#109: How alternative data is creating a new era of credit for the newly banked

W FINTECHS NEWSLETTER #109: 24/06-30/06

👀 Portuguese Version 👉 here

This edition is sponsored by

Iniciador enables Regulated Institutions and Fintechs in Open Finance, with a white-label SaaS technology platform that reduces their technological and regulatory burden:

Real-time Financial Data

Payment Initiation

Issuer Authorization Server (Compliance Phase 3)

We are a Top 5 Payment Initiator (ITP) in Brazil in terms of transaction volume.

💡Bring your company to the W Fintechs Newsletter

Reach a niche audience of founders, investors, and regulators who read an in-depth analysis of the financial innovation market every Monday. Click 👉here

👉 W Fintechs is a newsletter focused on financial innovation. Every Monday, at 8:21 a.m. (Brasília time), you will receive an in-depth analysis in your email.

Some months ago, I wrote about the creation of Aadhaar, a digital identity infrastructure developed by the Indian government (link 👉 here). The cornerstone of identity was crucial for India to advance not only in identifying its citizens — with 40% of the population lacking birth records in 2010 — but also in advancing financial inclusion.

Indeed, Aadhaar and the subsequent digital infrastructure allowed the population to have more data, or digital footprints. At the time, one of the architects of India Stack, Nandan Nilekani, mentioned that Indian residents and businesses would be data-rich before becoming economically rich.

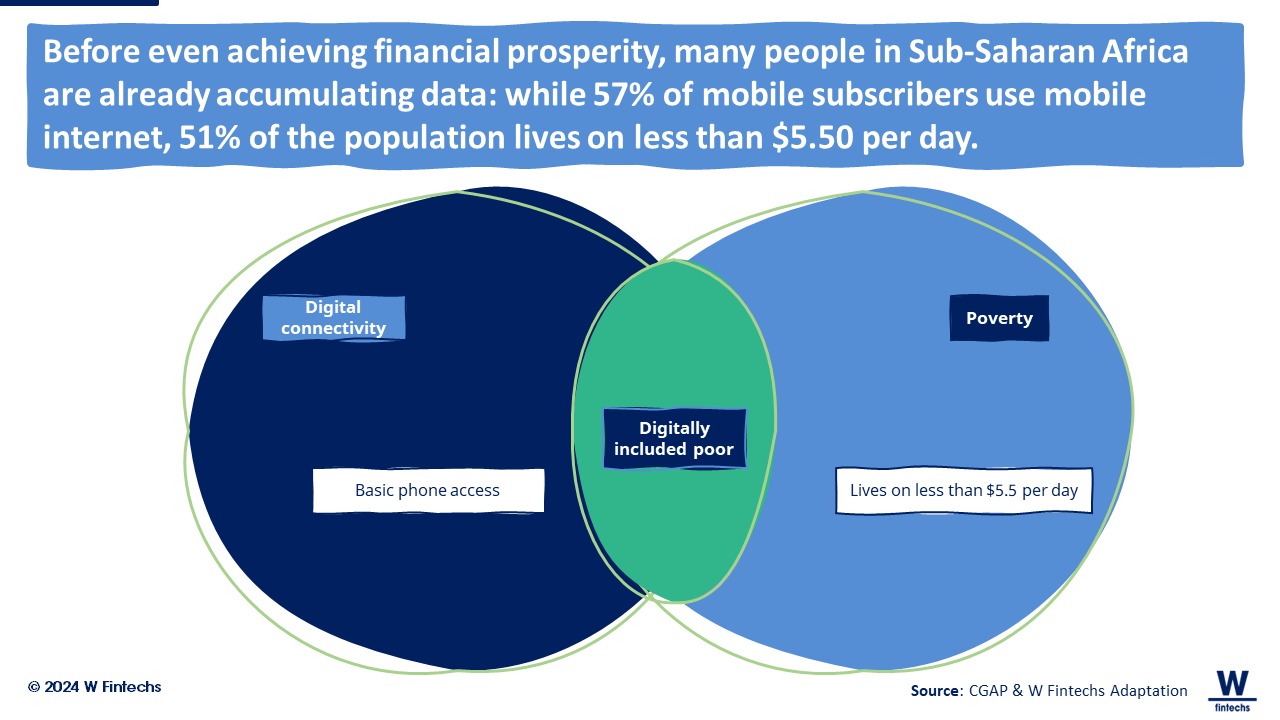

This phenomenon was driven by the increasing adoption of mobile internet and smartphones, followed by digital accounts, social media, and other digital services. According to GSMA Intelligence, in 2019, 57% of mobile subscribers in Sub-Saharan Africa used mobile internet, indicating greater digital inclusion. However, during the same period, 51% of the region's population lived on less than $5.50 a day, according to World Bank poverty data.

According to a CGAP study published in 2023, there are significant opportunities for financial institutions to serve digitally included poor (DIP) people.

Approximately 81% of DIP individuals have a national ID (about 1.46 billion people), but this percentage decreases considerably in terms of account ownership (67%), use of digital payments (32%), those making deposits (26%), and those borrowing from a financial service provider (12%). 1.

Financial service providers can leverage the untapped digital footprint of DIP individuals to offer more and better services, including accounts, remittances, credit, and savings.

However, there are many challenges in financially including this segment of the population who have a digital footprint but lack a bank account or access to credit.

In edition #108 (link 👉 here), for example, I wrote that the next frontier of financial inclusion would be to include millions of newly banked people who still do not have or have limited access to credit. I cited gig workers as an example, who work across various gig economy platforms and lack a traditional income source, thus limiting their financial information.

Several models are being developed to address this problem, typically in three ways: (i) direct partnerships between gig platforms and fintechs, enabling integration but possibly not offering a comprehensive view of users' finances across multiple platforms; (ii) fintechs and banks using APIs to obtain data from gig platforms, providing a more complete view of users' finances by consolidating information from multiple sources; and (iii) fintechs partnering with financial institutions for credit provision, in collaboration with platform companies or API firms, combining the expertise of financial institutions in credit provision with APIs' ability to aggregate data from multiple platforms, offering a robust and integrated solution.

The data generated by these platforms can be used to enhance credit analysis. Furthermore, there are numerous other data sources that can help individuals without a traditional financial history access the credit system. Among these sources are utility bill payment data, rental history, e-commerce transactions, and even social media activities.

In countries where Mobile Money plays a crucial role, especially due to limited access to traditional banking services, significant data creation has occurred. Examples include M-Pesa in Africa and bKash in Bangladesh, which have created digital traces of social and digital interactions left by individuals.

A 2013 analysis across nine low-income countries revealed that adult cell phone ownership ranged from 47% to 67%. Each call, airtime recharge, text message, or purchase left a digital record that could later be used by financial service providers for analysis2. Leveraging this information can provide a broader and more accurate view of individuals' creditworthiness, enabling more people to be included in the formal financial system.

Alternative data in financial inclusion

When examining existing credit models, they are indeed limited in many ways, which hinders the complete inclusion of individuals in the financial system and can even increase delinquency rates.

The current credit model

Traditional credit models typically rely on a combination of historical financial data and standardized criteria to assess an individual's creditworthiness.

Credit history is a key component, with credit reports obtained from agencies containing information about past loans, credit lines, bill payments, and other financial records. Based on this data, a credit score like FICO is generated, representing the likelihood of default.

In addition to credit history, income, and the individual's current debt analyzed through the debt-to-income ratio (DTI), employment status is also another factor considered. Many models also use employment stability as another important factor, as it suggests a more reliable capacity for repayment, which often excludes individuals in the gig economy.

Many individuals, especially in emerging economies, lack sufficient credit history, making it difficult to assess their creditworthiness. Furthermore, financial information may be fragmented and scattered across various credit agencies, complicating the ability to obtain a complete picture of an individual's financial situation.

Another limitation is the rigidity of criteria used in credit models. Often, these models rely on generic criteria that do not accurately reflect each individual's financial situation. There's also a lack of flexibility to consider contextual factors, such as sudden changes in income or employment, which can impact an individual's ability to repay.

The alternative data model

In this regard, the inclusion of alternative data can be crucial to overcoming the limitations of traditional credit models. For instance, detailed banking transaction histories via Open Finance reveal spending patterns. Regular payments of bills like utilities and rent demonstrate financial responsibility. The use of mobile devices and online behavior provide insights into financial stability and consumption patterns.

Social interactions and social media offer additional information about an individual's reliability and integrity. Additionally, employment data from the gig economy reveal additional income sources not captured by traditional models.

Although there are various sources of alternative data, some players focus on specific factors such as: income proxy, which determines customer segmentation and lifetime value using utility and payment data; spending patterns, which identifies customer channel preferences and needs through e-commerce and investment data; risk and compliance, which assesses customer risk using credit agency information and other sources; geography/Internet of Things (IoT), which provides personalized segmentation using location and telecommunications data; customer behavior, which understands characteristics and preferences through psychometric data and social networks.

According to a 2024 PwC survey, financial institutions are leveraging alternative data across the entire banking value chain, from lead generation to account management. Key uses include developing new products, customer segmentation, and analyzing credit risk/fraud, interest rates, and terms3.

One of the primary applications includes strategies like Next Best Offer (NBO), which involves creating customized offers that are optimal for the customer. This approach uses internal and external data to personalize offers based on customer life stages and specific needs. In other words, using machine learning and other technologies, institutions can provide contextual suggestions to enhance the customer experience.

Another common use case involves early warning alert systems and fraud detection models that identify early signs of delinquency and suspicious behaviors. These systems use a combination of internal and alternative data to mitigate risks and ensure financial solvency.

How are financial institutions using alternative data?

Many financial institutions are exploring ways to increase Customer Lifetime Value (LTV) on their platforms. The NBO model is gaining popularity among banks precisely for this reason: to offer a more personalized experience to their customers.

It's an advanced engagement model driven by analytics that uses customer-related data, whether from telecommunications or third parties, to predict the next best product that could be offered to the customer.

These data are then aggregated in a data mart — a subset of the data warehouse specifically designed to store and retrieve data used each time a customer is scored — and undergo rigorous preprocessing to ensure quality and statistical relevance.

Next, machine learning is used, for example, to segment customers. This segmentation not only categorizes customers but also generates enriched lifestyle analyses derived from a recommendation model based on centralized data. Based on these analyses, a Next Best Offer is prepared and presented to the customer, anticipating their needs and increasing the likelihood of acceptance of suitable financial products.

Transforming Credit through Mobile Money

A few months ago, I wrote about Nubank's entry into the Brazilian telecommunications market, a clear strategy to increase its Customer Lifetime Value (LTV). At the time, I mentioned that we would begin to observe a reverse movement compared to Sub-Saharan African and Asian countries, where many telecommunications companies started offering banking services through strategic partnerships with major financial providers — all because the competitive dynamics in the banking sector are changing (read more 👉 here).

This model adopted by these countries is intriguing because these strategic partnerships united two distinct interests to create significant impact: with many people owning mobile phones but lacking access to bank accounts, Mobile Money services allowed these individuals to make payments, thereby generating more data and expanding financial inclusion.

Consequently, in many countries, digital credit began to be offered alongside a robust digital payments industry. Most early digital credit offerings involved partnerships between Mobile Network Operators (MNOs) and financial institutions/fintechs.

Capitalizing on each partner's positioning, providers view digital credit as an opportunity to create new revenue streams and increase customer retention rates, leveraging the digital financial ecosystem and offering a new category of products to customers.

Typically, the loan decision-making process is automated, passing through a series of decision trees and algorithms, utilizing alternative data.

Existing digital data is leveraged to gain predictive insights into the likelihood of default by a potential borrower, manage the customer journey, and track loan repayments. Variables considered may include mobile airtime usage, data recharges, mobile money transactions, mobile wallet balance, applicant age, and previous loan history.

For example, M-Shwari and KCB M-Pesa — offered by Safaricom in partnership with the Commercial Bank of Africa (CBA) and Kenya Commercial Bank (KCB), respectively — are two distinct banking products offering digital loans. A prerequisite to apply for any loan product is that borrowers must be registered Safaricom M-Pesa customers and have used M-Pesa for at least six months. Similarly, Timiza, a digital credit product offered by Airtel and Jumo in Tanzania, is available only to existing Airtel customers who have an active Airtel Money account.

The New Era of Credit

We are entering a pivotal moment in the global financial system. New technologies, driven by enhanced data processing capabilities, have the potential to help us overcome longstanding challenges such as financial exclusion.

As artificial intelligence gains more prominence within financial institutions and open ecosystems and digital payment rails, such as Open Finance and Pix, bring more data into financial data lakes, it becomes possible to create even more personalized experiences.

This becomes particularly evident with the recent acquisition by Nubank, which purchased a vertical AI company, Hyperplane, that developed its own LLM to assist financial institutions in predicting customer behaviors4.

Globally, many financial institutions have leveraged alternative data to create internal risk scorecards, better understand customers, and assess customer sentiments, market risks, among other uses.

For example, Axis Bank used data from various sources to create income estimation models, rural loans, and new loans, reducing defaults and risks. The Union Bank of the Philippines used alternative data to improve efficiency and financial inclusion through AI-based credit solutions. Wells Fargo, in turn, partnered with fintech Envestnet | Yodlee for data exchanges via APIs.

The integration of alternative data is already a reality in the financial sector and is transforming how institutions operate and interact with customers. I believe that artificial intelligence, data sharing infrastructures, and digital payment rails will further drive the personalization of banking experiences and increase financial inclusion by reaching an even broader range of customers currently outside the credit market.

If you know anyone who would like to receive this e-mail or who is fascinated by the possibilities of financial innovation, I’d really appreciate you forwarding this email their way!

Until the next!

Walter Pereira

Disclaimer: The opinions expressed here are solely the responsibility of the author, Walter Pereira, and do not necessarily reflect the views of the sponsors, partners, or clients of W Fintechs.

https://www.cgap.org/sites/default/files/publications/slidedeck/Landscaping-Data-Trails_final.pdf

https://docs.gatesfoundation.org/Documents/Using%20Mobile%20Data%20for%20Development.pdf

https://www.pwc.in/assets/pdfs/beyond-traditional-data-leveraging-alternative-data-banking.pdf

https://braziljournal.com/hyperplane-a-aquisicao-do-nubank-para-levar-ai-a-decisao-de-credito/