#111: The next big bet: when finance improves healthcare

W FINTECHS NEWSLETTER #111: 22/07-28/07

👀 Portuguese Version 👉 here

This edition is sponsored by

Iniciador enables Regulated Institutions and Fintechs in Open Finance, with a white-label SaaS technology platform that reduces their technological and regulatory burden:

Real-time Financial Data

Payment Initiation

Issuer Authorization Server (Compliance Phase 3)

We are a Top 5 Payment Initiator (ITP) in Brazil in terms of transaction volume.

💡Bring your company to the W Fintechs Newsletter

Reach a niche audience of founders, investors, and regulators who read an in-depth analysis of the financial innovation market every Monday. Click 👉here

👉 W Fintechs is a newsletter focused on financial innovation. Every Monday, at 8:21 a.m. (Brasília time), you will receive an in-depth analysis in your email.

The financial sector has been gradually transformed as some players began to use their adverse characteristics to change the status quo. This was the case with Nubank, which competed with large banks by offering a cheaper digital account, a better customer experience, and now more personalized financial services. Stone and PagBank also followed same path, offering cheaper payment gateways to merchants. Hundreds of other companies did the same, taking advantage of market adversities to innovate.

Healthcare may be the next sector to undergo major transformations in the coming years. Globally, the healthcare sector is still inefficient. There is little differentiation, very high costs, legacy oligopolies, and mainly onerous processes for both consumers and healthcare providers (doctors, hospitals, clinics, etc.).

There are some similarities between the financial sector and the healthcare sector, where both operate under strict regulations that often prevent some innovations unless there is cooperation between the private sector and the regulator.

When it comes to consumer health innovation, there are different challenges. Most of these companies have not managed to effectively engage and retain patients as they often focus more on the provision of medical services than on the patient experience, resulting in a less customer-centric approach.

Moreover, the healthcare system is often complex and difficult to navigate. Service provision is also fragmented, with little coordination between different providers, leading to unsatisfactory experiences for patients.

On the provider side, the problems are also diverse, including administrative overload, lack of data integration between systems, and constant pressure to reduce costs, which often leads to lower quality care. There are many opportunities that can be explored by combining financial services and healthcare.

The problem of healthcare in the world

In recent decades, as technological advancements have expanded treatment possibilities, healthcare spending has increased. If we consider the history of healthcare, since the Enlightenment and Mercantilism, countries have been spending more and more on health, with a vision of promoting public health.

The US, for example, currently spends more government money per person on healthcare than many countries that finance universal programs, such as Brazil and England. The spending is so concentrated that the top 1% of spenders account for more than 20% of total healthcare spending.

Data from Our World in Data shows that in 1880, government healthcare spending was below 1% of GDP in all countries, but this began to change in the first half of the 20th century and, by 1970, government healthcare spending was above 2% of GDP in all these countries 1.

World War II greatly contributed to this change, largely due to advancements with the discovery and use of penicillin and other antibiotics. At the same time, some countries began adopting public insurance policies for their citizens, especially for those unable to work due to poor health resulting from the war.

In the following decades, the coverage of this insurance remained stable while healthcare spending rapidly increased, leading to highly concentrated healthcare expenditures, suggesting inequality in access to and need for healthcare.

What is most interesting to note in this data is the difference in healthcare financing between developed and developing countries. In many developing countries, a large portion of the money for medical care comes directly from household income ("Out-Of-Pocket"), unlike in developed countries. Some countries have managed to reduce these expenses, but others have seen an increase.

In countries with market economies, the health sector competes for resources with other sectors. This means that the prices of medical services are influenced by the productivity of other sectors. Since the healthcare sector is labor-intensive and its productivity grows more slowly than in other sectors, the prices of medical services tend to increase faster than inflation. Thus, healthcare spending as a proportion of income also increases.

Challenges of Payment Capacity

When we consider that in developing countries many people have limited access to the formal financial system and pay for their own healthcare, direct healthcare expenses exceeding 10% of a family's income are considered catastrophic. This is exactly what happened in 2017, when 13.2% of the global population spent more than 10% of their household income on healthcare, and 290 million people spent more than 25% of their household income2.

When fintech meets healthcare

The healthcare segment faces many challenges. Besides those highlighted above, there are also challenges for healthcare providers who struggle with payment collection, revenue reconciliation, and having an overall view of patient data. In other words, both consumers and providers face significant pain points where fintechs and healthtechs can explore.

Challenges for consumers

What becomes clear when looking at international experiences is that access to formal financial services allows families to invest in home improvements, which implies better sanitary conditions.

An example occurred in India, where home improvement loans provided to clients resulted in better living conditions and increased the health, safety, and security of borrowers.

There are five fronts where financial services can help consumers in healthcare, including:

Digital payments

Credit

Savings

Remittances

Insurance

Each of these has characteristics that, when isolated, already guarantee benefits for users, but if combined into a complete ecosystem of financial services, they can further enhance the offering.

Digital payments are considered the gateway to all other services. Countries that have invested in real-time payment rails or mobile money may be ahead in this regard.

For example, a study conducted in Uganda revealed that women who used mobile money services were more likely to seek prenatal care, resulting in better health outcomes for both them and their babies. Researchers suggest that the use of mobile money facilitated access to remittances, expanding women's financial resources and encouraging them to seek preventive care.

Digital credit can be seen in the healthcare sector in the form of loans for specific healthcare services whose initial costs are unaffordable. The major challenge here is finding an efficient way to balance risk and return. Alternative data can help with this, as I wrote in this edition 👉 here.

In India, Arogya Finance offers unsecured medical loans to low-income people in the informal sector, using alternative data to assess credit. Loans range from $300 to $7,000, with terms of up to four years and lower interest rates than those offered by other types of loans. While traditional banks can take up to a week to approve a loan, Arogya promises a decision in three hours and makes the payment directly to the service provider.

Savings are also an important factor for healthcare. As shown by a study conducted in Nepal, savings helped people better manage their health, where women who opened no-fee savings accounts increased household spending on education and nutritious food. In other words, offering a savings account with easy liquidity or savings accounts specifically targeted for anticipated healthcare costs, allowing accessible funds for an urgent health event, can be beneficial.

A few weeks ago, I started exploring with a fintech market friend the possibility of a Save Now, Health Later (SNHL) model.

Similar to Save Now, Buy Later (SNBL), SNHL would function as a way to create a specific savings account for healthcare services. If anyone is interested in exploring this idea further, I would love to share some thoughts and connect with people I’m talking to (👉 via DM on LinkedIn).

This model could be offered both in a B2C, with a provider offering it directly to the consumer as a kind of health-focused digital account (there are already cases like this in Kenya), or B2B2C (which I see as having greater potential), where the player would partner with third parties and use their existing customer base to offer the product via API.

I found a company with a similar model (Lynx) that, through its APIs, allows the embedding of healthcare financial services into another platform. This integration enables the platform's customers to save, pay, invest, and purchase healthcare products and services.

Two other types of financial services that are essential for healthcare are insurance and digital remittances. Given that many low-income families need to pay out-of-pocket for medical care, an accident or illness can easily push them into poverty. Thus, offering insurance, even if limited, can help people deal with health shocks without being pushed further into poverty, as happened in Pakistan.

The insurance experience is still fragmented in many countries. In Brazil, it is a market that has much to develop in terms of innovation. In healthcare, legislation in many countries makes the final product expensive for consumers due to the various risks that insurers have to assume.

Another highly relevant service is remittances. Last year, I wrote about how immigration could be facilitated by the introduction of interoperable systems, especially in payments and data sharing.

The life of an immigrant is often difficult. At the time, speaking with founders of a fintech based in the US, I discovered that many families living in Central America rely on remittances as their primary source of income (read the edition👉 here).

In 2022, international remittances to low- and middle-income countries totaled $647 billion 3. The situation becomes more interesting when we see that part of this number is used to cover healthcare expenses.

However, although the importance of remittances is significant for the immigrant's life, sending money from one country to another is still very expensive (the global average cost is 6.3%, but in some African countries, it can reach 15%) and often a slow process.

There are several reasons for this; the main ones are exclusive agreements signed by some countries, which increase profitability margins and reduce competition. Additionally, the cost of anti-money laundering regulations and counter-terrorism financing regulations further increases the costs for banks to process these remittances. In other words, it is a segment that requires not only innovative initiatives but also changes in regulation.

Healthcare Players for Consumers

While studying this market, I found few players who explore all these services on a single platform. The most emblematic case I found was M-TIBA in Kenya. There are other interesting cases as well, such as CareNow in Indonesia and Alice in Brazil.

CareNow

CareNow is a healthcare financial services platform in Indonesia. The platform offers installment payment solutions for medical expenses, allowing patients to split the costs into up to 12 installments with low interest, often even interest-free for the first installments.

The company has partnered with over 650 healthcare institutions in Indonesia, including hospitals, dental clinics, and laboratories, making quality healthcare more accessible to a wide range of patients. CareNow's proposition is to make medical care more accessible by eliminating the need for upfront payments and allowing users to pay only for the services they use, without the obligation of monthly premiums as in traditional health insurance plans.

In January 2024, Finfra, a loan infrastructure provider, partnered with the company to enable the full integration of its credit scoring product — one of the best in the region— into the CareNow platform, further enhancing its analytics. 4.

M-TIBA

Every year, more than 1 million Kenyans are pushed below the poverty line due to healthcare expenses, and 83% do not have health insurance.

In 2016, CarePay, a provider of insurance in Kenya, launched M-TIBA, which combines savings, credit, and remittance products with discounted healthcare services and health insurance to help subscribers manage various health expenses. M-TIBA has managed to build a network of 500 healthcare providers and has reached over 1 million Kenyans.

M-TIBA is an interesting case as it successfully integrated different services into a single platform, such as combining remittance features with savings, ensuring that received funds are reserved exclusively for use with participating healthcare providers.

Participating providers also gain access to the system, an M-PESA cash register, and training in quality and business management, benefiting from more reliable revenue streams, more efficient payment processing, and more secure cash management.

A success story shared by the company is that of Oserian, a flower farm, which enrolled its 4,600 workers in health insurance through M-TIBA, gaining visibility into which services their employees are accessing and where treatments are most successful. The data generated by M-TIBA is also helping to improve insurance program coverage by personalizing premium costs and covered benefits5.

Although the platform has succeeded in some ways, there are challenges such as the need to encourage low-income users to save. CarePay has found a solution through personalized incentives, such as bonus top-ups, to encourage savings.

Alice

In Brazil, the insurance sector still faces several challenges. What Nubank has done in the banking sector over the past 10 years is not yet matched in the insurance sector, although there are some players successfully exploring opportunities, such as Pier and Alice, for example.

I like the case of Alice because it resembles Nubank's in various aspects, especially in the passion that the founders have invested in the company, the branding, and the customer experience.

While researching the company, I came across a post from three years ago by Santiago Fossatti, a partner at Kaszek, a venture capital fund focused on LatAm. He shared his experience with a major insurer in Brazil, detailing how, after deciding to cancel his plan with Amil, a leading health insurance provider in the country, he had to navigate a completely manual and outdated bureaucratic process.

Alice has addressed this and many other issues related to the insurance experience. Although it operates on a B2B2C model — meaning a company must contract its service to offer it to its employees — I believe it is a prime example of how technology can transform the relationship with a sector that remains quite uninnovative in Brazil.

Challenges for Providers

For consumers, there are challenges in accessing and securing medical care services, and for providers, there are also difficulties in managing and financing their operations.

When a doctor or hospital treats a patient, they often do not know exactly how much they will receive, when they will receive it, or if the payment is accurate. Sometimes, they have no idea if they will have enough funds to pay their staff because the money expected from insurance companies and patients may be uncertain. This issue affects both small clinics and large hospitals.

In poorer regions, many providers rely on unpredictable cash flows from uninsured patients to finance their operations. As a result, they struggle to invest in better facilities, diagnostic equipment, and supplies like medications.

Innovative financing solutions have begun to emerge to address these challenges. For example, PharmAccess provides funding to small clinics in seven African countries, allowing them to improve service quality and purchase essential medications.

Currently, most clinics use electronic health record (EHR) systems to manage patient care, but there are few cases where a financial system is in place to track finances. This is in contrast to other major industries that already have well-established financial systems.

This discrepancy arises because the flow of money in healthcare is complex, and there are no specific systems to track how it enters and exits. a16z has summarized how this flow works6:

Patient Visit: the patient provides insurance information and pays any amount not covered by the insurance.

Service and Billing: the doctor provides service and sends a summary to a biller, who converts this documentation into billing codes.

Claim Submission: the biller submits the claim to a clearinghouse, which verifies if everything is correct and, if so, forwards it to the insurance company.

Insurance Payment: the insurance company reviews the claim and makes the payment to the doctor, which can take up to 90 days to complete.

After this, the doctor needs to manually check their bank account and other records to understand why they received that amount. If there are errors, they may need to fight for additional payments or collect directly from the patient.

This process creates several financial problems, such as data disconnection, where the systems used to manage patients and finances are not well integrated, leading to errors and inaccurate numbers. Reconciliation is done manually, which is prone to errors and makes it difficult to forecast cash flow.

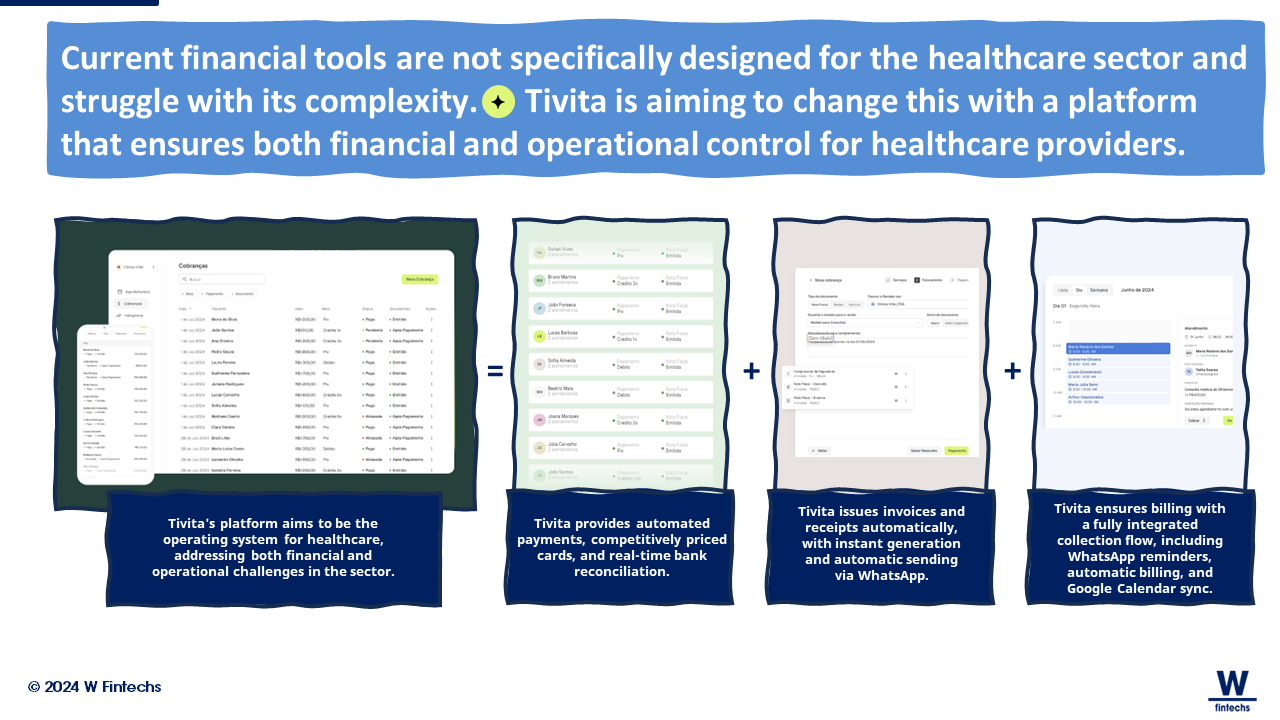

Overall, current financial tools are not specifically designed for the healthcare sector and do not handle its complexity well. This also creates challenges in obtaining financing, making it harder to access loans and affecting the ability to expand or pay salaries.

A few weeks ago, I came across a Brazilian player aiming to change this. Tivita has created a platform that not only ensures smarter scheduling but also automates financial processes. It offers automated payments, automatic submission of certificates, reports, and other medical processes, as well as complete banking reconciliation. This is a significant step towards improving the provider's experience, which in turn can enhance the experience for patients as well.

There are other initiatives focusing on data openness. The most challenging step towards an open data economy will be the opening of health data. As I shared a few months ago, I believe that an open data economy will not emerge from regulatory actions but rather from market-driven initiatives that will later be regulated for standardization and security — similar to what happened with Open Banking in the UK and Open Finance in Brazil.

A British company called Medi2data has started to facilitate this exchange of information by building a suite of products and services that support clinics, patients, and other intermediaries in the rapid and secure transaction of medical data. This is an interesting step towards data openness in the sector, and my personal view at this point is that bilateral agreements could accelerate the advancement of these infrastructures in traditionally innovation-averse sectors like healthcare.

The Next Big Bet in Healthcare

As healthcare increasingly consumes a larger portion of national GDPs, it is likely that the intersection of healthcare and fintech will become more common. Both consumers and providers still lack solutions capable of addressing the various challenges inherent in healthcare.

International experiences show that offering different services on a single platform, as M-TIBA has done in Kenya, can reduce distribution costs and improve scalability. The use of alternative data for credit decisions and structuring financial products can also unlock financing for healthcare expenses, as demonstrated by Arogya Finance in India.

Digital payment rails have also facilitated the mobilization of funds and the prompt, secure payment of healthcare expenses, as evidenced by cases in Uganda and Kenya.

If we were to divide the transformation of the financial sector over recent decades into two phases, they would be: (i) the initial phase focused on customer experience, and (ii) the current phase focused on creating complementary and personalized services. In healthcare, I believe we are still in the first phase, with digital insurers like Alice being a great example.

The second phase will involve a transformation of complementary and personalized services, but it will likely occur much faster than it did in the financial sector — thanks in large part to advancements in AI and increased competition. The player who successfully integrates financial services with the current challenges in healthcare could gain significant competitive advantages.

If you know anyone who would like to receive this e-mail or who is fascinated by the possibilities of financial innovation, I’d really appreciate you forwarding this email their way!

Until the next!

Walter Pereira

Disclaimer: The opinions expressed here are solely the responsibility of the author, Walter Pereira, and do not necessarily reflect the views of the sponsors, partners, or clients of W Fintechs.

https://ourworldindata.org/financing-healthcare

https://www.afi-global.org/wp-content/uploads/2023/02/Integrated-Digital-Financial-Service-Models-for-Financial-and-Healthcare-Access_24022023.pdf

https://www.exemplars.health/stories/the-impact-of-remittances-on-health-outcomes

https://ibsintelligence.com/ibsi-news/finfra-carenow-partner-to-streamline-healthcare-payments-in-indonesia/

https://www.cgap.org/blog/essential-role-of-finance-in-education-housing-and-health-care

https://a16z.com/healthtech-x-fintechs-biggest-prize-the-financial-operating-system-for-healthcare/