#141: The impact of AI agents on the future of work, capital efficiency, and VC dynamics

W FINTECHS NEWSLETTTER #141

👀 Portuguese Version 👉 here

👉 W Fintechs is a newsletter focused on financial innovation. Every Monday, at 8:21 a.m. (Brasília time), you will receive an in-depth analysis in your email.

When I wrote about Klarna, one of the things that stood out most to me was how much efficiency the company gained through the use of AI. Klarna became a textbook case of a company that raised massive amounts of capital during a period of high liquidity, hired aggressively, and, when global liquidity dried up, had to cut costs, improve financial metrics, and chase efficiency. The result was a significant layoff and a remarkable downround from $45.6 billion to $6.7 billion.

During that period, time and circumstance were kind: the drive for efficiency met the rise of generative AI. The same year Klarna faced its first downround, Sam Altman was preparing to launch ChatGPT. The world was still operating under tighter capital constraints, but the bets on AI had solid foundations — tasks that once took hours, days, or even weeks could now be accomplished in seconds or minutes with the right prompt. Klarna seized that momentum and used generative AI to streamline its operations.

In 2023, Klarna cut its operating expenses by 16% and significantly reduced costs in customer service and marketing. By 2024, over 90% of its employees were using AI tools daily, allowing for a further 2% cut in operational costs.

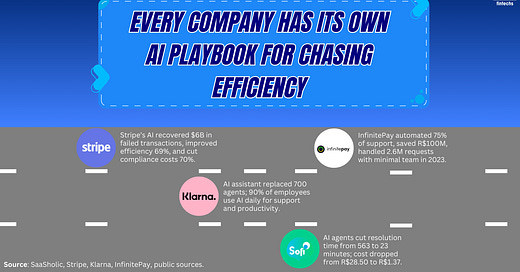

Klarna is just one example among many companies that have embedded AI into their processes. Today, 78% of organizations are using AI in at least one business function, with the most common areas being IT, marketing, and sales, followed by service operations1.

Klarna also partnered with OpenAI to implement an AI assistant capable of performing the equivalent work of 700 customer service agents, reducing average resolution time from 11 minutes to just 2, while maintaining high levels of customer satisfaction2.

There are examples beyond the financial sector as well. In March 2025, Shopify CEO Tobi Lütke stated that AI usage is now a baseline expectation for all employees. He emphasized that before requesting any new hires, managers must demonstrate why a given task cannot be completed by AI.

It seems we’re living through a transition where professionals are increasingly managing and training AI systems, rather than solely supervising other people. Even NVIDIA’s CEO, Jensen Huang, recently said that AI won’t steal jobs, but it will shift them. He also noted that in the near future, using AI won’t be a competitive advantage, but it will be the bare minimum required to stay in business.

What we’re witnessing now with AI echoes what we’ve seen with previous tech waves — like the internet in the 2000s or cloud computing more recently. Back then, being online or using the cloud was a differentiator. Over time, it became a prerequisite. AI is following the same path.

And this isn’t new. History has shown us this cycle many times. In the early 19th century, the Luddites — textile workers in England — destroyed machines because they saw them as threats to their jobs. In the end, the machines did change the nature of work, but they also created space for new roles, skills, and professions.

Today, AI is driving a similar shift. It’s not just replacing tasks — it’s reshaping how work is done, how companies operate, and how they manage investor capital. In this edition, I’ll explore how AI agents are ushering in a new era. Not just for the future of work, but more importantly, for the efficient use of capital. A new generation of companies may emerge during this time, favoring lean teams, and in some cases, teams made up solely of their founding members.

The operating model of fintechs

Technology has drastically changed how companies operate over time. In one edition of the newsletter, I highlighted how the API economy follows the same principle as Adam Smith’s division of labor (link 👉 here): in the past, companies had to build their entire tech infrastructure from scratch. Today, by connecting with different providers, they can launch a product in the market in a fraction of the time. This shift paved the way for a new wave of business models — like API Management, API Performance, and orchestration platforms.

In fact, back in issue #126, I wrote that as more providers emerged — offering data, infrastructure, or services — orchestration would become even more strategic. And fintech models that truly embraced this orchestration layer would pull ahead. We're starting to see the same shift in the world of autonomous agents. New business models will emerge — many we can’t even imagine yet. But if I had to bet, I’d say we’ll soon see companies focused on orchestrating, managing, and tracking the performance of autonomous agents at scale.

The API economy also had an indirect impact on employment. Companies began investing more in integration projects than in large, full-stack builds. Still, there was (and is) considerable demand for operational workforces. The contrast between incumbents and fintechs becomes clear when you look at their staffing models.

While Itaú operates with over 90,000 employees, Nubank runs with around 8,000 and has more customers than Itaú. XP has just over 6,000 employees, and C6 Bank around 4,000. Startups like Neon and Banco Inter follow the same path: lean structures, focused on technology and automation — not on headcount.

Part of that is due to legacy systems at traditional banks. Another part comes from manual processes that still persist. But I believe AI agents will have an even bigger — and much faster — impact in this area.

The efficiency of businesses built with technology as a foundational layer (first layer) is, in practice, a massive differentiator. A 2022 study by PitchBook showed that fully digital fintechs can serve up to 10 times more customers per employee than traditional financial institutions.

Even so, when the macro environment shifted — with rising interest rates and a decline in venture capital — many fintechs were forced to cut staff. Maybe some had overhired. Maybe not. It’s hard to say. But the fact is, between 2022 and 2024, over 100,000 tech job cuts were reported, according to Layoffs.fyi.

Stripe, Plaid, Brex, Robinhood, Klarna… all were forced to restructure after years of aggressive expansion, not just in users, but in employees. Nubank itself went through internal reshuffling and hiring freezes in multiple departments. Robinhood laid off more than 30% of its workforce across two major rounds.

During the low-interest era, raising massive funding rounds and scaling headcount was almost a ritual. Rapid growth became synonymous with success — even if it meant operating at a loss for years. But that model collapsed when money got more expensive and investors began demanding results. Today, a different metric is taking the spotlight: revenue per employee. Wise is a great example of this shift. In 2023, the UK-based fintech generated £846 million in revenue with around 4,000 employees — that’s approximately £211,500 per employee3.

The arrival of Agents

And then came the agents. What we're witnessing today is an interesting shift — although it's still hard to fully describe, mainly because we’re just at the beginning. What we can already see, however, is a curve that closely resembles what we saw with cloud computing: it starts slow, then scales exponentially.

But even now, it’s already a market drawing serious attention and big bets. CrewAI, for example, raised $18 million in 2024 to expand its autonomous agent platform, which now operates over 10 million agents per month and serves nearly half of the Fortune 500 companies. Another example is Artisan, a U.S.-based startup that has developed AI agents to automate tasks like sales prospecting, data entry, and email outreach — a clear sign of repetitive functions being replaced by orchestrated decision-making.

hiSofi, operating in Brazil, Colombia, and Peru, uses vertical agents to automate collections — with an empathetic tone — and has managed to cut OPEX by 45%, increasing conversion rates by up to six times 4.

In the crypto world, the pace is even faster. In that ecosystem alone, AI agents reached a $13 billion market cap by the end of 2024, with expectations to surpass 1 million active agents by the end of 2025 5.

The first major use case for AI agents has been in the most repetitive tasks — those that are time-consuming but require little creativity or judgment: customer service, tech support, document submission, data validation, ticket triage. Klarna was one of the earliest examples of visible impact. In Brazil, InfinitePay showcased the power of automation by automating 75% of its customer service, saving BRL 100 million in 2023 and handling 2.6 million requests with a minimal team6.

Even before the generative AI boom, Bradesco’s virtual assistant BIA had already surpassed 2 billion customer interactions by 2023. Abroad, NatWest was ahead of the curve by forming a strategic partnership with OpenAI to enhance its digital assistants — Cora and AskArchie — with goals of improving efficiency and fighting fraud. Unlike in 2023, AI today feels far more tangible in operational workflows. Gartner projects that by 2026, 30% of workers will have at least one AI colleague. That number was less than 5% in 2023. In short, the impact is just beginning, but it already signals a coming transformation in operational structures over the next few years.

A shift in the professional profile

All of this also requires a shift in mindset among professionals. As AI takes on more execution tasks, the role of humans evolves into one focused on thinking, orchestrating, adjusting, supervising, and training. The value lies less in the ability to perform tasks directly and more in the ability to enable outcomes. This involves knowing how to structure prompts, configure systems, understand automation logic, and design effective workflows. Even as automation becomes more prevalent, humans still maintain control, but now in the role of editors rather than hands-on executors. What truly changes is the position within the value chain. Those who grasp the entire system will become more valuable, while those who only carry out isolated tasks without a broader understanding are at greater risk of being sidelined or replaced.

I believe the biggest shift is that every employee now becomes a hub of intelligent decisions, not just a passive node in the production flow. Management becomes less about delegating tasks and more about designing systems and processes.

If you're enjoying this edition, share it with a friend. This will help spread the message and allow me to keep offering quality content for free.

The new dynamics of capital and venture funding

The rise of AI agents is transforming not only how companies operate, but also the profile of the modern entrepreneur — and it’s inevitably reshaping the logic of venture capital. Founders today have access to a tech stack that, just a few years ago, would have required dozens of people. With tools like autonomous agents, copilots, and AI-orchestrated workflows, it’s now possible to launch, test, iterate, and scale a product with a minimal team. This shift is redefining how venture capital works, especially at a time when many funds are struggling to raise money from LPs. Now, VCs are chasing exponential businesses that can do more with less.

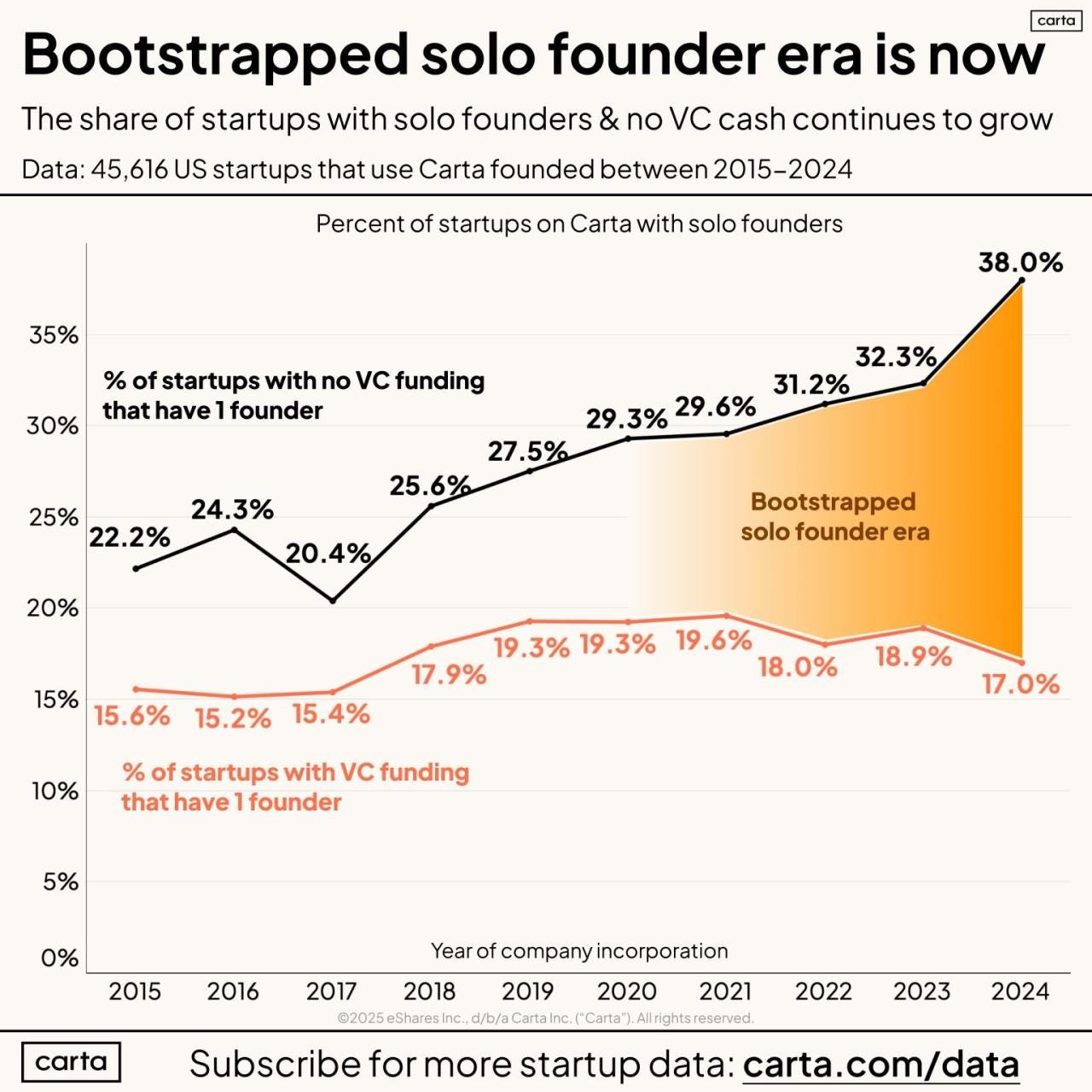

This shift is already visible in the data. According to Carta, 38% of startups founded in 2024 with zero venture funding were started by a solo founder. That figure has more than doubled since 2015. It may reflect a growing mindset shift: the solo, bootstrapped founder who would rather ship a product in days using agents than spend months perfecting a pitch deck to raise a round.

This also changes the role of money. Venture capital, which used to be fuel to accelerate everything at any cost, now needs to be more strategic. In other words, it's no longer about hiring 50 people the next month, but about investing in smart infrastructure, agents, and integrations that support sustainable growth.

The era of agents is not only optimizing processes but also redefining the starting point for many companies. The next fintechs might be formed by just a few people with a strong ability to orchestrate a well-defined stack of tools and operate with precise focus on their target market. The priority shifts from building a large team to building an efficient system, where each part, whether human or an AI agent, works in sync to find product-market fit quickly and at low cost.

If you know anyone who would like to receive this email or who is fascinated by the possibilities of financial innovation, I’d really appreciate you forwarding this email their way!

Until the next!

Walter Pereira

Disclaimer: The opinions expressed here are solely the responsibility of the author, Walter Pereira, and do not necessarily reflect the views of the sponsors, partners, or clients of W Fintechs.

https://www.mckinsey.com/capabilities/quantumblack/our-insights/the-state-of-ai

https://openai.com/index/klarna

https://wise.com/imaginary-v2/Wise-Annual-Report-Accounts-FY2023.pdf

https://www.saasholic.com/latam-ai-benchmarks-report-2025

https://substack.com/home/post/p-154132322

https://www.infinitepay.io/newsroom/inteligencia-artificial-traz-retorno-de-r-100-milhoes-para-cloudwalk