#149: Short Takes: What will fintechs look like in 2040?; Circle's IPO in the U.S.

W FINTECHS NEWSLETTTER #149

👀 Portuguese Version 👉 here

👉 W Fintechs is a newsletter focused on financial innovation. Every Monday, at 8:21 a.m. (Brasília time), you will receive an in-depth analysis in your email.

Welcome to the Short Takes edition! As the name suggests, unlike deep dives, these editions will explore a variety of topics that might later evolve into full deep-dive editions.

Short Takes is designed for entrepreneurs, investors, and operators looking for quick, actionable insights.

Fintechs of the future are moving toward a slightly different model from what we know today. Last year, when Nubank acquired Hyperplane, a startup that developed an LLM model focused on finance, the bank’s strategy to hyper-personalize the banking experience became clear. The financial sector as a whole is moving in this direction. Klarna has been exploring AI internally to drive efficiency and is increasingly leveraging algorithms to enhance the banking experience. Inter has followed a similar path. As players aim to build ecosystems of financial or non-financial products, more data flows into their systems, directly or indirectly fueling their artificial intelligence models.

The bank of the future will be a system of decisions distributed across intelligent layers, powered by contextual data and operating in real time. Products will still exist, but their delivery logic will be reversed. It will no longer be the user seeking credit, insurance, or investment. These products will present themselves to the user at the right moment, in the right way, almost imperceptibly.

In the previous edition of FinOpen, I showed that as Open Finance advances and integrates with more sophisticated features of instant payment systems, new frontiers begin to emerge. One example I highlighted was the concept of the “Super Payment Assistant,” an emerging alternative to the traditional credit card model. In this format, all of a user’s accounts are gathered in a single app. Each transaction is processed via Pix, and monthly expenses are consolidated into a unified bill, with the option of on-demand installment payments. Meanwhile, funds remain invested in fixed-income instruments with daily returns, similar to treasury funds or, in the Brazilian context, CDBs, and are only moved when the bill is due.

A relatório recente da Riverty helps outline this scenario. The study projects that by 2040, the fintech ecosystem will be shaped by a few key pillars. I’ll highlight four that stood out to me: automation, personalization, decentralization, and inclusion. The Order-to-Cash (O2C) process is used as a lens to understand how these technologies will transform the relationship between consumers, companies, and financial institutions throughout the entire journey.

Among the core technologies driving this transition are AI agents. They will act as personal financial assistants, accessible through multiple interfaces and autonomous enough to handle everything from goal planning to executing purchases, transfers, and investments. Human involvement will be occasional, triggered only when desired. With a market estimated at 1.5 trillion dollars, these agents will redefine how we manage everyday financial decisions.

Another transformation vector is represented by cryptocurrencies and decentralized finance. The removal of intermediaries and the use of smart contracts create a structure where transactions, guarantees, and obligations are executed automatically. Applied to O2C, these solutions enable instant settlement, transparent auditing, and new payment models, including international ones. The market potential exceeds 4 trillion dollars, with a direct impact on the efficiency of value chains.

Quantum computing, though less visible to the end user, represents another major structural leap. Its processing power will enable new levels of prediction, optimization, and security. Risk algorithms will be faster and credit models more accurate. Just as consumers don’t notice the electricity behind a charger, they likely won’t notice quantum computing. They will only notice its effects.

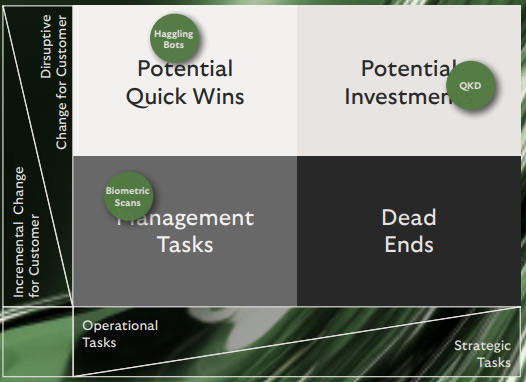

The Riverty study also proposes a technology adaptation matrix that classifies innovations based on perceived impact and time to maturity. Technologies like facial biometrics are considered quick wins, with easy implementation and immediate impact. Trading bots are seen as strategic investments that require technical and regulatory readiness. Quantum key distribution is positioned as a long-term bet, with profound implications for security and trust.

As this transformation progresses, the competitive edge will no longer lie solely in the adoption of emerging technologies but in the ability of financial institutions to combine them into modular, interoperable, and AI-driven architectures. The institutions of the future will undoubtedly be orchestrators of smarter financial experiences, capable of integrating partners, data, and decisions in real time.

If you enjoyed this edition, share it with a friend. It will help spread the message and allow me to keep delivering quality content for free.

Circle's debut on the U.S. stock market last week marked a milestone for the crypto sector. The company, issuer of the USDC stablecoin, initially aimed to raise up to $896 million but exceeded expectations by raising $1.05 billion. Shares were priced at $31 and surged 169% on the first day, closing at $83.231.

Despite the optimism, Circle faces several challenges. USDC still competes with the dominance of USDT, and although the company has shown significant growth in revenue and profit in recent years, its operating costs have also increased considerably. I shared more of this story in last week’s edition of FintechFrames — check it out here:

Until the next!

Walter Pereira

If you know anyone who would like to receive this e-mail or who is fascinated by the possibilities of financial innovation, I’d really appreciate you forwarding this email their way!

Disclaimer: The opinions expressed here are solely the responsibility of the author, Walter Pereira, and do not necessarily reflect the views of the sponsors, partners, or clients of W Fintechs.

https://www.reuters.com/business/circle-shareholders-aim-raise-896-million-upsized-us-ipo-2025-06-02/