#118: How to build consumer trust when banks and fintechs transform into data-driven companies?

W FINTECHS NEWSLETTER #118

👀 Portuguese Version 👉 here

This edition is sponsored by

Iniciador enables Regulated Institutions and Fintechs in Open Finance, with a white-label SaaS technology platform that reduces their technological and regulatory burden:

Real-time Financial Data

Payment Initiation

Issuer Authorization Server (Compliance Phase 3)

We are a Top 5 Payment Initiator (ITP) in Brazil in terms of transaction volume.

💡Bring your company to the W Fintechs Newsletter

Reach a niche audience of founders, investors, and regulators who read an in-depth analysis of the financial innovation market every Monday. Click 👉here

👉 W Fintechs is a newsletter focused on financial innovation. Every Monday, at 8:21 a.m. (Brasília time), you will receive an in-depth analysis in your email.

In a world where banks and fintechs are no longer just financial institutions but have become data companies, information has become the ultimate currency. In this new reality, consumer trust is the most valuable asset — without it, everything else loses meaning.

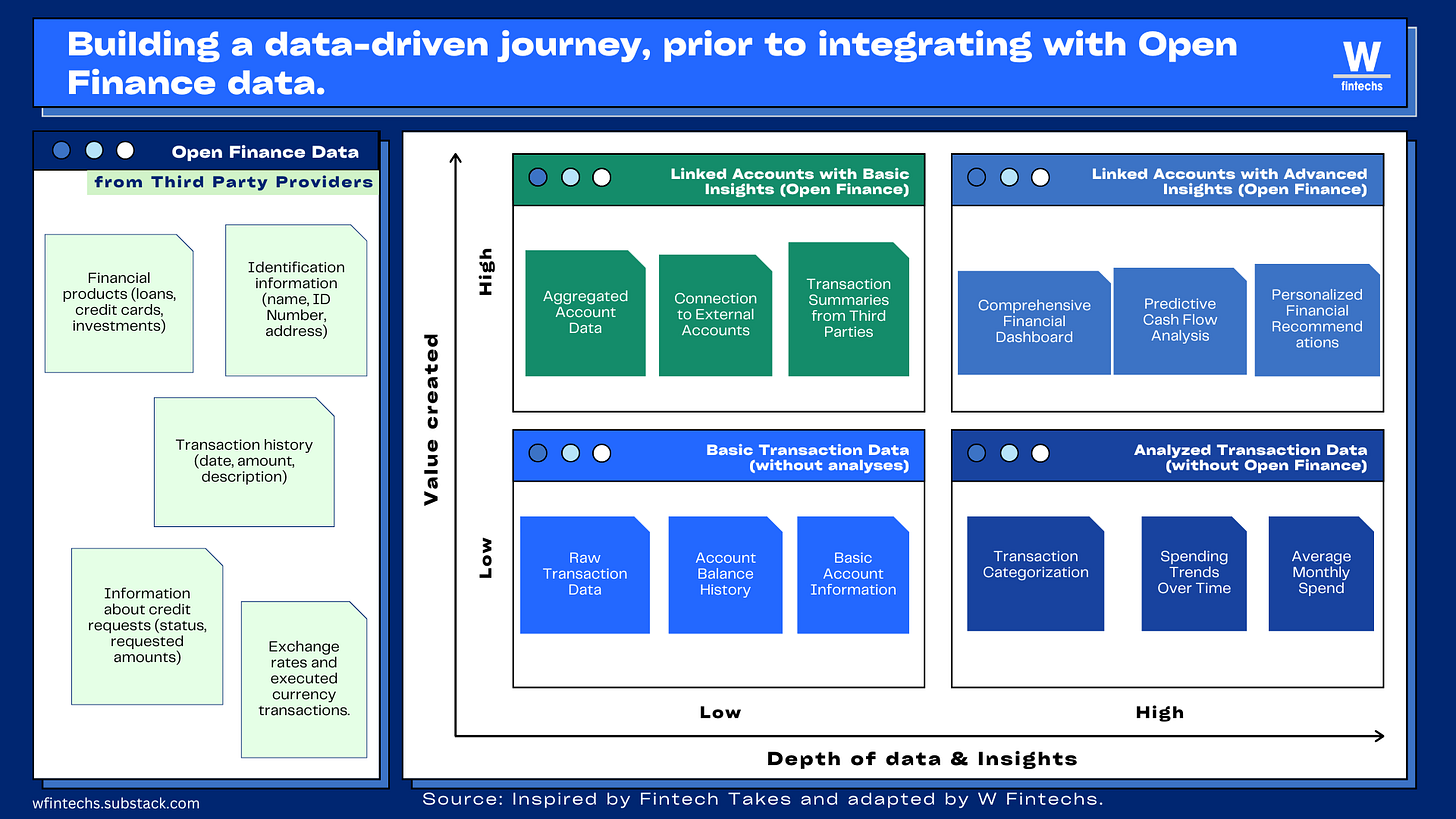

The process of leveraging data is full of challenges, placing financial institutions in what we might call a "paradox of choice" as they integrate into Open Finance. With so many opportunities available, deciding which to pursue first becomes a complex and often paralyzing task. As I mentioned in edition #114, the journey with data doesn’t have to start from scratch. On the contrary, it can begin with what is already available within the institution itself, gradually evolving to include data from open ecosystems.

Even in this process, it’s crucial to maintain three well-defined and solid pillars aligned with the institution’s strategy and ultimate goal. Each organization will have a unique objective with Open Finance. It could be improving customer retention rates, boosting cross-sell opportunities, expanding credit offerings, optimizing product personalization, enhancing customer experience, or reducing operational costs. The ultimate goal must always be clear, as it guides the implementation of actions and the exploration of opportunities.

Measuring this process is another challenge, but it is essential to refine the trajectory. An effective approach involves using clear KPIs (key performance indicators) such as an increase in transaction volume, improved conversion rates for new products, and reduced delinquency rates. Additionally, monitoring the impact on engagement and customer satisfaction metrics can provide valuable insights to adjust the course. It’s important to measure not just financial results but also improvements in customer experience and operational efficiency.

The Pillars of Trust

A data-driven journey fundamentally relies on the active participation of the customer. Their consent, data, and behaviors are the elements that fuel and refine predictive models. For this process to be effective, three pillars are essential: transparency, security, and value.

Transparency is the first step because people don’t want to feel manipulated by fine print or vague language. They demand to know clearly and directly what is being done with their data. Transparency is no longer a differentiator—it’s an obligation, as outlined by Open Finance regulations. However, I believe that the more transparent an institution is regarding customer data, the greater trust it will earn in the long run. As the market continues to explore new opportunities and develop more use cases, consumers will become quicker at spotting inconsistencies. Trust will break the moment they feel they lack control or clarity over their information.

Security is the second pillar because innovation becomes irrelevant if data isn’t protected. Beyond simply following rules, institutions need to demonstrate a commitment that exceeds compliance, showing they are willing to go above and beyond expectations in a world where security breaches can quickly become headline news. Consumers want to feel assured that their information is entrusted to an institution that not only adheres to legislation but deeply understands this responsibility and acts proactively to ensure their trust won’t be betrayed.

Finally, none of this matters if consumers don’t see real value in the exchange. People don’t share their data out of blind trust, and this is where personalization, better financial conditions, and simplicity in processes become tangible differentiators. Customers want to feel that their data is working for them, that the exchange is fair, and that the benefits are evident in their experience.

This ties into the concept of the “paradox of choice,” which challenges institutions to align internally, ensuring that their teams are united around clear objectives and expected outcomes within the context of Open Finance. It pushes institutions beyond mere regulatory compliance toward using data strategically to create solutions that genuinely meet consumer needs. Many institutions are leveraging tools like Design Thinking to align expectations and focus on delivering real value to users.

Transparency, security, and value aren’t just abstract concepts—they are the essential framework for operating in a data-driven market. Ignoring any of these pillars means risking alienating a consumer who is now more skeptical, informed, and demanding than ever—and rightly so.

Read about

👉 A look at some players. Is consolidation on the way?

👉 Banks and fintechs are becoming data-driven companies, what opportunities does this create?

👉 How can institutions turn Open Finance opportunities into revenue?

If you know anyone who would like to receive this e-mail or who is fascinated by the possibilities of financial innovation, I’d really appreciate you forwarding this email their way!

Until the next!

Walter Pereira

Disclaimer: The opinions expressed here are solely the responsibility of the author, Walter Pereira, and do not necessarily reflect the views of the sponsors, partners, or clients of W Fintechs.