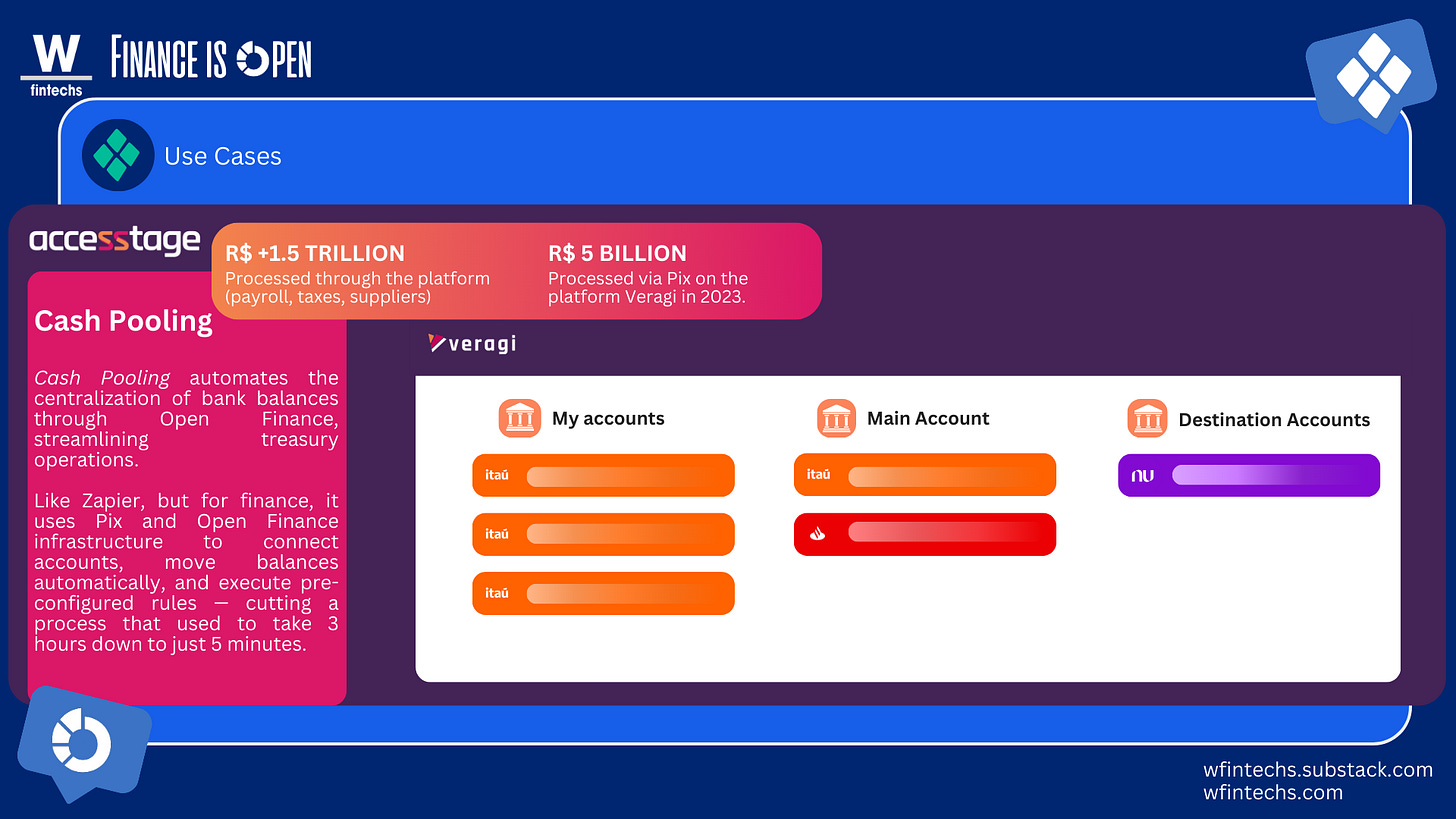

Many business-oriented use cases in Open Finance are centered around two main pillars: aggregating information from multiple bank accounts and increasing operational fluidity. One of the most widely explored benefits by market players is the automation of financial processes. A practical example is Accesstage’s Cash Pooling solution, which enables the automatic centralization of bank balances from different accounts belonging to the same company.

Authorized by the Central Bank to operate as a Payment Initiation Service Provider (PISP) since November 2024, the solution connects to multiple banks to execute scheduled transfers based on parameters predefined by the user.

The flow begins when the user selects which accounts will be monitored and designates a central account. From there, the platform retrieves available balances from the satellite accounts and transfers the funds to the main account. The operation is automated and runs periodically, using the Open Finance infrastructure and the Pix system to facilitate the transfers. The system adheres to the configured rules and limits, allowing for better financial management of resources spread across multiple banks.

This automation replaces processes that previously required time-consuming, manual interaction with multiple banking systems — reducing the time needed to consolidate balances and move funds from around 3 hours a day to just 5 minutes. With balance consolidation, companies gain a clearer view of their cash position and can make real-time, data-driven decisions while reducing exposure to common operational errors in manual treasury routines.

More integrations, more data

In edition #126, I did a deep dive into how, in an increasingly integrated market — with growing volumes of data — workflows are becoming even more relevant. A new generation of companies is emerging, focused on decision engines and automation, inspired by the success of tools like Zapier. Check out the full edition below 👇

Report Open Finance 2024 - Portuguese

Lets Media has released an in-depth report on Open Finance in Brazil, exploring the landscape beyond traditional banking and showcasing a variety of use cases. Check it out by clicking👉here.

If you know anyone who would like to receive this e-mail or who is fascinated by the possibilities of financial innovation, I’d really appreciate you forwarding this email their way!

Until the next!

Walter Pereira

Disclaimer: The opinions expressed here are solely the responsibility of the author, Walter Pereira, and do not necessarily reflect the views of the sponsors, partners, or clients of W Fintechs.

https://www.sicredi.com.br/site/blog/open-finance/open-finance-revolucao-financeira/

https://www.sicredi.com.br/coop/univales/noticias/cooperativismo/beneficios-economicos-do-sicredi-para-associados-atingem-a-marca-de-r-255-bilhoes-em-2024/

https://ri.bb.com.br/servicos-para-investidores/downloads/