#117: How Financial Data Companies Make Money: Lessons from the Failures and Acquisitions of a Few Players

W FINTECHS NEWSLETTER #117

👀 Portuguese Version 👉 here

This edition is sponsored by

Iniciador enables Regulated Institutions and Fintechs in Open Finance, with a white-label SaaS technology platform that reduces their technological and regulatory burden:

Real-time Financial Data

Payment Initiation

Issuer Authorization Server (Compliance Phase 3)

We are a Top 5 Payment Initiator (ITP) in Brazil in terms of transaction volume.

💡Bring your company to the W Fintechs Newsletter

Reach a niche audience of founders, investors, and regulators who read an in-depth analysis of the financial innovation market every Monday. Click 👉here

👉 W Fintechs is a newsletter focused on financial innovation. Every Monday, at 8:21 a.m. (Brasília time), you will receive an in-depth analysis in your email.

Every player dreams of going far — leaving a legacy, making history, building a solid foundation, and being remembered. But the reality is that many fall short along the way, never even catching sight of the shoreline. Unsustainable business models, combined with periods of low liquidity, inevitably lead to pivoting — or, in the worst-case scenario, bankruptcy. It's the ultimate realization of "so close, yet so far."

The difference between success and failure for these players isn't just about what they offer, but when they offer it. In the last edition, I explored the various positions of players in the data economy across four distinct categories, highlighting the potential for consolidation. This time, I'll dive into pricing models — essentially, how they make money.

The Fall of PFMs

Offering something for free might seem like a tempting shortcut for many startups, providing easy and fast access to customers. And, of course, when you're not paying for a product, your data becomes the commodity. However, in the long run, these models prove to be unsustainable.

Initially, the promise of rapid, cost-free growth attracts users. But this model tends to be a double-edged sword: without a consistent revenue stream, companies find themselves stuck in a constant struggle to monetize their user base or are forced to adopt aggressive fundraising strategies to stay afloat. A bad market moment can severely (a lot!!) undermine this approach.

Startups that rely on free models without a clear path to profitability often pay the price of unsustainable growth, eventually being swallowed up by investors or the market itself. This is exactly what happened to many Personal Finance Management (PFM) players.

Last year, Alex Johnson from Fintech Takes shared a tweet from the co-founder of Better Tomorrow Ventures, which stated that if entrepreneurs wanted to build scalable businesses, it was time to rethink the PFM business model.

As he highlighted, many free PFM models are dying because they don’t scale. Startups like Mint, a financial management app acquired by Intuit, and Dabox, another financial management player, failed to sustain their services due to a lack of consistent revenue streams. Meanwhile, platforms like Credit Karma, which combines PFM with financial services such as personalized credit, have turned the concept into a strategic tool for cross-selling.

The future may lie in paid models like Monarch, which offers premium financial management, and in leveraging AI and Open Finance to create solutions that justify their costs. Active financial management caters to a niche audience — a limited but engaged group of users, at least initially.

Regulated Open Finance has undoubtedly removed the barriers that early players faced in Brazil during 2016–2017 when they had to request users’ banking credentials to perform screen scraping and access their data. With advancements in this regulation, some entrepreneurs are once again betting on this model.

I plan to explore this segment more deeply in 2025, but what seems clear to me is that monetization will be the key to sustainability. The risk for independent PFM startups is that large banks and fintechs, with their greater scale, can turn financial tools into simple free features, undermining any business model without solid revenue streams.

That said, I see opportunities. Open Finance and AI-driven personalization can create more sophisticated and tailored experiences — something that larger players, with their legacy systems, will struggle to deliver. Additionally, there’s room to target niches where users might be more willing to pay for services. The PFM of the future won’t just be about graphs and numbers; it will be a true financial assistant —one that not only organizes your finances but also helps you make smarter decisions and even increase your income. The challenge, however, will be finding quick and sustainable ways to monetize.

The 4 Categories: How Do They Make Money?

When it comes to understanding how these companies generate revenue, the key is identifying how they transform their assets — whether data, services, or solutions — into a consistent source of income. Each company has a specific asset it monetizes, such as collecting data to resell, offering a platform as a service, or providing consulting services. The challenge, however, lies in scaling and sustaining this cash flow.

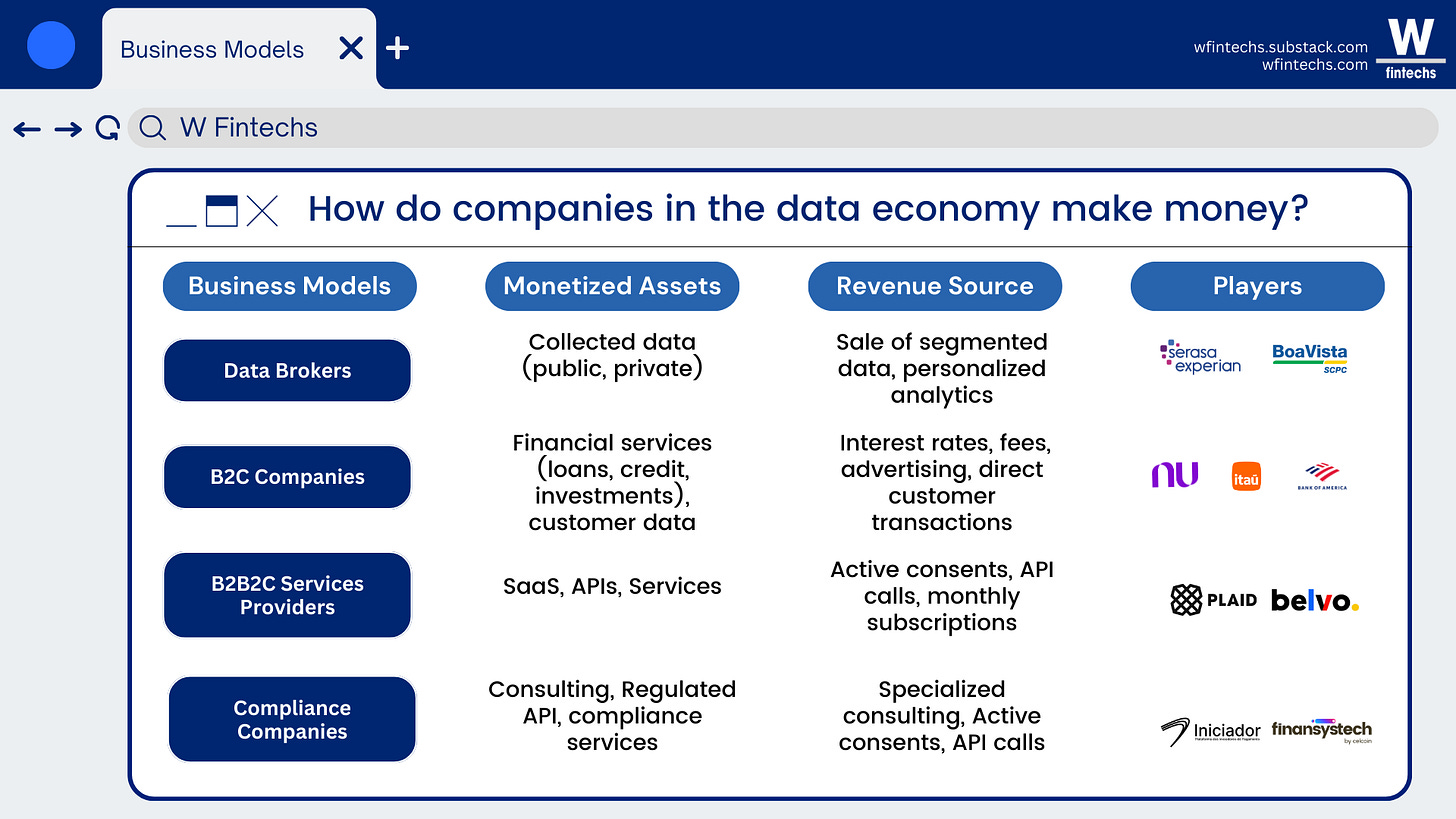

The 4 categories of companies leverage recurring models, aiming to find ways to turn data or services into something customers need month after month, year after year. The table below outlines how some of these companies monetize.

Data Brokers

Data brokers have emerged as a prominent business model in recent years, especially with pro-credit regulations driving data collection and usage. However, to stay relevant, these companies must continuously reinvent themselves. Far from merely selling raw data, they act as intermediaries between data sources and the businesses that rely on this information for strategic decisions. Their true value lies in applied intelligence: these data brokers deliver detailed segmentations and predictive analytics, enabling companies to personalize offerings and optimize marketing campaigns. In other words, the value isn’t in the raw data itself, but in the ability to identify behavioral patterns and apply them to create new strategies.

B2C

In the B2C model, banks like Itaú and Bradesco, along with fintechs such as Nubank and PicPay, sell products and services directly to end consumers. The real magic happens when we examine how consumer data is used to drive revenue. For example, Nubank leverages customer information to personalize offerings and enhance user experience, boosting retention.

In 2021, PicPay took a strategic step by acquiring Guiabolso, a pioneer in Open Banking in Brazil and specialized in Personal Finance Management (PFM). This move was a smart strategy to integrate financial management features directly into its platform, creating a competitive edge in an increasingly dynamic market. Additionally, the company has been investing in advertising as a new revenue stream, capitalizing on the data it collects about its users 1 — a strategy also being tested globally by companies like PayPal and JP Morgan.

B2B2C

The B2B2C model involves platforms like Belvo and Plaid, which provide infrastructure and services to other businesses that, in turn, deliver these services to end consumers. These companies charge fixed fees to their clients (the businesses using their platform), usage-based API fees, and active consent management, operating a pay-as-you-go model.

Compliance

Finally, the compliance model has become indispensable as regulations have grown and the need for adherence has become increasingly complex. Companies like Iniciador, Finansytech, and Lina exemplify this in Brazil, offering consultancy and services to ensure businesses meet regulatory requirements.

Monetization in this area is typically based on platform usage and sometimes consultancy services that help companies monitor risks and maintain compliance. Compliance thus generates revenue not only through consultancy but also via software solutions.

Despite their varied approaches, these business models share a common trait: the ability to transform assets — whether data, services, or expertise — into recurring and scalable revenue streams. Whether through data sales, direct consumer transactions, platform intermediation, or compliance solutions, the key to each model is delivering continuous value while keeping customers engaged and reliant on the solution. Ultimately, the true measure of success lies in how these companies turn unique assets into revenue streams that not only endure but grow as the market evolves.

Transformation from the Inside Out

The financial sector stands at a turning point, driven by the evolution of open data ecosystems. What once seemed like a matter of convenience and service integration has now become a critical strategy for ensuring agility and efficiency. Some players are repositioning themselves to fully harness the power of data.

The potential is immense, but the real impact will be felt not only in financial management options for consumers but, more importantly, in how internal systems, credit processes, and personalization are transformed to make operations faster and less costly.

Financial management will undoubtedly enter a new chapter with Open Finance. However, I believe its true impact will be deeply tied to internal operations, credit efficiency, and personalization. The real value lies in improving the systems that underpin the financial sector — those that ensure agility, accuracy, and cost efficiency. With this transformation, processes are accelerated, errors are minimized, and access to credit becomes more efficient and inclusive.

The sustainability of businesses will be tested as new market demands emerge, requiring players to adapt. As I mentioned in the previous edition, consolidation may occur through adaptation rather than control.

When data is used to anticipate needs, offer credit more accurately, or tailor products to individual realities, it’s not just about enhancing the customer experience — it’s about building a more efficient and scalable system. Ultimately, the data economy in the financial sector is about maximizing these gains sustainably and transforming the industry from the inside out.

Read about

👉 A look at some players. Is consolidation on the way?

👉 Banks and fintechs are becoming data-driven companies, what opportunities does this create?

👉 How can institutions turn Open Finance opportunities into revenue?

If you know anyone who would like to receive this e-mail or who is fascinated by the possibilities of financial innovation, I’d really appreciate you forwarding this email their way!

Until the next!

Walter Pereira

Disclaimer: The opinions expressed here are solely the responsibility of the author, Walter Pereira, and do not necessarily reflect the views of the sponsors, partners, or clients of W Fintechs.