#FinOpen: How can Open Finance data improve credit? Use cases; updates

W FINTECHS NEWSLETTER #128

👀 Portuguese Version 👉 here

👉 W Fintechs is a newsletter focused on financial innovation. Every Monday, at 8:21 a.m. (Brasília time), you will receive an in-depth analysis in your email.

Welcome to the edition of the Finance is Open series.

Every other Wednesday, in addition to the traditional Monday editions, I will cover key topics and the latest updates on what's happening in Open Finance, both in Brazil and around the world.

Finance is Open is sponsored by

Iniciador is the complete infrastructure platform specialized in Regulated Open Finance, enabling Payment Initiation and Data Access.

The solution removes technology and compliance concerns, allowing clients — with their own regulatory license or using Iniciador’s — to focus on new products and business growth.

💡 Want to advertise in the W Fintechs Newsletter?

Reach a niche audience of founders, investors, and regulators who read an in-depth analysis of the financial innovation market every Monday. Click 👉here

About this section:

In this section, I bring the latest updates from the working groups and the structure of Open Finance Brazil.

The topics are: governance, with potential rule changes and management updates; technology, with updates on infrastructure, APIs, and security; user experience, highlighting improvements in the journey; and ITPs, addressing news on regulated participants and the Payment Transaction Initiator.

The latest updates in Open Finance Brazil have focused on improving infrastructure efficiency, both in terms of support and some changes to APIs. Starting with the Variable Income API and the compliance engine, which now require new mandatory tests to ensure regulatory rules are met more strictly. Along with this, the Service Desk also underwent adjustments, including the addition of a specific field to monitor SLAs during the user journey.

On the payments side, the release of version 2.0.0-rc.1 of the Automatic Payments API brought improvements in consent management and error handling, along with adjustments to transfers. One of the changes was the need to validate the consent status before activating access tokens. This aims to avoid unnecessary use of infrastructure by eliminating repetitive API calls. Additionally, there were revisions in consent permissions, especially in cases where the customer does not have financial products such as accounts or cards linked, which enhances the system's flexibility and security.

The journey without redirection (JSR), which was the featured use case in the last edition (link 👉 here), will remain valid only for payments initiated by individuals on mobile devices and browsers.

Although this model has shown positive results in reducing friction, its expansion to other scenarios is still under discussion. The goal is to ensure the payment process is more agile while maintaining a high level of governance to prevent fraud and ensure security during user authentication.

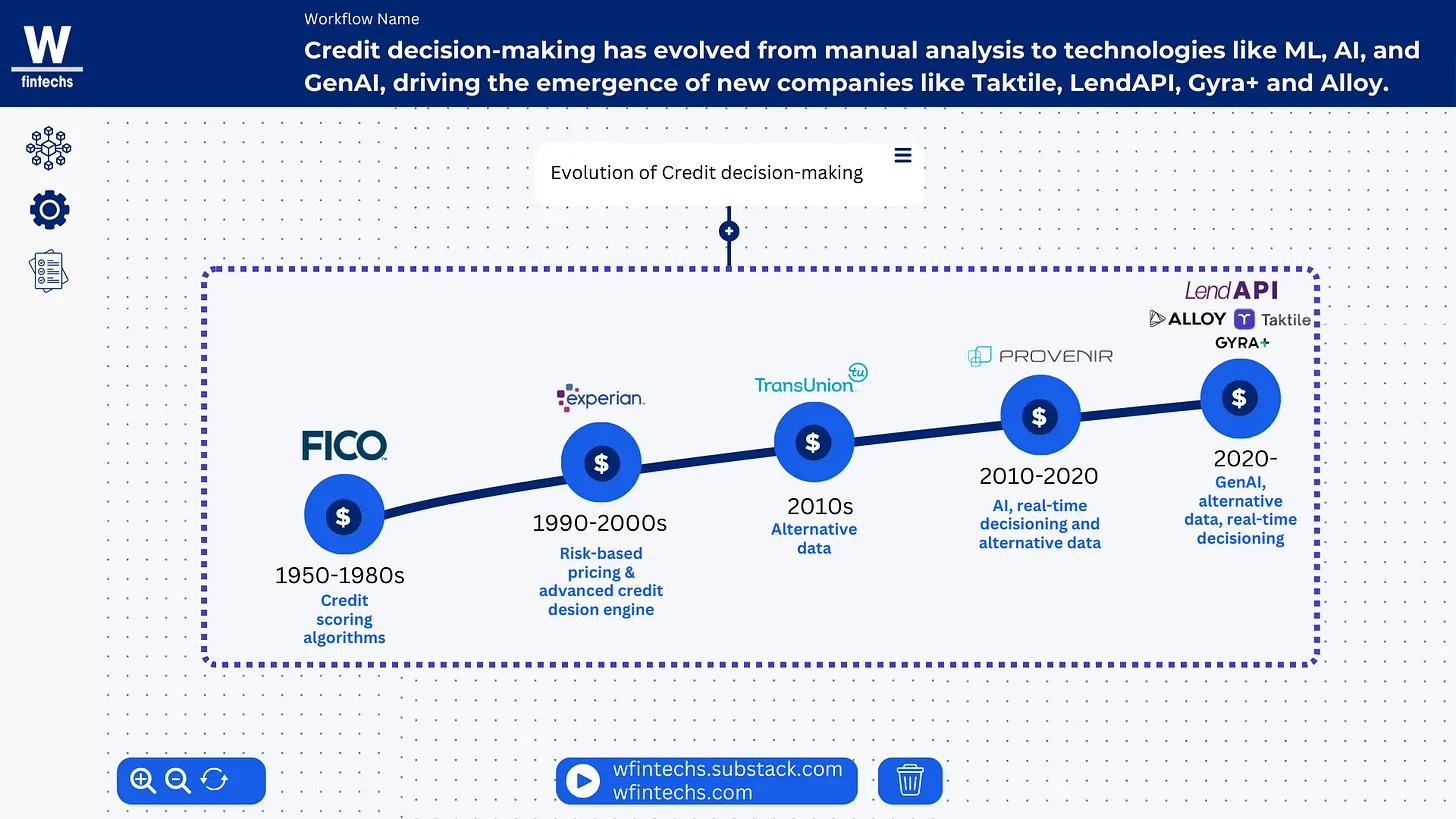

Last week, in Deep Dive #126, I wrote about the future of the workflow and decision engine market in credit.

Check out the full edition #126 below 👇

Looking at the evolution of the credit market, it's clear that institutions are increasingly demanding specialized solutions. Credit decision-making evolved from manual analysis to credit scoring algorithms in the 1950s. In the 1980s, processes were digitized, and in the 1990s, risk pricing systems made the process even more objective and precise. But it was from 2000 onward that AI and alternative data enabled an even greater enhancement of decision-making, with companies like Taktile, LendAPI, Gyra+, and Alloy accelerating this progress with faster and more personalized analyses.

One of the major challenges in credit has always been measuring consumers' income. There are two key concepts here: observed income 1, whether through CLT registration, retirement, or PJ (business) earnings transferred to a PF account; and estimated income, calculated based on transactional data, behavioral data, and market projections.

Although income is one of the main criteria in credit granting, direct verification is still a challenge, leading many institutions to rely on providers of estimated income.

Open Finance changes this scenario by improving credit estimation and creating new possibilities for analysis, with one of its major advantages being the verification of consumers' real income, which reduces the reliance on estimated income.

In Brazil, in 2024, 38.7 million people were formally employed and 31.5 million people were retirees, pensioners, or beneficiaries of assistance. This means that at least 70 million Brazilians could have their income assessed by connecting their bank accounts to a credit provider.

Many Open Finance players are offering income products. In practice, what they provide are JSON files that, when connected to the lender's credit model, enrich the analysis. The quality of these files is crucial. Some come with various types of financial entries, dates, and amounts — which can help institutions use this information to further enrich their analyses.

But in many cases, the lender only needs one thing: the income amount. This saves time and avoids the rework of analyzing and cleaning data. Ideally, this data should be simple and well-organized, providing the lender with the clarity needed to assess the reliability of the information and make their decision — and this is where decision engine players come in.

Despite access to bank accounts, this can still have limitations, as it doesn't always reflect the full income of an individual, especially for informal workers or freelancers with multiple sources of income and bank accounts that may not be connected to the provider (meaning they don't have consent to access it).

Therefore, even with Open Finance, estimated income still plays an important role in credit analysis. Income estimation models analyze cash inflows and outflows over a specific period, as well as considering credit limits used. This way, it's possible to infer a consumer's income based on their financial behavior.

These income estimates can be made in several ways, such as analyzing the flow of money in and out, considering the frequency and volume of deposits in the consumer's account, or through credit usage, evaluating the amounts used on credit cards and the limits granted by banks. The trend and stability of income are also important factors for credit decision-making, as they indicate whether the consumer's income is growing, decreasing, or remaining stable over time.

For example, if income is observed and it is noted that someone's income comes from a CLT job worth 8,000 reais, there is stability, as this amount is constant and received every month on the same day. However, there is no trend, as the value is fixed. If it is estimated through a model, both the trend and the stability may appear.

Studying some Open Finance players, I will bring two for the income API analysis: Belvo and Klavi.

Through Belvo's documentation, it is evident that it offers a deep level of detail, focusing on the stability, regularity, and reliability of income flows over time, which enables a more detailed behavioral analysis. The JSON also provides averages, medians, and historical trends, as well as indicating the best days for collections.

Klavi, on the other hand, adopted a more direct and objective approach, resulting in a greater focus on observed net income analysis, with more emphasis on income stability and trends — variables typically associated with estimated income since it's a model. In observed income, only the amount, type (such as CLT, public employee, Bolsa Família, etc.), and the payment date are provided. Both offer value, but they cater to different needs in terms of depth and the type of information.

Now, looking at the numbers from Dashboard do cidadão and the evolution of API calls, it's also noticeable that there has been consistent growth over time, especially in endpoints related to credit cards, such as statements, transactions by statement, and limits, as well as account data, like balances and transactions.

For example, credit card transaction data by statement showed a gradual increase, with 12.17 million calls on January 20, 2023, and reaching 21.15 million on January 17, 2025. Calls related to bank account balances saw significant growth, from 107.68 million in January 2023 to 332.5 million in January 2025.

Although this doesn't necessarily indicate final or practical use of this information, in the very near future, the integration and consumption of this data could lead to an even greater enrichment of credit models.

As Open Finance advances and more consumers opt into data sharing, credit models are likely to become increasingly precise. The combination of incomes from Open Finance with other market data sources will further enrich risk assessment and access to credit in Brazil. Ultimately, Open Finance won't be the only avenue, but it will be an important one for the expansion and improvement of credit market quality in the country.

If you're enjoying this edition, share it with a friend. It will help spread the word and allow me to keep providing quality content for free.

Contribution

I'm creating a use case mapping, divided into data and payments, with an interactive dashboard. I’ve already mapped out some cases, but before the official launch (expected at the end of March), I want to enrich the mapping even further.

If you'd like to include your institution’s use case, just send me a message by replying to this email or via LinkedIn (link 👉 here). And if you're a fintech without its own license, don’t worry—we want you involved too!

The question that gives this edition its name can be easily answered by the case of Banco BV, one of the leading private banks in Brazil, with a strong presence in vehicle financing, personal loans, and solutions for businesses.

Through Klavi, BV adopted klaaS, the company’s Analytics as a Service unit, which began providing data intelligence to the bank. And here’s the interesting point: as more institutions use Klavi, the company further refines its categorization and analysis model based on processed data.

Klavi developed a proprietary variable categorization model, and by adopting this framework, BV began applying the variables designed by the company, using its own dataset. In this way, the bank was able to leverage the intelligence and precision of Klavi’s model, which resulted in significant impacts, such as a 30% increase in pre-approved credit limits for customers.

Vehicle financing — BV's flagship product — was one of the most benefited. Instead of relying solely on traditional credit analysis, the bank began considering data such as IPVA expenses, fuel, and car maintenance, allowing for a more accurate assessment of the customers' financial capacity and consumption profile.

As we saw above, Klavi adopts a more direct and objective approach when providing income data. Delivering a multitude of variables to the client, many of which are not always useful or easy to apply to the institution’s business language, doesn’t always yield positive results. Klavi's strategy, therefore, was to focus on providing only the variables that are truly useful, without overloading the models with data that often do not add direct value.

Open Finance data brings a true transformation in the way credit is granted.

Traditional models, based on bank history and credit scores, leave gaps that often distort the true financial reality of customers. An internal study by Klavi, for example, compared the average income estimated by credit agencies, which was R$ 2,000, with data from IPEA, which indicated R$ 3,137. Adjusting this estimate based on the demographic profile of Brazil at the time, the calculated average income was R$ 3,038.50, much closer to the actual numbers. This difference is not a detail, but proof that Open Finance data can redefine projections and change the way credit models and decisions are made — bringing even more accuracy.

If you know anyone who would like to receive this e-mail or who is fascinated by the possibilities of financial innovation, I’d really appreciate you forwarding this email their way!

Until the next!

Walter Pereira

Disclaimer: The opinions expressed here are solely the responsibility of the author, Walter Pereira, and do not necessarily reflect the views of the sponsors, partners, or clients of W Fintechs.

Klavi wrote an article about the definition of observed data and the process of obtaining it. This data can be accessed from traditional sources, such as pensions, government benefits, public employees, employers, credit history, and bank statements, either publicly or with the user's consent.