#132: Short Takes: Do All Roads to Financial Innovation Lead to India? Lessons from Aadhaar in Identity, UPI in Payments, and Sahamati in Data.

W FINTECHS NEWSLTTER #132

👀 Portuguese Version 👉 here

👉 W Fintechs is a newsletter focused on financial innovation. Every Monday, at 8:21 a.m. (Brasília time), you will receive an in-depth analysis in your email.

Welcome to the Short Takes edition! As the name suggests, unlike deep dives, these editions will explore a variety of topics that might later evolve into full deep-dive editions.

Short Takes is designed for entrepreneurs, investors, and operators looking for quick, actionable insights.

💡 Want to advertise in the W Fintechs Newsletter?

Reach a niche audience of founders, investors, and regulators who read an in-depth analysis of the financial innovation market every Monday. Click 👉here

In the past, looking at the United States 🇺🇸 was the same as seeing the future. What emerged in Silicon Valley or on Wall Street soon spread across the world. But this leadership has been changing its address. Asia’s economic and technological dynamism has been redefining global trade and showing how our relationship with money might be in the future.

I find India’s case particularly interesting — not just because of its identity system but because of all the adjacent infrastructures built around it. Unlike many countries, India had to build almost everything from scratch, and the result became the true operating system of its economic transition. I’m not sure if that made the process easier or harder, but one thing is certain: India is a great example of how we can rethink the intersection of data and finance.

India’s digital infrastructure, known as India Stack, has already shown the world how technology can revolutionize digital identity and payments. This infrastructure evolved through three phases: (1) Aadhaar, launched in 2009, provided biometric and digital identity to over 1 billion Indians, reducing the cost of opening accounts from $23 to $0.15, according to the World Bank1. (2) UPI that enabled more than 16 billion transactions in January 2025, accounting for 80% of retail payments and connecting over 600 active banks2. (3) Now, the Account Aggregator (AA) is emerging to integrate identity, payments, and financial data, creating a fully connected digital ecosystem. Sahamati, the industry alliance promoting AA, is at the forefront of this effort.

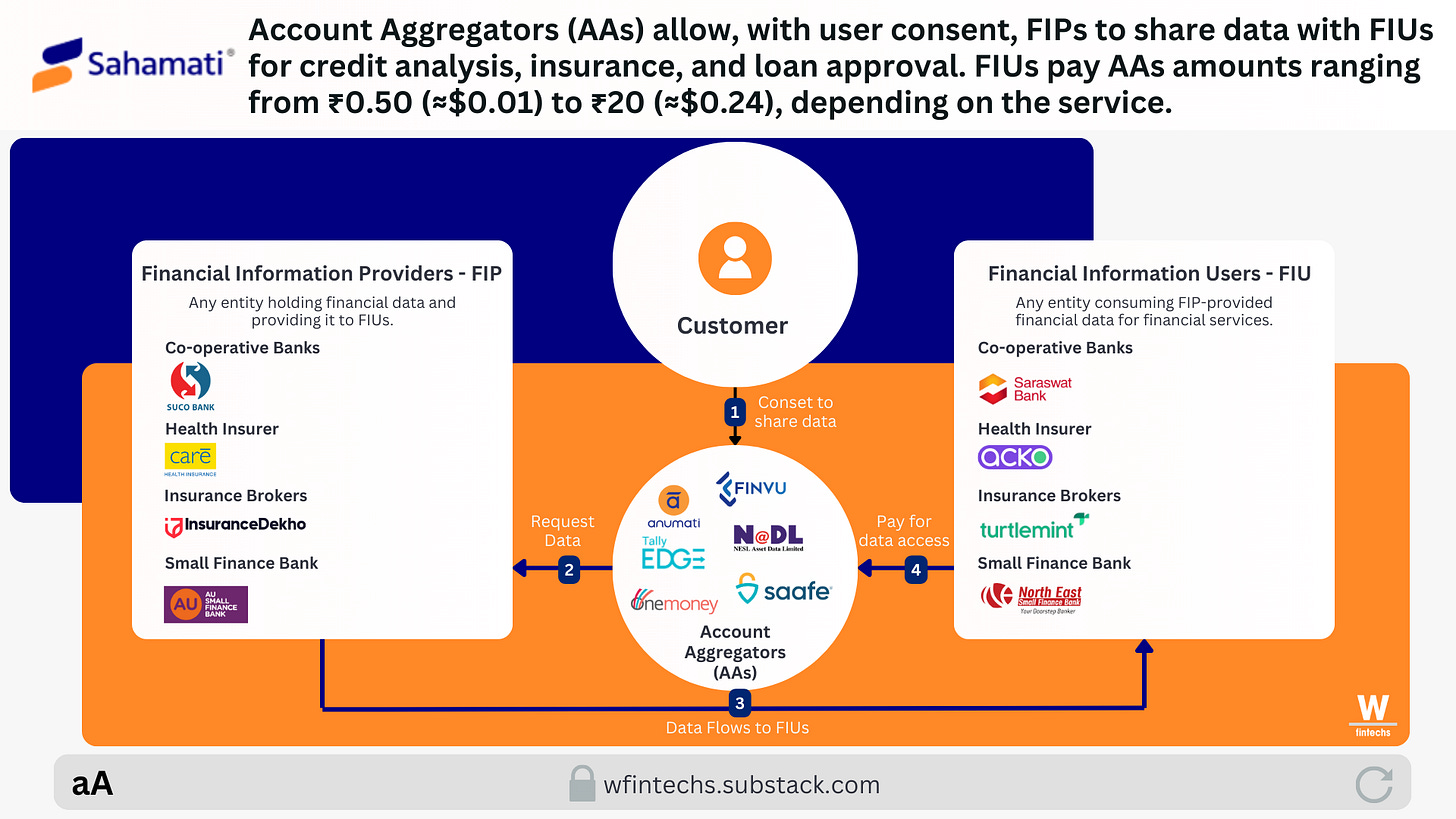

AA is not just another banking protocol; it is the core infrastructure of a new model for financial data sharing, based on consent, security, and efficiency. At its center is DEPA (Data Empowerment and Protection Architecture), a framework that safeguards user data while turning it into a usable asset. AAs are NBFCs (Non-Banking Financial Companies) regulated by the Reserve Bank of India (RBI). They connect three key players in the ecosystem: FIPs (Financial Information Providers), such as banks, insurers, and brokers, which supply data; FIUs (Financial Information Users), such as fintechs and banks, which utilize the data; and the AAs themselves, which mediate this transfer without accessing the data.

Officially launched in 2021 and regulated by the RBI, the AA system allows consumers to share their financial data securely, efficiently, and transparently. The process works in three steps: (1) The user registers with an AA and receives a virtual identifier (e.g., "joao@finvu"), linking their accounts. (2) When an FIU requests data, the user receives a detailed consent request, specifying which data will be shared, for how long, and for what purpose. (3) Upon approval, the data is transferred in a standardized and encrypted format, without the AA ever accessing it (link to demos 👉here).

Unlike traditional data-sharing methods — such as PDF uploads or screen scraping —AA introduces standardization, fraud reduction, and lower operational costs. AA adoption grew from 70.82 million in February 2024 to 131.6 million in February 2025, an increase of over 85% in just one year, maintaining a strong growth trajectory.

By December 2023, more than 420 financial institutions had joined the AA ecosystem, facilitating 40 million consented transactions and enabling 2.1 million loans worth Rs 204 billion ($2.4 billion)3. Before AA, applying for a loan meant spending days collecting bank statements, printing documents, and sending PDFs. Now, it all happens in just a few clicks. The user grants consent, data is encrypted and transmitted in real time, and banks can make decisions within minutes.

Small merchants and informal workers — who were previously invisible to the banking system — can now use their cash flow as collateral. Micro-entrepreneurs can automatically share their banking transactions and tax records (GST), allowing fintechs to grant credit based on financial behavior rather than physical assets. The average loan size granted via AA has already reached Rs 95,347 (approximately $1,140), demonstrating that the model is working.4.

Banks also benefit. Instead of relying on outdated credit history, they can access real-time financial data and dynamically adjust credit limits.

Beyond lending, AA is transforming personal finance management and investments. Apps can now integrate data from multiple bank accounts, offering intelligent budgeting insights, investment recommendations, and spending alerts. For end users, this means a new level of financial control — without spreadsheets or juggling multiple banking apps. Currently, 22 types of financial assets are supported, including bank accounts, credit cards, investments, retirement funds, insurance, and taxes. This diversity paves the way for new, personalized financial products and services.

The insurance and investment sectors are also being reshaped. With AA, insurers can calculate premiums based on actual financial behavior rather than generic demographic profiles.

AA’s revenue model works as follows: FIUs pay AAs for data access, with average fees ranging from Rs 0.50 to Rs 2 per transaction for loans and Rs 2 to Rs 20 per month for personal finance management services5.

But it's not all smooth sailing. The model still faces adoption challenges. Many consumers and small businesses are unaware of AA, and financial institutions need incentives to integrate it into their platforms. Currently, only 0.3% of the population has used an AA, and transaction success rates stand at 60%, indicating room for improvement.

AA makes it clear: banks, which have always controlled people’s financial information, are now competing to offer the best services. As I’ve been saying for some editions, the future of the financial sector is increasingly driven by data rather than traditional services. And in this new era, financial institutions aren’t banks anymore but they’re data companies.

Read more here 👇

If you enjoyed this edition, share it with a friend. It helps spread the message and allows me to keep providing high-quality content for free.

In my last deep dive, I explored Klarna’s strategies and its approach to establishing itself in the BNPL market.

Read more here👇

Over the past few months, I’ve been analyzing a few points that connect to questions that came up while writing that piece: could some players in Brazil test Klarna’s thesis and build a similar network?

Many argue that BNPL already exists in Brazil through Casas Bahia’s installment plans — and that’s true— but there are innovative elements in Klarna’s model, such as seamless integration, the ecosystem it has built, and the use of technologies like AI and Open Banking. Traditional installment plans have also started incorporating these technologies, making them less of a unique differentiator for BNPL.

A key factor in this landscape is the network effect, which operates indirectly in BNPL by connecting consumers and merchants. The more users join, the more attractive the service becomes for retailers, and vice versa.

In Klarna’s case, this effect drove its growth but isn’t enough to sustain the model on its own. For BNPL to work, it needs scale: since profit margins are low, the business only becomes viable with a high volume of transactions. The more people use it, the lower the cost per transaction and the higher the profitability. Additionally, access to cheap capital and effective risk management for defaults are crucial challenges for the model’s sustainability. Some players stand out by generating revenue per transaction rather than from the credit itself, which helps protect them in unfavorable economic conditions.

In practice, BNPL fintechs are positioning themselves as more than just payment providers — they are becoming platforms that connect consumers and brands, with a strong focus on customer loyalty.

Still, I believe a Klarna-like case is viable in Brazil and Latin America — not just because of the installment model itself, but because of the opportunity to establish a major player in the payments market as a whole. Nubank is a great example of a company that first built a strong B2C base before expanding into B2B. While its portfolio is broader than Klarna’s (including investment accounts, credit cards, and banking services), it is also playing the B2B game — not just by offering business accounts but by positioning itself as a strategic player at checkout.

This is a thesis I’d like to explore further in a future deep dive. If anyone wants to discuss the topic, I’d be happy to exchange ideas — just reach out to me on LinkedIn (link 👉here).

Until the next!

Walter Pereira

If you know anyone who would like to receive this e-mail or who is fascinated by the possibilities of financial innovation, I’d really appreciate you forwarding this email their way!

Disclaimer: The opinions expressed here are solely the responsibility of the author, Walter Pereira, and do not necessarily reflect the views of the sponsors, partners, or clients of W Fintechs.

https://documents1.worldbank.org/curated/en/219201522848336907/pdf/Private-Sector-Economic-Impacts-from-Identification-Systems.pdf

https://www.thehindu.com/business/upi-transactions-in-january-surpass-1699-billion-highest-recorded-in-any-month/article69273704.ece