#FintechFrames: Circle’s ambition to create a “Money Protocol” with Stablecoins: cheaper, faster, and more efficient

W FINTECHS NEWSLETTER #147

👀 Portuguese Version 👉 here

Fintech Frames — Edition #03

Fintech Frames is a series by the W Fintechs Newsletter highlighting the journeys and strategies of fintech companies that have established themselves in the market — whether through an IPO, acquisition, or a valuation exceeding USD 10 billion.

Other editions Fintech Frames

For those looking for stories of founders still in the early stages, 3W in Fintechs dives into the beginnings of many ventures. Click 👉 here to explore all editions.

👉 W Fintechs is a newsletter focused on financial innovation. Every Monday, at 8:21 a.m. (Brasília time), you will receive an in-depth analysis in your email.

For centuries, trust in money was anchored in tangible elements: precious metals, royal seals, notes signed by central authorities. Gold was a scarce asset and, for that reason, a symbol of stability. Then came central banks, banking systems, and government bonds. All operated under a similar logic: to inspire trust in something abstract through solid institutions and strict rules. Value was preserved because someone — an institution, a set of rules, or a trusted person — guaranteed it.

But in the 21st century, that logic began to reverse. Trust no longer came only from central authorities but emerged from distributed, auditable, and programmable architectures. Code moved to the center of operations. Smart contracts, immutable ledgers, and open APIs began to shape a new way of believing in value: not just because of who issues it, but because of how it operates. And in this context, Circle emerged as a new kind of alchemist: not converting metals into gold, but converting a set of algorithms into stability.

USDC, its native stablecoin, also depends on trust, but each unit is backed, audited, transparent, and above all, accessible by any application. Trust, in this case, is not granted, but verified. And that’s what makes Circle’s proposal so powerful: it doesn’t replace central banks, but offers a new monetary logic for a world that operates in real time — where money needs to be as fast, auditable, and interoperable as the data flowing through the internet.

The founders’ obsession with Open Protocols

Behind Circle’s story lies an obsession from its founders — one that was fundamental and helps explain what the company is doing in the market today. Long before the blockchain hype, Jeremy Allaire was already advocating for an open and programmable internet. In the 1990s, he founded Allaire Corporation, which created ColdFusion, a language that made it easier to build web applications. Later, he launched Brightcove, one of the first online video platforms, and played an active role in the W3C (World Wide Web Consortium), championing open standards like HTML5 over proprietary formats. But behind each of these initiatives was a deeper conviction: that open protocols would shape the future.

It was with this mindset that, in 2013, he founded Circle alongside Sean Neville. At the time, Bitcoin was just beginning to draw attention, but the market was still dominated by ideological narratives, fragile solutions, and unfriendly interfaces for end users. Allaire saw cryptocurrencies not as a revolution against the financial system, but as an opportunity to rebuild it based on auditable, accessible, and interoperable code. Circle’s first bet was to take advantage of that moment and launch a Bitcoin wallet — an attempt to give a usable form to the idea of digital money. But it quickly became clear that the mission was larger than simply storing or transferring assets.

Allaire’s ambition was to turn money into an internet protocol, just as HTTP transformed content and SMTP transformed email — and that would require more than cryptocurrencies, which are often highly volatile. To gain traction and the trust of the market, it would require stability, regulatory trust, and integration with the traditional financial system. That’s when the seed of USDC was planted.

The thesis behind USDC

The launch of USDC in 2018 marked the beginning of a deliberate attempt to create a digital asset reliable enough to operate at the core of the global economy — not just at its margins or for speculative purposes. The project was born out of a partnership between Circle and Coinbase, two of the most recognized companies in the crypto ecosystem, and was structured under the governance of the Centre Consortium — an entity created specifically to ensure transparency, compliance, and interoperability from day one1.

The goal was to build a digital dollar that could circulate on any blockchain, without losing sight of the standards required by the traditional financial system. In other words, to bridge the crypto market with the traditional financial system.

Unlike Tether (USDT), which, although widely used, has always been surrounded by doubts regarding the solidity of its reserves and governance, USDC was designed from the outset to be 100% backed by U.S. dollar reserves and U.S. Treasury securities, with regular audits and public reports. The aim was to create a digital currency that inspired the same level of trust as a regulated bank, without relying on closed or opaque structures. USDC, therefore, positioned itself not as a speculative instrument, but as a new form of liquidity — more predictable and traceable.

Interoperability was another pillar of the thesis. From the early days, USDC was designed to operate seamlessly and reliably across multiple blockchains (Ethereum, Solana, Avalanche, Arbitrum, Base, Polygon, and others). This made it a fundamental component for payment applications, DeFi, gaming, corporate treasury, and international transfers. Its architecture was designed to enable any financial application, digital wallet, or company to integrate it.

But perhaps the most strategic aspect of the thesis is its regulatory compliance. Instead of taking a confrontational stance with monetary authorities, Circle chose the opposite path: seeking proximity, dialogue, and alignment with regulatory bodies. This gave USDC a significant competitive advantage because while other tokens “asked for permission” after already being in operation, USDC entered markets with a license, adopting a discourse of responsibility and institutional security from day one.

This approach led to USDC being used by banks, fintechs, publicly traded companies, and even governments, and made USDC an auditable monetary layer that connects the fiat world to the on-chain world, becoming a fundamental step in making digital money as trustworthy as any traditional banking system — only infinitely faster, more open, and programmable.

Circle's Business Model

Although USDC is Circle's most visible asset, the company goes far beyond stablecoin issuance — it is also the issuer of EURC, the Euro version. Behind the token is a full financial infrastructure designed to truly integrate the traditional banking world with the crypto universe.

Circle positions itself as an infrastructure company, offering a range of financial APIs for payments, treasury, and digital custody, enabling banks, fintechs, and marketplaces to operate with crypto assets in a transparent and regulated manner. In recent years, the company has expanded this offering with products such as digital wallets with advanced security (MPC), which split access keys across multiple parties to reduce theft risk; ready-to-use smart contracts that allow for asset tokenization without writing code from scratch; and CCTP, a protocol that enables USDC to move across different blockchains quickly, securely, and programmatically.

Among Circle’s main products are Circle Payments (for accepting crypto payments), Circle Accounts (a business account to manage digital assets), and Circle Payouts (for making global payments in multiple currencies and stablecoins). These APIs are the commercial engine of Circle: the company makes money when its clients move larger volumes, use more sophisticated services, or integrate the infrastructure more deeply. It's as if Circle provides the “infra” layer of the new financial system, without requiring the end user to understand what’s happening behind the scenes. With the launch of Paymaster, for example, companies can automatically cover blockchain transaction costs (the so-called “gas fees”), allowing users to pay everything in USDC, without needing to worry about coins like Ethereum or Polygon — greatly simplifying the experience for those unfamiliar with the crypto world.

Another strategic component of the model is the infrastructure for crypto-to-fiat conversion — the so-called on-ramps and off-ramps. Circle facilitates the entry and exit of businesses and individuals into the crypto ecosystem, directly connecting digital wallets, bank accounts, and blockchains. This bridge enables the company’s stablecoins to be used practically and securely by both developers and traditional companies.

Moreover, one of Circle’s main sources of revenue comes from the yield on USDC reserves, which are primarily invested in U.S. Treasury securities and bank deposits with partner institutions. This model allows the company to generate predictable passive income, without relying solely on fees from APIs and other products. As USDC grows in circulation, the reserves increase — and so does the financial return.

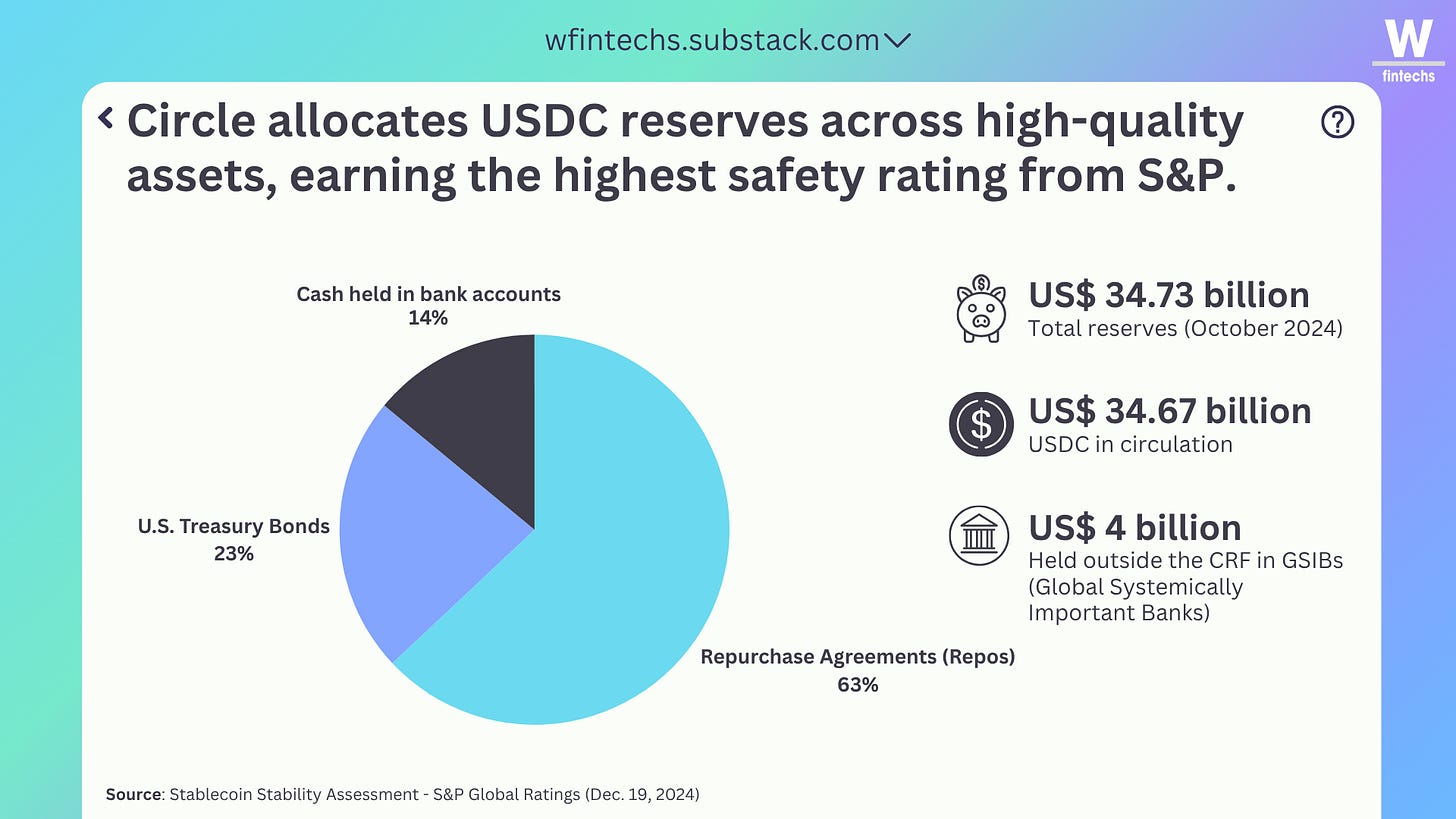

According to a report by S&P Global Ratings (Dec. 2024)2, Circle’s reserves received the highest possible rating (1 – “very strong”) in asset quality. In October 2024, the fair value of the reserves stood at USD 34.73 billion, compared to USD 34.67 billion in USDC in circulation. The composition of these assets included 23% in U.S. Treasuries, 63% in repurchase agreements (repos), and 14% in cash, with the majority allocated to the Circle Reserve Fund (CRF), a SEC-registered fund managed by BlackRock. This liquidity structure is reinforced by an average maturity of just 13 days for the CRF assets, which provides stability and a rapid response to redemptions, allowing Circle to capture financial yield with low risk and high predictability, while maintaining USDC’s peg to the dollar.

In addition, the management of Circle’s reserves undergoes monthly independent audits conducted by Deloitte & Touche LLP. Of the total reserves, approximately USD 4 billion were held outside the CRF fund, in regulated banks identified as Global Systemically Important Banks (GSIBs), for liquidity management purposes. Since the events of March 2023, when part of the funds was held in the collapsed Silicon Valley Bank, Circle has strengthened its diversification policy, prioritizing institutions with high credit ratings.

The company has also adapted to the European MiCA regulation by maintaining specific reserves in France for clients of Circle Mint — the platform used by businesses to issue and redeem large volumes of USDC and EURC, with near-instant settlement and direct connection to banks. Under the regulation, at least 60% of these reserves must be held in local bank accounts. This structure has reinforced the governance and resilience of its stablecoins in the face of external volatility.

If you're enjoying this edition, share it with a friend. This will help spread the message and allow me to keep offering quality content for free.

Circle as global infrastructure

The Circle Payments Network (CPN) marked another milestone in the company’s mission to modernize global financial infrastructure by offering a digital, scalable, and interoperable alternative to the legacy systems that underpin the flow of money across borders.

Today, payment infrastructures remain tied to pre-internet-era protocols — such as SWIFT and ACH — which impose high costs, long settlement times, and multiple intermediaries. In 2024, for example, sending USD 200 internationally cost an average of 6.65%, according to the World Bank, and a single international transfer could exceed USD 50 per transaction.

Based on its stablecoins like USDC and EURC, CPN proposes a new payment protocol that connects financial institutions around the world. Instead of moving funds directly, CPN acts as a coordination protocol between institutions, orchestrating global payments efficiently and transparently. Its design principles are aimed at overcoming the historical barriers of international settlement, bringing the logic of the internet to the world of payments.

One of the things that stood out to me while writing about Wise was realizing how the company managed to build an efficient payment network by enabling multi-currency accounts and near-instant transfers, with reduced FX spreads in strategic corridors. But achieving that required real-time payment (RTP) infrastructure on both ends, making the real challenge navigating complex and fragmented regulatory environments across multiple jurisdictions.

In Circle’s case, the path chosen was different but equally ambitious: instead of relying on traditional financial infrastructure — marked by networks like SWIFT and the correspondent banking model — the company built its own payments network based on stablecoins, positioning itself as the infrastructure for the new internet of money. Through CPN, Circle enables global payments with USDC and EURC, significantly reducing technical and regulatory complexity. Whether for international trade, cross-border salaries, family remittances, or payments to content creators, CPN enables more efficient and inclusive experiences — often previously unfeasible within traditional systems.

According to company documents, the ambition of CPN is to become the “money protocol” of the internet — a neutral and auditable foundation3. With a hybrid architecture, the platform combines the best of both on-chain and off-chain worlds, enabling everything from near-instant settlement to the creation of customized modules for integration with various financial services, such as credit, insurance, escrows, or even AI-powered payments.

In practice, this is already reflected in real use cases: stablecoin payments through Stripe with settlement via Solana; Visa’s use of USDC for settlements with Worldpay and Nubank; and integrations by companies using CPN to streamline global payroll and trade finance.

👉 Subscribe to W Fintechs and receive an analysis like this in your inbox every Monday.

The next Money Protocol

From the very beginning, Circle chose to navigate the ecosystem with a rare institutional approach — in a space often defined by disruption, informality, and radical experimentation. By doing so, it achieved something unusual: combining credibility in the traditional financial world with relevance in the decentralized digital environment.

This position was reflected in the strategic alliances it built with regulators, central banks, and policymakers around the world. While many crypto projects avoided the regulatory arena, Circle moved toward it. Circle’s ambition to be the bridge between the legacy financial system and the new digital layer born from blockchains, smart contracts, and stablecoins is clear. With CPN, its role has become even more evident: not to challenge traditional institutions, but to connect them to the crypto universe.

Through this effort, USDC is now used in over 190 countries, with more than USD 150 billion in transaction volume and direct integration with 14 public blockchains 4.

Still, the challenges are far from over. In March 2023, Circle faced a moment of high vulnerability when part of USDC’s reserves was held at Silicon Valley Bank. Although all funds were recovered and trust was restored, the episode exposed the company’s dependence on the stability of the traditional banking system.

Since then, Circle has diversified its custody partners and strengthened transparency around its reserves — which, as mentioned above, in 2024 consisted of 23% in U.S. Treasuries, 63% in repurchase agreements, and 14% in cash. Yet new challenges have emerged along the way: competition from algorithmic stablecoins, corporate-issued tokens like PayPal USD, and ongoing global regulatory uncertainty still surrounding the sector.

In the regulatory space, USDC operates on ambiguous ground. Countries like the United States, the United Kingdom, Brazil, and Singapore have adopted different approaches when it comes to the classification and supervision of stablecoins. In Brazil, as I showed in edition #139, there is still no consensus on whether they are payment instruments, securities, or hybrid assets — which creates legal uncertainty for both issuers and users. And although the Crypto Assets Law has made progress, the legal framework for stablecoins remains undefined.

In the U.S., the GENIUS Act 5 — approved by the Senate in late May 2025 — proposes the first federal regulation for stablecoins. It establishes a dual regulatory system: issuers with over USD 10 billion must follow rules set by the FED (for banks) or the OCC (for non-banks), while smaller issuers may follow state regulations. Issuance will be restricted to authorized institutions. The bill also mandates transparency of reserves and annual audits.

What Circle proves is that if the money of the industrial era was based on paper, hierarchy, and physical institutions, the money of the digital era will be based on transparency and interoperability across different global layers. Jeremy Allaire, the company’s CEO, understood this when he championed the openness of internet protocols and began advocating that money would one day become an internet protocol. That day seems to have arrived.

If you know anyone who would like to receive this e-mail or who is fascinated by the possibilities of financial innovation, I’d really appreciate you forwarding this email their way!

Until the next!

Walter Pereira

Disclaimer: The opinions expressed here are solely the responsibility of the author, Walter Pereira, and do not necessarily reflect the views of the sponsors, partners, or clients of W Fintechs.

https://etherworld.co/2018/10/23/coinbase-announces-support-for-usdc-stablecoin/

https://www.spglobal.com/_assets/documents/ratings/research/101610806.pdf

https://6778953.fs1.hubspotusercontent-na1.net/hubfs/6778953/PDFs/Whitepapers/CPN_Whitepaper.pdf

https://hkifoa.com/wp-content/uploads/2024/11/state-of-usdc-economy-circle.pdf

https://www.congress.gov/bill/119th-congress/senate-bill/394/text