#FintechFrames: The bet of BVNK on building the next generation of financial infrastructure with stablecoins

W FINTECHS NEWSLETTER #163

👀 Portuguese Version 👉 here

Fintech Frames — Edition #04

Fintech Frames is a series by the W Fintechs Newsletter highlighting the journeys and strategies of fintech companies that have established themselves in the market — whether through an IPO, acquisition, or a valuation exceeding USD 10 billion.

Other editions Fintech Frames

For those looking for stories of founders still in the early stages, 3W in Fintechs dives into the beginnings of many ventures. Click 👉 here to explore all editions.

👉 W Fintechs is a newsletter focused on financial innovation. Every Monday, at 8:21 a.m. (Brasília time), you will receive an in-depth analysis in your email.

The history of international money transfer companies usually revolves around the same problem: high fees, slow transaction completion, high costs imposed by intermediary banks, and a fragmented experience for both senders and receivers. Behind this dynamic lies an old infrastructure designed for a world where time was measured in business days and money was a message that needed to pass through several intermediaries before reaching its destination.

Wise, for example, emerged by leveraging the infrastructure of instant settlement systems in each country, creating a bridge between different national infrastructures and banking networks. Circle, on the other hand, saw in blockchain an opportunity to transform money into a kind of internet protocol, reducing friction between the traditional market and the digital world. Both reinterpreted the same problem but through different paths, one within the system itself, the other in its adjacencies.

BVNK is born from this crossroads. What caught my attention the most when studying the company’s business model was how it managed to bring together the most efficient aspects of each model and, from there, proposed something more ambitious by turning settlement itself into infrastructure. Founded in 2021, BVNK has grown at an accelerated pace in recent years, processing over USD 20 billion in projected annual volume, with more than 25 regulatory licenses and a valuation close to USD 800 million.

One of the biggest challenges for enterprise adoption of stablecoins has always been the dependence on fragmented custodians and providers, which makes integration slow and unreliable. BVNK was created precisely to solve this limitation by building a universal settlement layer that connects currencies, institutions, and networks in real time. Instead of merely building payment rails, it turned the settlement process into infrastructure, allowing money to flow with the same predictability as information circulates on the internet.

The company operates at this point of convergence between banks, fintechs, and Web3 protocols, offering an API that abstracts all the complexity of custody, compliance, and different networks. The experience remains institutional, but the pillars are decentralized, meaning companies still operate within a regulated environment, with KYC, AML, and traditional banking standards, yet all value movement occurs over a blockchain-based infrastructure that enables instant liquidity, greater transparency, and improved interoperability across networks without relying on intermediaries.

Unlike Circle, which used stablecoins to create a new digital asset and build a money protocol on blockchains, BVNK does not aim to create a new currency but to redesign how existing currencies move. Its thesis is that the next leap in the financial system will not come from new products but from a new operational layer capable of integrating institutions, networks, and different assets in real time. This vision translates into the proposal of being a kind of “Stripe for crypto,” offering an API that abstracts the heavy lifting of on-ramp and off-ramp between fiat and crypto, as well as enabling fiat-to-fiat, crypto-to-fiat, and vice versa transactions.

At the core of this structure is a global system that moves and settles payments between parties using stablecoins. It connects to major blockchain networks and makes money function similarly to information on the internet, uniting the traditional financial system with the digital world.

In this edition, I will analyze the thesis behind BVNK, its architecture, the logic of stablecoins as infrastructure, what differentiates it from other players in the market, and why a possible acquisition by Coinbase or Mastercard could mark the beginning of a new phase in building the next generation of global settlement. BVNK has already raised USD 50 million in a Series B round, reaching a valuation close to USD 750 million, and it is estimated that a sale could occur for a value between USD 1.5 billion and USD 2.5 billion.

The origin of BVNK’s thesis

The story of BVNK begins with its founders already immersed in the world of payments and crypto. Jesse Hemson-Struthers, Donald Jackson, and Chris Harmse, before creating BVNK, had co-founded Coindirect, a payment platform that used stablecoins to move value between emerging and more mature markets. When they realized that Coindirect’s model required too many detours between fiat and crypto, they saw a greater opportunity to create infrastructure capable of eliminating those manual bridges and making the process more direct as well as efficient and scalable.

The birth of what would become BVNK’s thesis took place in 2021. Shortly before that, the founders had already left their positions at Coindirect to reposition the operation with a more ambitious and global scope. At that time, the world of payments was at a turning point. Fintechs were multiplying banking integrations, traditional banks were facing competition and regulatory changes, and international settlement mechanisms were still operating with old and slow structures, although some players were already trying to streamline these operations and national payment infrastructures were being implemented around the world. BVNK’s proposal emerged from this contrast, focusing on not being a niche service but, above all, on being born as a new layer capable of redesigning global settlement.

At the core of the company’s business model was the recognition of a regulatory and structural gap. Banks were not prepared to offer efficient, transparent, and adaptable routes across jurisdictions. The cross-border banking system remained dependent on correspondents and manual reconciliations. In this context, space opened up for more agile and technically sophisticated digital intermediaries. BVNK set out to fill this void by offering settlement infrastructure for this new financial cycle that was emerging.

The foundational insight came from the realization that stablecoins did not need to be treated as speculative assets but as a global settlement layer. If properly backed and integrated into compliance and treasury systems, they could serve as a secure foundation for transfers between fiat currencies, with immediate liquidity and institutional predictability. BVNK understood that it was not enough to move value between systems, but rather it was necessary to move the system itself, which meant creating a common base where different currencies, institutions, and technologies could communicate more fluently.

The founders also understood that the fragmentation between banks, fintechs, and Web3 protocols was both a barrier and an opportunity. Each ecosystem advanced in isolation: banks with their regulatory requirements, fintechs with more agility in execution, and blockchain networks with liquidity and decentralization. BVNK’s mission then became to build universal rails that would connect these worlds, allowing an institution to operate with stablecoins without having to deal directly with crypto complexity.

This vision is reflected in the very journey of stablecoin adoption, which began with traditional payments for crypto companies and evolved into a broader ecosystem in which digital wallets allow users to send, receive, and convert stable currencies with the same ease as a banking transaction. In this scenario, BVNK not only built a bridge between the traditional financial system and the digital universe but also designed the path for both to operate within the same global flow.

One interesting thing about the company’s story is that just as SWIFT emerged to standardize global interbank communication, BVNK’s intention to standardize digital settlement is quite clear. While SWIFT standardized messages, BVNK sought to create a common protocol for transfers between currencies and networks, replacing workarounds and manual integrations with a unified and programmable infrastructure.

The architecture of BVNK

The way BVNK designed its architecture reveals its ambition to transform settlement into a universal financial infrastructure. The company built a layer that combines fiat accounts, stablecoins, and APIs in a single experience, where the boundaries between traditional and digital no longer exist. This integration allows corporate clients to move money with the same fluidity between fiat and digital currencies, eliminating the operational frictions that have historically separated these two worlds. Instead of treating crypto and fiat as distinct spheres, BVNK unifies them in a continuous settlement circuit, where stablecoins are the link that ensures predictability, traceability, and speed.

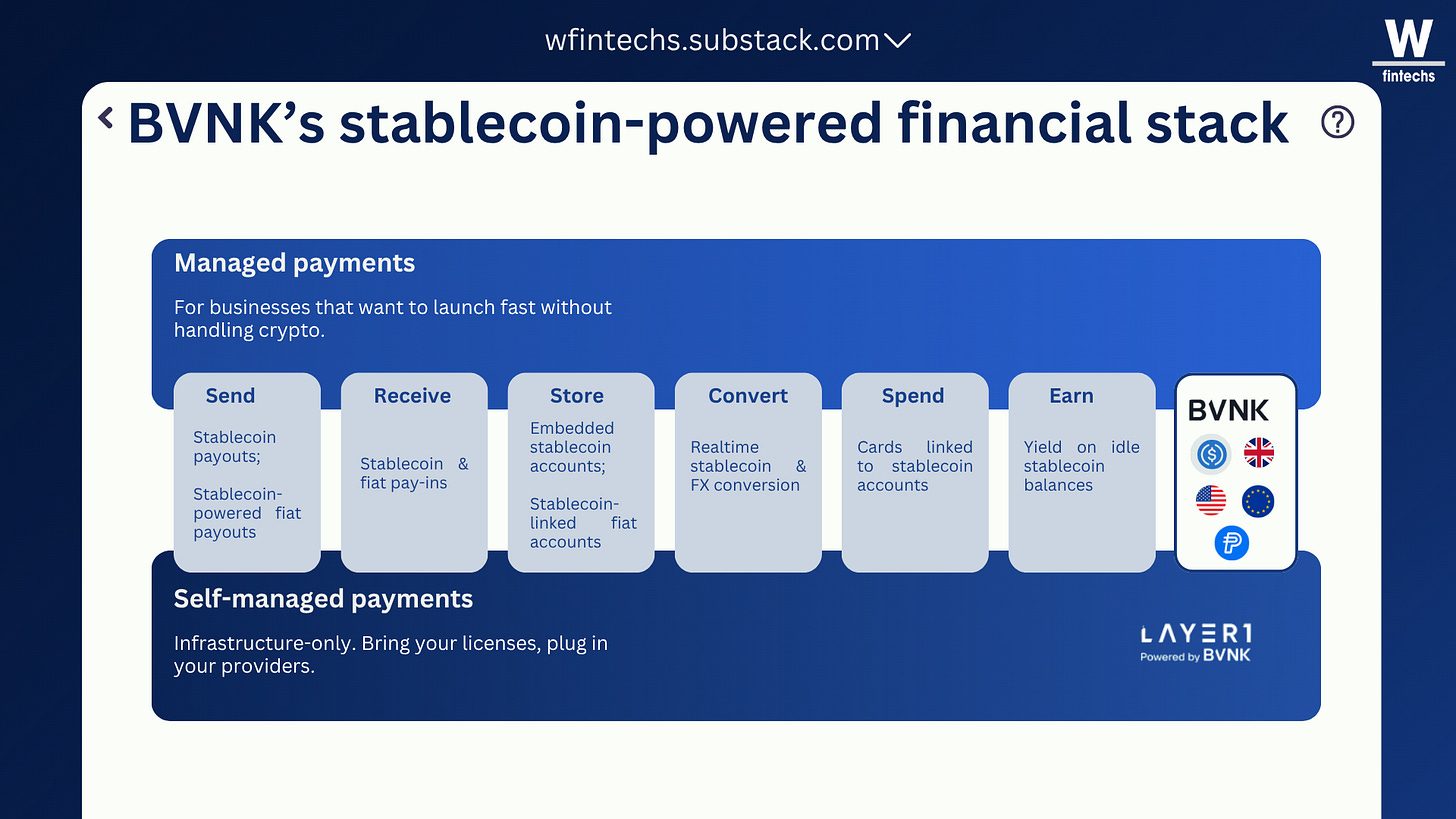

BVNK’s financial stack is structured around six functions — send, receive, store, convert, spend, and yield — which integrate fiat and digital flows into a single API. In this model, the company assumes all technical and regulatory complexity, allowing businesses to operate globally and move stablecoins without having to deal directly with crypto. The self-managed module operates more independently, providing only the infrastructure for companies that already have their own licenses and want to connect their own providers.

BVNK acts as a settlement layer between banks, fintechs, and Web3 protocols, allowing the coexistence of stablecoin and fiat balances within the same environment. The multi-ledger architecture operates across networks such as Ethereum, Solana, and Stellar, maintaining value parity between them and turning blockchain diversity into greater operational efficiency. Regardless of the network used, the user always transacts based on a stable value, which transforms the diversity of networks into a competitive advantage rather than an obstacle.

This fluidity is only possible because BVNK has built an ecosystem of banking partners, e-money institutions, and licensed custodians. These entities support the platform’s fiat layer, enabling on/off-ramps and conversion between stablecoins and traditional currencies. The company acts as the orchestrator of this system, connecting liquidity providers, regional banks, and crypto networks into a single settlement logic, an infrastructure where compliance and innovation can naturally coexist.

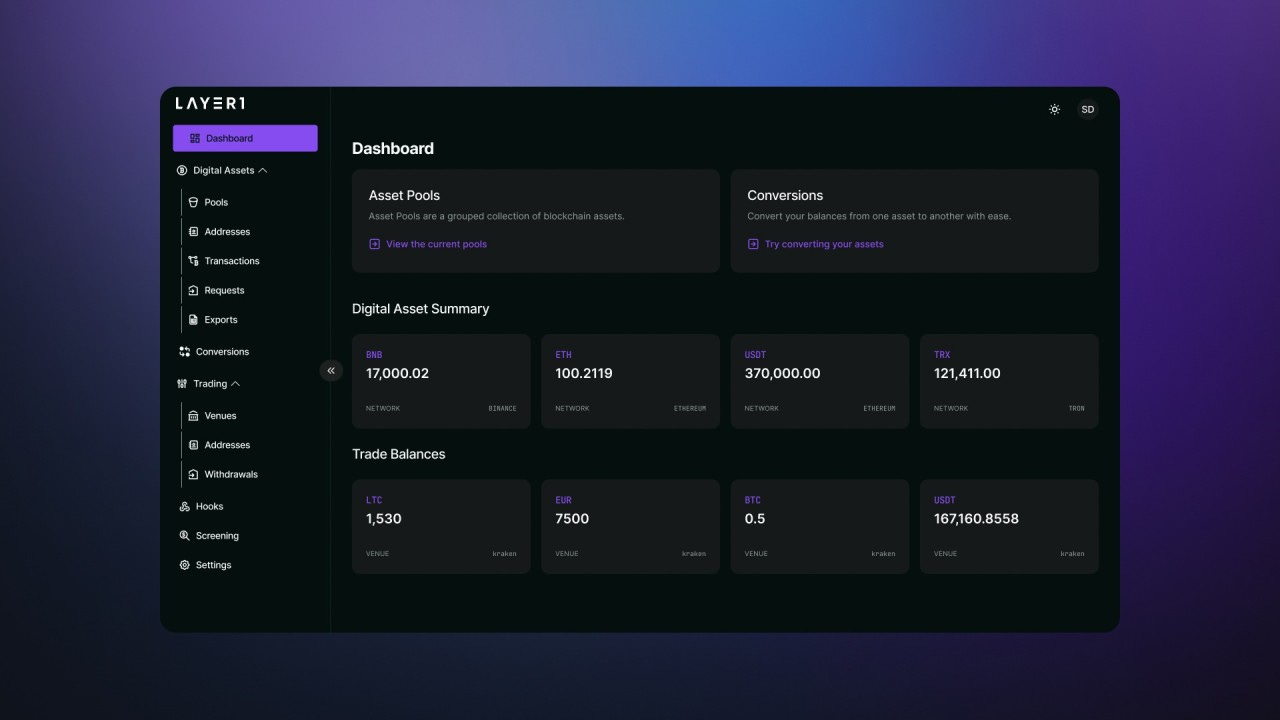

Layer1 is the operational core of BVNK, where custody, conversion, FX, and compliance are centralized in a single layer, allowing companies to integrate their financial flows with less friction.

The API is, in fact, the central axis of this architecture, because it is through it that an operation which previously required multiple intermediaries now becomes a simple and integrated experience. In a short time, a corporate client can send or receive international payments, convert currencies in real time, or incorporate BVNK’s infrastructure into its own system.

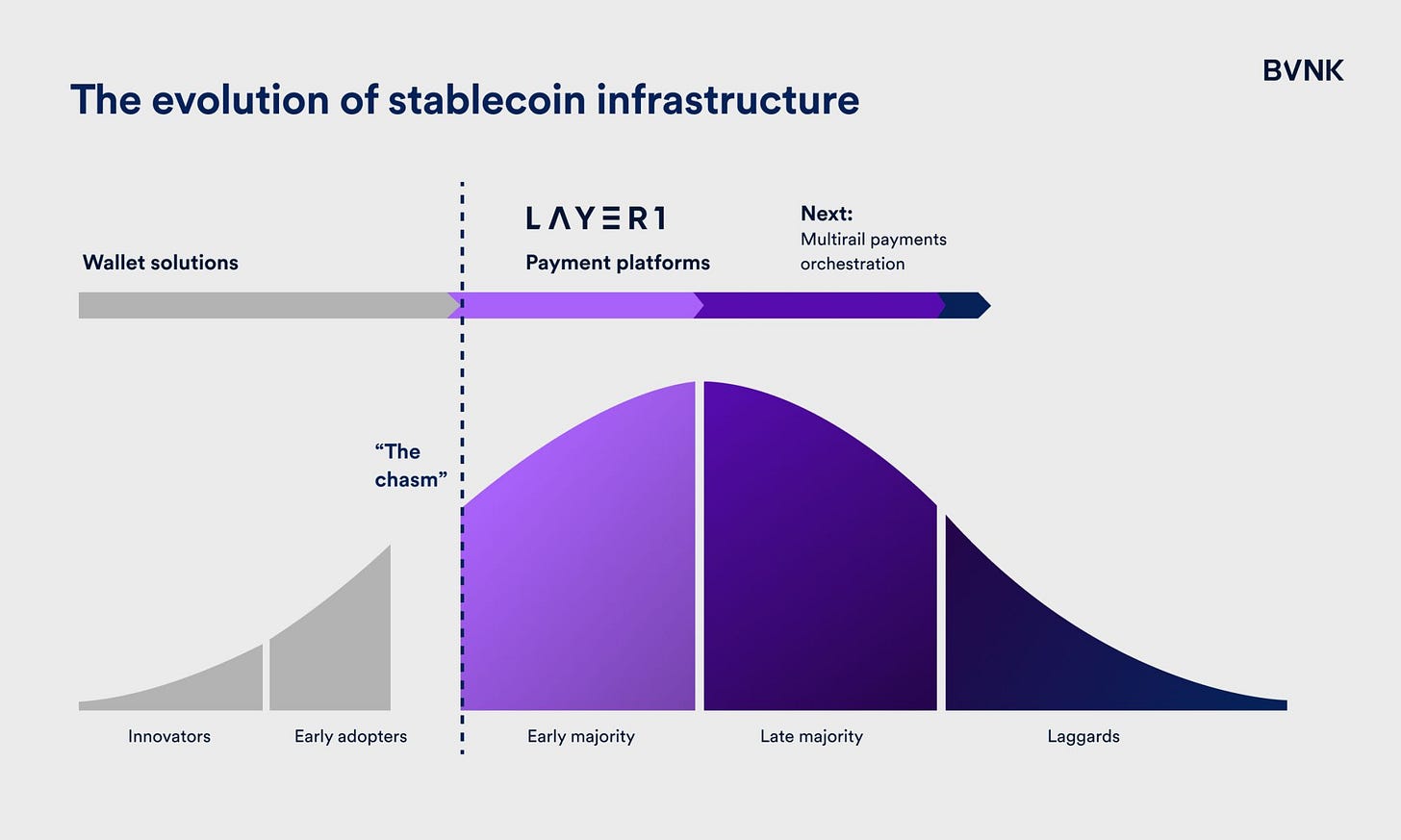

This evolution also reflects the trajectory of stablecoin infrastructure itself. The market has moved from the wallet solutions phase to the payment platforms phase, where BVNK and Layer1 position themselves as the inflection point between early adopters and the early majority. The next step is the orchestration of multirail payments, where stablecoins, fiat, and other means coexist within a single intelligent routing system. It is the beginning of a new layer of infrastructure that connects global liquidity, regional networks, and legacy systems into a single continuous flow of value.

It is precisely in this integration that BVNK builds its value capture mechanism. Each operation initiated via API feeds one of the three loops that sustain the company’s economic model: the Liquidity Loop, the FX Loop, and the Network Loop. The more clients maintain balances in stablecoins, the greater the internal liquidity and yield on assets. Each conversion between currencies generates spreads and fees that strengthen the FX Loop, while each new B2B integration expands the network effect and recurring revenue of the Network Loop. The architecture and the business model thus become part of the same circular system, where technology enables the flow and the flow itself feeds the expansion of the infrastructure.

If you’re enjoying this edition, share it with a friend. It will help spread the message and allow me to keep providing high-quality content for free.

BVNK’s positioning to be the infrastructure of the future

The strategic contrast between BVNK and other players becomes clear as we understand the purpose and positioning of the main actors in the cross-border market. While companies such as CurrencyCloud, Circle, and Ripple built their solutions from a single type of rail — whether fiat or blockchain — BVNK was born as an integration layer between these two worlds. Its business model was not designed to replace banks or crypto networks but to connect them within a single operational infrastructure, with licenses, compliance, and liquidity under one API.

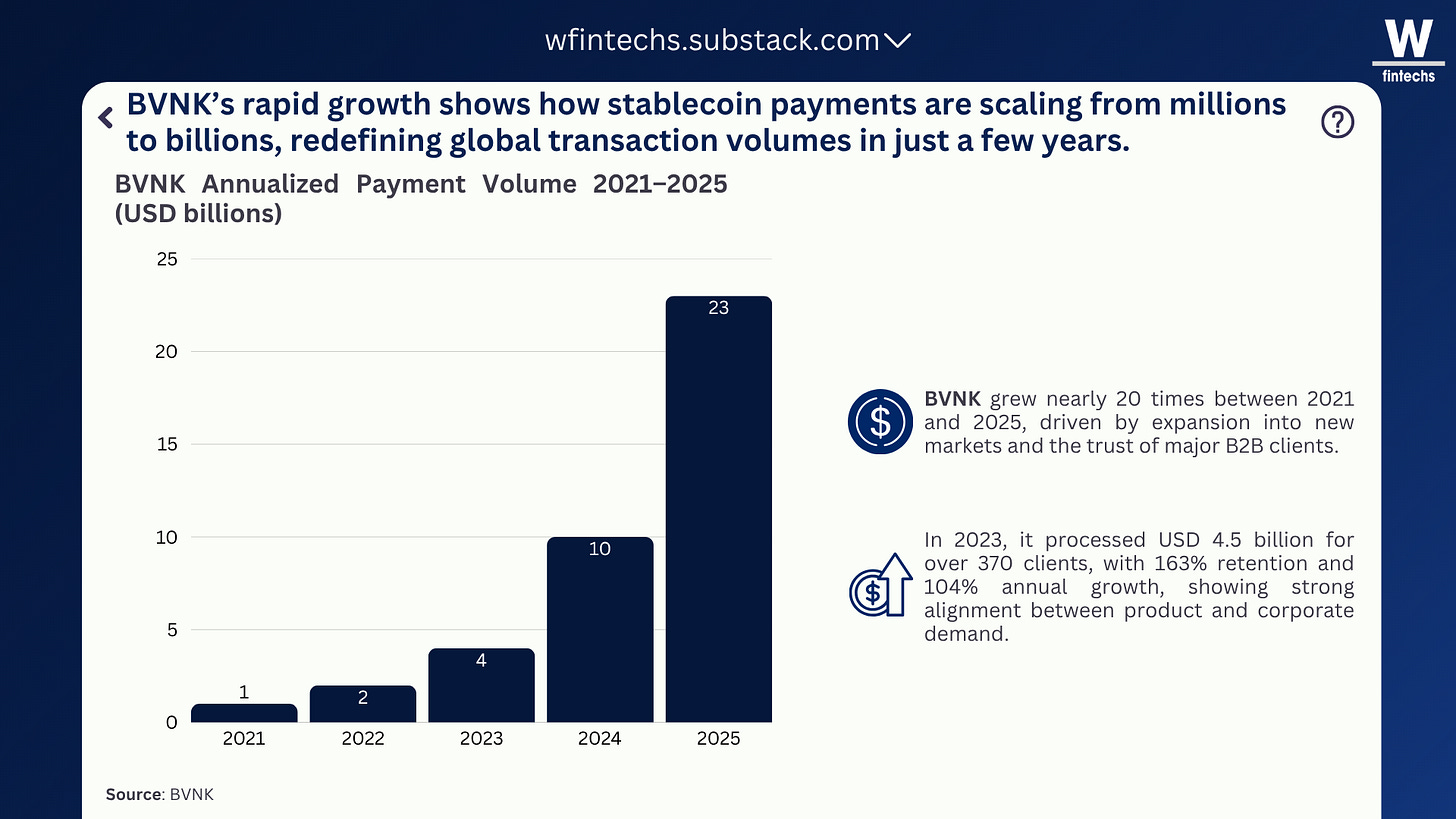

In recent years, this positioning has been reflected in the numbers, especially in payment volume. The company’s growth was nearly twentyfold between 2021 and 2025, driven by expansion into new markets and the trust of large B2B clients. In 2023, BVNK processed USD 4.5 billion for more than 370 clients, with a 163% retention rate and 104% annual growth. In other words, they managed not only to achieve commercial traction but also to find a clear product-market fit among companies that needed to transact between fiat and digital currencies.

The differentiator seems to lie in the combination of regulated infrastructure and rail agnosticism. While CurrencyCloud still relies on traditional banking integrations and Circle focuses solely on its own stablecoin, BVNK works directly with issuers such as Paxos-Paypal, responsible for PYUSD, and with Circle itself for USDC. This structure allows BVNK to create and convert stablecoins in a controlled manner, backed by fiat currencies such as the dollar, euro, and pound, ensuring transaction transparency and reducing the need for intermediaries.

Another advantage is the regulatory structure. BVNK holds several licenses and registrations worldwide, including authorization as an electronic money institution in the United Kingdom (EMI), registration as a VASP in Spain, and MSB status in the United States. This combination is rare among companies that operate simultaneously with fiat and crypto and creates a regulatory moat that makes it difficult for competitors to replicate the model. It is a strategy that reminds me of Wise, which also turned its international banking licenses into a competitive advantage for global scaling.

Finally, BVNK maintains its focus strictly on B2B. Unlike Coinbase or Bitpanda, which serve both consumers and businesses, it has concentrated its efforts in recent years on becoming corporate infrastructure, powering platforms such as dLocal, Equiti, Entain, and XM Global. This specialization clearly reduces conflicts of interest and positions the company as a neutral provider within the global payments ecosystem. This logic supports the “settlement as a service” thesis, which is at the core of BVNK’s model. Just as Stripe simplified payments for developers, BVNK aims to simplify settlement between currencies and assets.

The competition then becomes about the base settlement layer, where the future of global financial traffic is decided. BVNK understood this by positioning itself as the financial backbone of this new phase. It is clear that for the company, settlement is a service and that every payment, conversion, or transfer must go through a network as reliable as the banking system and as fast as the blockchain.

If you know anyone who would like to receive this e-mail or who is fascinated by the possibilities of financial innovation, I’d really appreciate you forwarding this email their way!

Until the next!

Walter Pereira

Disclaimer: The opinions expressed here are solely the responsibility of the author, Walter Pereira, and do not necessarily reflect the views of the sponsors, partners, or clients of W Fintechs.